Created in 2004, Eternit’s Investor Relations Department has the objective of maintaining transparency in the rendering of accounts and establishing a dialogue channel between shareholders and investors.

To maintain its relationships in a fast and efficient manner, it manages its activities using Investor Relationship Manager (IRM) software and undertakes to respond to any request within 72 hours, and plans to reduce this length of time to 48 hours in 2013. In addition to this, web casting conference calls are held every culture, public meetings, publication of press releases and fact sheets, national and international roadshows and individual meetings. In 2012, this department at more than 1,458 contacts with investors, shareholders and interested parties, and held over 80 meetings, including those with individual investors.

In 2012, Eternit’s Investor Relations site was reformulated, which has made it easier to navigate and search for information, principally the most important, about the Company. Among the new aspects introduced on the personalisation of the homepage, for rapid access to sections of greatest interest, access to social media (Twitter, Youtube, Slideshare and RSS), Eternit’s blog (www.blogdaeternit.com.br) and the Interactive Calendar, which allows interaction with Outlook who receive alerts about events in the capital markets. The IR site (www.eternit.com.br/ir) is compatible with all types of equipment, including tablets and smartphones.

ETERNIT ADOPTS THE BEST CORPORATE GOVERNANCE PRACTICES IN ITS RELATIONSHIP WITH ITS TARGET AUDIENCES.

Shareholding composition

Eternit’s paid-up capital, since 2010, has been composed of 89.5 million ordinary shares. A substantial proportion of this capital is held by private individuals, basically due to Eternit’s practice of distributing dividends and interest-on-equity on a quarterly basis. This capital is also thinly spread, with 76.1% comprising the free float at the end of 2012, without the existence of a shareholders agreement or controlling shareholding group. Only three shareholders held a stake of more than 5% in 2012, coming to a total of 35.51%. The Company’s Executive Board held 1.53% of the shares, acquired through the Share Acquisition Plan.

| Shareholders with a stake of more than 5% in 12/31/2012 | |

|---|---|

| Geração L.PAR Equity Investment Fund | 15.25% |

| Luiz Barsi Filho | 13.56% |

| Victor Adler | 6.70% |

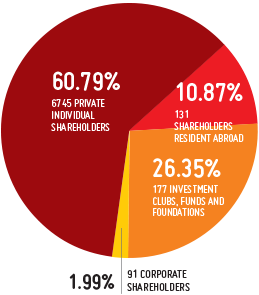

In 2012, the Company maintained its high concentration of private individual shareholders, but the most noteworthy fact was that shares held by foreign investors increased from 7% to around 11%, compensated for by slight reductions in the proportion of shares held by other group categorias. The updated shareholding structure is available for consultation on www.eternit.com.br/ir.

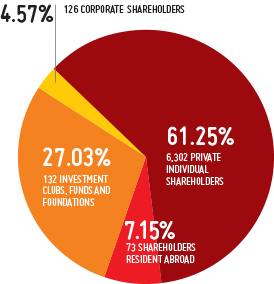

Shareholding structure as at 12.31.2011

SHAREHOLDING STRUCTURE AS AT 12.31.2012

AWARDS WON BY THE INVESTOR RELATIONS DEPARTMENT

THE OUTSTANDING WORK OF THE ETERNIT INVESTOR RELATIONS TEAM WAS RECOGNISED IN 2012 WITH THE WINNING OF FIVE AWARDS.

- 39th NATIONAL APIMEC AWARD – ASSOCIATION OF INVESTMENT ANALYSTS AND CAPITAL MARKET PROFESSIONALS: THE COMPANY RECEIVED THE PRIZE IN THE B CATEGORY, COMPANIES WITH CONSOLIDATED NET REVENUE OF UP TO R$3 BILLION. THIS ELECTION WAS CONDUCTED ON THE BASIS OF VOTING VIA INTERNET, WITH THOSE PARTICIPATING BEING ASKED TO CHOOSE THE COMPANIES THAT MOST CONTRIBUTED THE PREVIOUS YEAR WITH THE DEVELOPMENT AND IMPROVEMENT OF THE FINANCIAL AND CAPITAL MARKETS, AND INVESTMENT PROFESSIONALS.

- APIMEC MINAS AWARD: ETERNIT GIVEN RECOGNITION FOR HOLDING THE BEST PUBLIC MEETING IN 2012 BY APIMEC MG.

- 14TH ABRASCA ANNUAL REPORT AWARD: ETERNIT RECEIVED AN HONOURABLE MENTION IN THE CATEGORY OF CORPORATE GOVERNANCE.

- IRGR FOR LATIN AMERICA: ETERNIT WAS ELECTED AS THE COMPANY WITH THE BEST CORPORATE GOVERNANCE IN LATIN AMERICA FOR THE FOURTH YEAR RUNNING, BY IR GLOBAL RANKINGS.

- IR MAGAZINE AWARDS: OR THE SECOND YEAR RUNNING, ETERNIT’S INVESTOR RELATIONS TEAM WAS ELECTED AS THE BEST FOR PRIVATE INDIVIDUAL INVESTORS IN THE SMALL & MID-CAP COMPANY CATEGORY (COMPANIES WITH A MARKET CAPITALISATION OF UNDER R$3 BILLION). THE SELECTION BY IR MAGAZINE AWARDS IS RECOGNISED INTERNATIONALLY FOR ITS QUALITY AND SERIOUS APPROACH, IN BRAZIL, THE SURVEY WAS CARRIED OUT INDEPENDENTLY BY THE GETULIO VARGAS FOUNDATION BRAZILIAN ECONOMIC INSTITUTE, TAKING A SAMPLE OF MORE THAN 500 OF THE COUNTRIES INVESTMENT PROFESSIONALS.