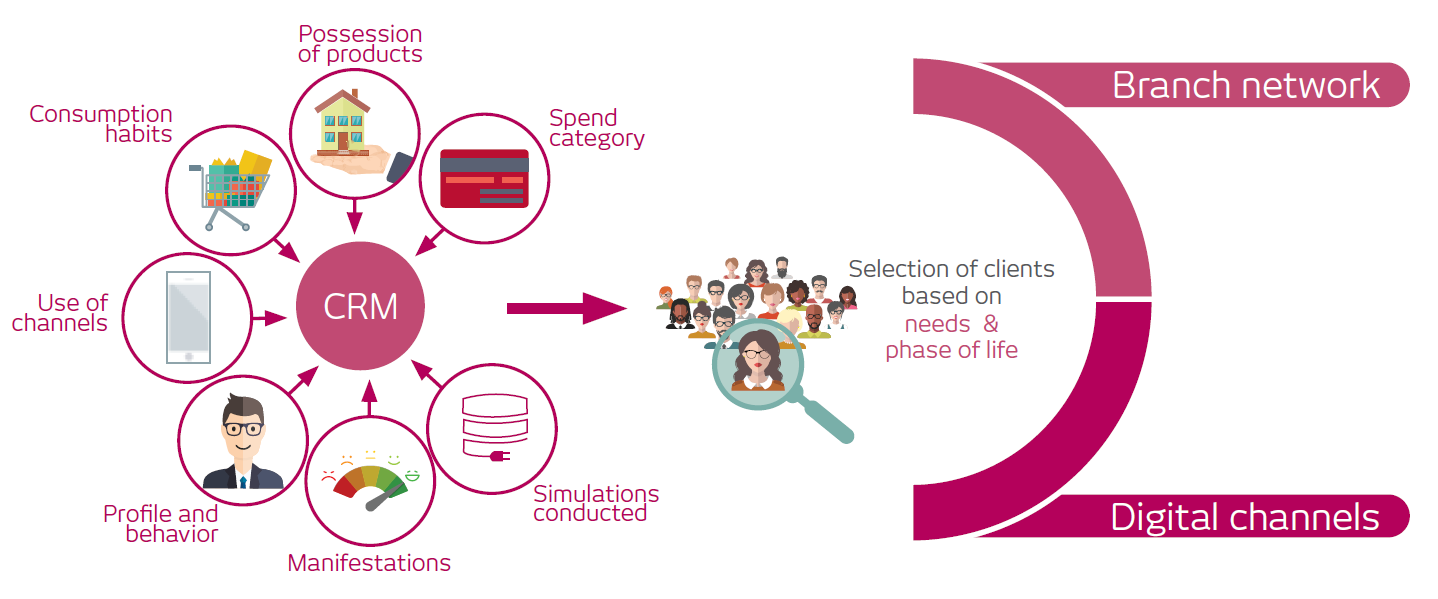

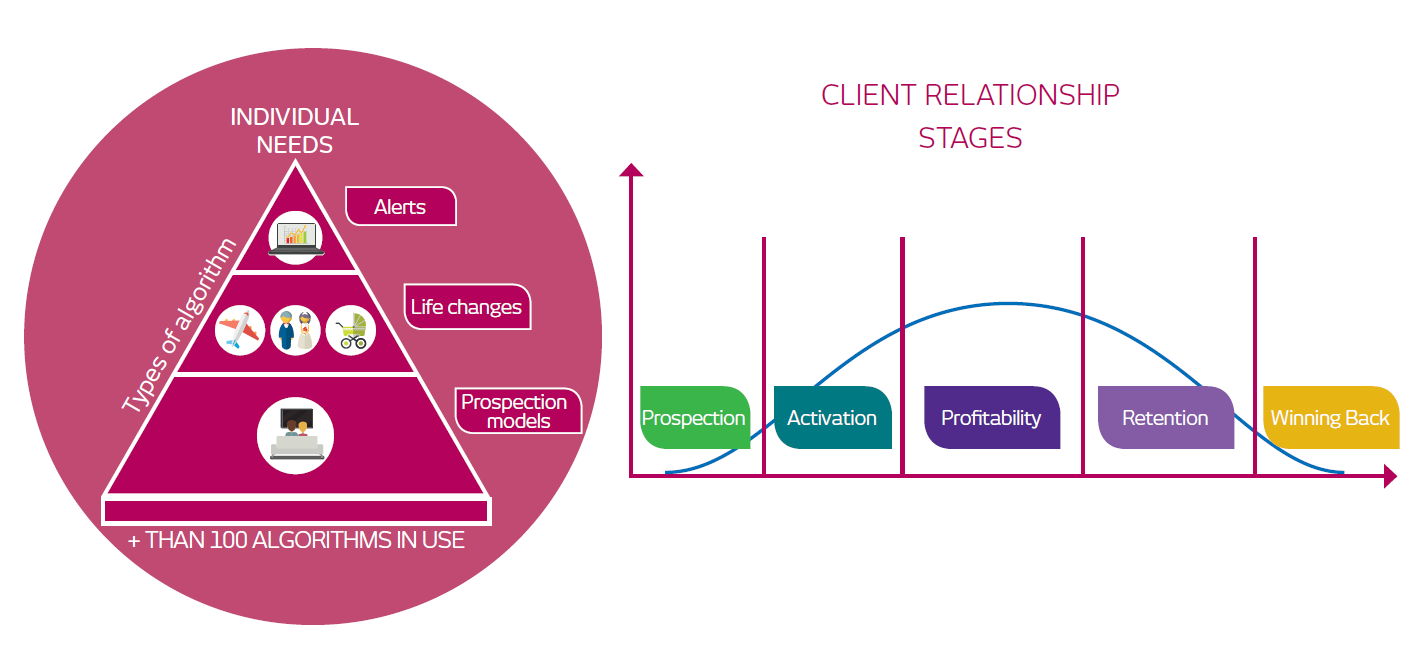

To ensure service quality and improved client satisfaction we have a Customer Relationship Management (CRM) structure that is interrelated with all of our other areas, enabling the receipt of data and information. This is organized, measured, standardized and used to provide inputs for commercial and client relationship actions. The model enables more accurately targeted product launches and greater efficiency in commercial approaches, enhancing the clients’ experience in their relations with us.

To further knowledge about clients, the CRM area runs its Visão Única de Clientes project which, by structuring and analyzing a set of data, reveals preferences, behaviors and trends that orientate commercial and relationship strategies.

Based on digital data banks and statistical models of behavioral analysis and the client life cycle, among other tools, we obtain an individualized view that includes registration data and information on transactions and credit card use, among others, enabling alignment between sales targets and real client needs.

OUR INTEGRATED SYSTEMS ENABLE MORE ACCURATELY TARGETED PRODUCT LAUNCHES AND GREATER EFFICIENCY IN COMMERCIAL APPROACH

WE USE A MANAGEMENT SYSTEM THAT GENERATES ACCURATE AND RELEVANT INFORMATION TO DRIVE CONTINUOUS IMPROVEMENT IN OUR CLIENT RELATIONS

TAILOR-MADE PRODUCTS

We have an Executive Committee and a Product and Services Commission which, in conjunction with managers, assesses opportunities and the financial and operational feasibility of proposals to create and alter products and services, as well as tracking their performance.

There is also the Executive Innovation Committee (Cein), responsible for deciding on innovation initiatives, in alignment with strategic guidelines, in order to make differentiated business models, products, services, solutions and consumption experiences available for clients. Strategic innovation nuclei, such as inovaBra, are subordinated to this committee.

Examples which involved the participation of external stakeholders are:

Bradesco Seguros Group

- Bradesco Seguros Digital Portfolio

- Bradesco Seguros Portal – Accessibility

Bradesco Saúde

- Meu Doutor program

- Orthotic, Prosthetic and Special Materials Direct Delivery Program

- Second Medical Opinion for Spine Disorders Program

- Drugstore Discount

Bradesco Capitalização

- Pé Quente Bradesco Amazonas Sustentável

- Pé Quente Bradesco O Câncer de Mama no Alvo da Moda

- Pé Quente Bradesco SOS Mata Atlântica

- Pé Quente Bradesco Tamar Project

Bradesco Bank

- Highly Scalable Security and Mobility Research Program

- Electronic transaction fraud detection mechanisms

- Image capture system

- Safety device for digital signature transactions

- SMS-based security framework

- New interaction and collaboration technologies for integrating social networks in financial transaction contexts

- Contactless technologies

- Proof of life via biometrics

- Voice biometrics in internet banking and the telebanking

- Transportation card

BRADESCO OMBUDSMAN

For us, ensuring service quality and the satisfaction of clients and non clients is a fundamental principle. In 1985, the Alô Bradesco channel was created to receive client and user complaints and contacts five years before the introduction of Brazil’s consumer defense code. We also constituted the Alô Bradesco Management area, with the mission of ensuring efficient handling of initial contacts (Contact Service) focusing on the clarity of the information provided and the effective contact with the client.

As secondary contact channels we have two independent Ombudsman services: one dedicated to contacts from our clients, aligned with the requirements of the Brazilian Central Bank (Bacen) and the Comissão de Valores Mobiliários (CVM) and another to deal with contacts from Bradesco Seguros clients, compliant with the standards established by the private insurance regulatory body SUSEP and the national supplementary health agency ANS.

Both channels are distinguished by their pioneering structure and the manner in which they handle consumer contacts. The Bradesco Seguros Group Ombudsman has been in place for 13 years and the bank Ombudsman for 11 years, preceding the mandatory requirement of the establishment of this client relationship tool by the regulatory authorities.

Our Ombudsman’s mission is to represent clients impartially, transforming their complaints into an experience that strengthens their relationship with us and drives improvements that generate mutual benefits. This mission was reinforced with the drafting of the Ombudsman Strategic Planning, which introduced 15 strategic objectives, 35 indicators and 54 initiatives that will orientate the activities of the Ombudsman for the next five years.

Based on statistical surveys and qualitative analyses, the Ombudsman assesses the root causes of the complaints made about our products and services.

The relevant company areas are invited to reassess the effectiveness of the measures used to correct the causes of the complaints so that these do not recur or increase in volume.

The channel also participates actively in the Product and Services Commissions and the Commercial Actions Commission, in addition to having a consolidated governance process involving periodic reports to senior management. The Ombudsman also works directly with the business units, sites and associated companies to provide a definitive solution to the client’s complaint in the shortest time possible.

In 2016 the Ouvidoria + process was adopted. This is a specific cell with a flow designed to provide a speedy and efficient response to complaints. As a result, in the first semester 57.2% of the clients who resorted to the channel received a definitive response within six working days, and 27.1% received a response within seven and eight working days, less than the ten working day deadline established by law 4,433/15, which regulates ombudsman services. Also during 2016, around 98.6% of the clients submitting complaints to the channel obtained definitive solutions to their problems.

The service is also supported by regional agents, called ombudsman agents, who have been in place in the main regions of the country since 2012. Their activities were reinforced in 2016 focused on improving the resolution rate for complaints.

Clients and users who want to register any complaints with receipt of proof of the complaint may use the primary service channels (branches, transaction centers and bank correspondents). They receive a numbered receipt which may be used in the Ombudsman service, as well as a deadline for the resolution of their case. If they do not agree with the response they may resort to the Ombudsman service, which will re-analyze the case.

In 2016, we constituted the Corporate Conduct Tracking Commission (CACC), comprising senior managers. The objective is to drive greater integration and coordination in dealing with complaints, addressing the root cause of the contacts and complaints received in the channels and proactively identifying ways to prevent the repetition of such cases.

We also adopted the Competition Compliance Program. This involved the development of a specific policy and standard aimed at driving the compliance of managers, employees and other workers with fair competition standards. Senior management and our representatives in sector associations are directly involved. There is an exclusive channel (concorrencial@bradesco.com.br) for reporting incidents or suspected incidents involving anti-competitive conduct.

FIVE YEARS BEFORE THE CREATION OF THE CONSUMER DEFENSE CODE, WE LAUNCHED THE ALÔ BRADESCO CHANNEL TO LISTEN TO OUR CLIENTS AND LEARN THEIR NEEDS

BRADESCO SEGUROS GROUP OMBUDSMAN

Bradesco Seguros Group implanted its Ombudsman service in September 2003, adopting the standards established by Resolution No. 110, and was recognized by SUSEP in January 2005, via the SUSEP/GABIN Charter No. 011/2005, currently based on the CNSP rulings No. 279/2013 and No. 337/2016. In February 2008, it was recognized by ANS, by means of the communication No. 10/2008/GGRIM/DIFIS, currently based on RN No. 323/2013, on IN 2/2014 (DOU) and on RN No. 395/2016.

To drive continuous improvement in client relations, we have worked with the Ombudsman Award since 2006. This recognizes the best instances of the Service Culture, rewarding employees/workers and areas for quality performance and demonstration of a sense of urgency.

From 2012 to 2016, the Bradesco Seguros Group Ombudsman was recognized as one of the best in the country in the Brazil Ombudsman Award, based on the development of the Strategic Ombudsman Planning and its review in 2015.

All these stimuli reinforce Bradesco Seguros’ commitment to offering the public quality service. The stimuli are aligned with the directives that guide our corporate governance and compliance policies, ensuring transparency and the provision of reliable information.

In 2011, we developed the Strategic Ombudsman Planning, which underwent a review in the first half of 2015.

SINCE 2006, THE BRADESCO OMBUDSMAN AWARD HAS VALUED PEOPLE AND AREAS WITH OUTSTANDING PERFORMANCE IN MEETING CLIENTS’ REQUIREMENTS

The Ombudsman Department Goals for 2017 are:

Target for 2017

Reduce by 5% the timeframe for customer response of the BACEN, Procon and Ombudsman 0800 channels.

Enhance the SACL System and extend its functionalities to gain scale and performance.

To continue making 0800 Procon and the other Procons in Brazil available (to provide faster service and more litigation resolutions for the Organization’s customers that contact the agency).

Increase by 10% the amount of Ombudsmen located at the Branches. They are responsible for narrowing the relationship with Procon offices.

INTEGRATION

G4-13

In a communication to the Consumer Defense Agencies (Procons) nationwide from October 8, 2016, the Bradesco and Bradesco Seguros Group Ombudsmen fully absorbed all the demands arising from the subsidiaries of the Banco HSBC Brasil and the companies of the HSBC Brasil insurance arm. This integration involved the following companies:

Banco HSBC Brasil subsidiaries assumed by the Bradesco Ombudsman:

HSBC Bank Brasil S.A. – Banco Múltiplo

HSBC (Brasil) Administradora de Consórcio Ltda.

HSBC Corretora de Títulos e Valores Mobiliários S.A.

HSBC Leasing Arrendamento Mercantil (Brasil) S.A.

Banco Losango S/A – Banco Múltiplo

Subsidiaries of the HSBC Brasil Insurance arm assumed by the Bradesco Seguros Ombudsman Seguros:

HSBC Capitalização (Brasil) S.A.

HSBC Corretora de Seguros (Brasil) S.A.

HSBC Seguros (Brasil) S.A.

HSBC Empresa de Capitalização (Brasil) S.A.

HSBC Vida e Previdência (Brasil) S.A.