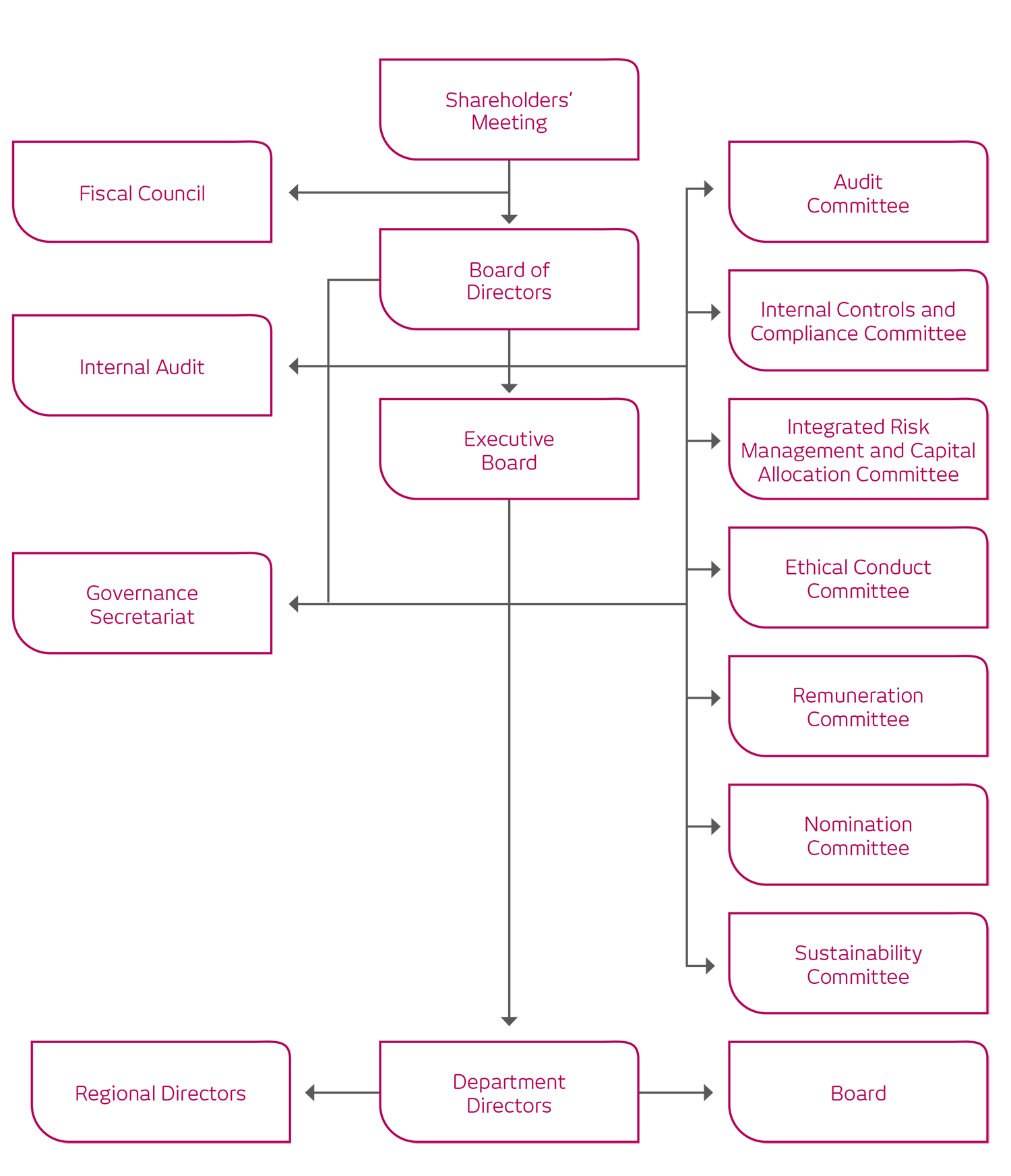

GOVERNANCE STRUCTURE

| Shareholders’ Meeting | |||

|---|---|---|---|

| Board of Directors | Fiscal Council | ||

| Board of Directors | Internal Audit, Audit Committee, Internal Controls and Compliance Committee, Integrated Risk Management and Capital Allocation Committee, Ethical Conduct Committe, Remuneration Committee, Nomination Committee, Sustainability Committee | Governance Secretaria | |

| Regional Directors, Board, Department Directors | |||

Our governance is based on the General Shareholders’ Meeting, the Board of Directors and the Executive Board. The General Shareholders’ Meeting is sovereign in the organization’s decision making process, with the power to decide on any business related to its goals and to elect the members of the Board of Directors and the Fiscal Council.

The presence of former executives on the Board of Directors reinforces our internal career development policy. The members’ experience is also the result of the rotation of functions to which they were submitted when they were executives. This enables them to acquire knowledge of diverse internal areas, thus enriching strategic discussions that contribute to the joint decisions.

The Management Nomination Policy is committed to promoting diversity and gender equality, respecting the process of indicating candidates for vacancies on the Board of Directors and the Executive Board.

BOARD OF DIRECTORS

This body bases its conduct on the Code of Best Corporate Governance Practices issued by the IBGC, the Brazilian Corporate Governance Institute (Instituto Brasileiro de Governança Corporativa) and the guidelines laid down by the Securities and Exchange Commission (SEC). It is also monitored by regulatory authorities such as Brazil’s Central Bank (Bacen) and the CVM, the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários). Its attributions are set forth in the bylaws and in our internal regulations.

There are eight board members who normally meet once every quarter and whenever necessary under extraordinary circumstances. The board members are fully aware of the benefits of adopting best governance practices and are committed to improving them, ensuring effective and independent risk management and internal control processes.

They have unified mandates of one year and are responsible for choosing the chairman and vice chairman. In accordance with the bylaws, the chairman may not hold the position of CEO.

At the end of 2016, the board comprised the following members:

Lázaro de Mello Brandão – Chairman (external member and former executive)

Luiz Carlos Trabuco Cappi – Vice Chairman (internal member – CEO)

Denise Aguiar Alvarez – External member

João Aguiar Alvarez – External member

Carlos Alberto Rodrigues Guilherme – External member and former executive

Milton Matsumoto – External member and former executive

José Alcides Munhoz – External member and former executive

Aurélio Conrado Boni – External member and former executive

This composition corroborates our preference for prioritizing former executives as board members given their experience and their capacity to bring greater experience and knowledge to the task of drafting guidelines for strategic planning aligned with our culture.

EXECUTIVE BOARD

The Executive Board is elected for a one-year term by the Board of Directors. Members may be reelected and their main functions are to manage and represent the organization, in addition to drafting and monitoring the execution or the strategic orientation established by the Board of Directors. The CEO is Luiz Carlos Trabuco Cappi and the CFO is Alexandre da Silva Glüher.

The Executive Board meets on a weekly basis and on an extraordinary basis whenever necessary.

COMMITTEES

Of the seven committees that provide support for the Board of Directors, two are statutory (Audit and Remuneration) and five are non-statutory (Ethical Conduct, Internal Controls and Compliance, Integrated Risk Management and Capital Allocation, Nomination and Sustainability). They are coordinated by a member of the Board of Directors. The exceptions are the Integrated Risk Management and Capital Allocation and the Sustainability Committees, for which the Board opted to nominate the executives responsible for the respective areas as coordinators. These committees were constituted by the Board of Directors, which also establishes their attributions.

The CEO and the Executive Board are advised by diverse Executive Committees, which discuss and advise on relevant matters in their sphere of interest on a joint basis. Each has its own internal regime, composition, attributions and meeting schedule. Decision making processes are wide ranging and involve a number of internal areas.

Audit: supports the Board of Directors in monitoring the accounting practices adopted for the Company’s and its subsidiaries financial statements and in indicating and assessing the effectiveness of the independent auditors.

Remuneration: its function is to advise the Board of Directors in overseeing the Management Remuneration Policy, drafting Remuneration Policy and proposing the overall amount of remuneration for management to the Board of Directors, as well as conducting an annual review of this policy, suggesting corrections and improvements.

Ethical Conduct: this committee proposes measures to communicate and ensure compliance with the Codes of Ethical Conduct of the Bradesco Organization, the corporate area and the diverse sectors, in addition to the rules of conduct related to anti-corruption and fair competition, ensuring their effectiveness and efficiency.

Internal Controls and Compliance: provides support for the Board of Directors in relation to strategies, policies and measures aimed at disseminating our culture of internal controls, risk mitigation and compliance with applicable standards.

Integrated Risk Management and Capital Allocation: its role is to assist the Board of Directors in matters related to managing and controlling risks and capital.

Nomination: constituted in April 2016, this committee advises the Board of Directors on policy for nominating managers as well as succession-related processes.

Sustainability: the Sustainability Committee supports the Board of Directors in the foment of sustainability-related strategies, including the establishment of corporate guidelines and measures and reconciling economic development with social and environmental responsibility.

banco.bradesco/ir

Governance Secretariat

The Governance Secretariat, officially denominated General Secretariat, is a department subordinated to the Board of Directors but which also provides support for the Executive Board on a day to day basis.

Worthy of note among its attributions are:

- Managing the appointments and commitments of the eight members of the board and the 23 executive directors

- Managing the Chairman’s blog, the main link between the Chairman and employees

- Coordinating and overseeing the shareholders’ meetings

- Supporting the Fiscal Council by managing its agenda and preparing the minutes of meetings

- Providing direct support for the Executive Dissemination and Corporate Governance Committees

- Managing the minutes for the committees subordinated to the Board of Directors

- Providing support in institutional relations

- Addressing corporate governance matters, undertaking proposals and implementations

- Disclosing Notices for Shareholders, Communications to the Market and Material Facts

- Managing the corporate governance page in the Investor Relations website