Operation

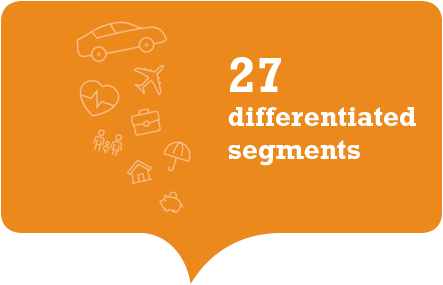

In order to define and improve its products and services, Liberty Seguros has Relationship Management initiatives based on a Customer Relationship Management (CRM) tool, and which are consolidated and cross-referenced with solutions such as the Net Promoter Score (NPS), which is the main customer and broker satisfaction tool for an exceptional service (find out more on Costumers).

Therefore, the customers’ demands and the brokers’ perceptions support the definition of products and services in the Company. In this sense, more than 60 NPS surveys are carried out a year, together with the “moments of truth”, monthly diagnostic surveys of customers’ experiences.

The needs are also raised by means of Brokers’ Councils and Customer Experience Committees, which every month assess points of improvement, innovation and the construction of solutions.

All of these inputs are added to the work and knowledge of Liberty’s Technical and Products area in order to launch products and services that meet customers’ real needs and provide the brokers with business opportunities. In 2016, Liberty Seguros launched eight products in different areas: Transporte Fácil (Easy Transport), Liberty Apartamento (Liberty Apartment), Liberty Home Office, Liberty Auto Essencial and Liberty Festas (Liberty Parties), as well as three types of insurance for niches in the retail and services sectors.

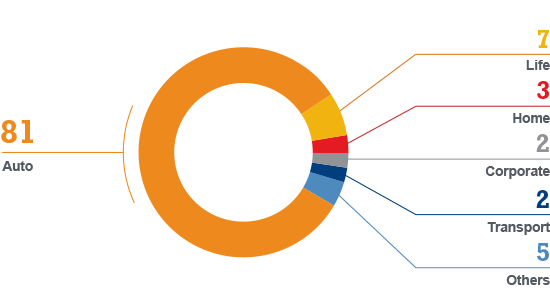

The weight of each portfolio (%)

Liberty Auto

Products:

- Conscientious Auto

- Essential Auto

- Exclusive Auto

- Profile Auto

- Truck

Liberty Conscientious Auto

With excellent cost/benefit, this product offers exclusive coverage for material damages and personal injury, which protects the insured in case of collision with third parties. In terms of differentials it offers more affordable prices, the possibility of insuring second-hand vehicles up to 25 years old and contracting that removes the requirement for prior inspection, as well as services such as 24-hour assistance, tow-truck, locksmith and the possibility of contracting optional coverage, in accordance with each profile.

The insured also builds up bonuses that can be used in the future when contracting Liberty Auto Profile, which makes this product very attractive to young audiences.

Conscientious Auto Campaign

In 2016, Liberty Seguros rewarded 172 brokers who took part in the Liberty Conscientious Auto sales campaign. This action was part of the Connected for Encouraging pillar of the Connection Program (find out more on page 36). In accordance with the number of policies sold, the brokers were able to opt for fuel credit or vouchers. They could also redeem other awards, such as a tablet, an office chair, a coffee maker, an air conditioner or a mini-projector.

Liberty Essential Auto

One of the Company’s leading products in 2016, Liberty Essential Auto introduced a major innovation to the segment: with a lower cost than a traditional insurance policy, it is the Company’s first insurance aimed exclusively at protection in cases of total loss, theft or robbery.

Therefore, it is ideal for those who cannot afford the costs of a more comprehensive insurance policy and who want to ensure the asset. It also reinforces Liberty’s commitment to offer increasingly customized products.

Liberty Home

Products:

- Apartment

- Home Office

- Residence

Liberty Home

Providing insurance coverage for the most common damage in houses and apartments is the main purpose of Liberty Home, which offers coverage that goes beyond the fire insurance provided in the tenancy law. Customers can take out civil liability insurance; insurance against theft with subtraction of property with traces; broken glass, mirrors, marble and granite; electrical damage; gale; electronic equipment; vehicle impact; and, in the case of rented real estate, loss or payment of rent. They can also count on 24-hour home assistance services such as plumbers, electricians and repairs of household appliances, as well as assistance for pets.

Liberty Apartament

With customized coverage and assistance, Liberty Apartment can be taken out by owners or tenants who are looking for convenience and exclusive assistance, such as payment of condominium charges in case of loss of income, damage caused by burst pipes, theft of goods in storage or from bicycle rack, fumigation, cleaning and air-conditioning repairs and even the placement of screens on windows.

Liberty Life

Products:

- Special Life

- More Peaceful Life

- Personal Accident

- Parties

- Profile Life

Liberty Parties

This product was designed in order to guarantee peace of mind when contracting parties of different sizes. In order to do this, it ensures the amount paid to the company organizing the event (rental of the space and catering service in a single contract) in the case of non-fulfillment on account of bankruptcy, fire or natural events occurring on the premises. One of the differentials in the basic coverage is the reimbursement of the amount paid by the party contracting the event (grooms, graduates, debutantes, people celebrating their birthdays and family members) in the case of bankruptcy of the main company contracted.

The customer can also take out a series of additional insurance coverage that guarantees the payment of expenses, such as the use of a power generator, the rental or purchase of formal clothing in case of bankruptcy of the supplier originally chosen, the theft of the insured’s assets during the event and expenses with an events planner or advisor for the planning and organization of a new event.

Liberty Profile Life

One differential is the optional coverage for those who are concerned about health and well-being: Nutritionist and Personal Fitness Assistance. By means of a specific questionnaire to determine pathological and cultural nutritional history, in addition to the Body Mass Index (BMI), a nutritionist traces the profile of the insured and assists them with the preparation of special menus for weight control and preventive nutrition. Personal Fitness, in turn, is an advisory service regarding physical activity programs, with the service provided over the phone, by physical education professionals.

Liberty Companies

Products:

- Auto (Car Fleets)

- Personal (School; Educational Protection; Financial Protection; Global Life; Small Company Life; Liberty Collective Personal Accident; Liberty Group Life)

- Civil Liability (Educators; Events; Trade Fairs and Exhibitions; Provision of Services)

- Engineering Risks (Engineering; Construction Engineering; Installation and Assembly Engineering; Renovations Engineering)

- Asset Risks (Commerce and Services; Industries; Real Estate Brokers)

- Transport (RC Transporter; Easy Transport; International Transport; Domestic Transport)

Easy Transport

Liberty Easy Transport is an affordable insurance, which is aimed at very small and small sized businesses, which does not require communication of loading (registration). It protects goods transported throughout Brazil by land or air, with a guarantee of replacement in cases of losses and damage to the goods due to accidents with the transporting vehicle, such as collision, rolling over, tipping over, fire or explosion; damage to loads caused by nature; various damages to new goods; theft of the cargo together with the transporting vehicle; and armed robbery.

Liberty Renovations Engineering

Liberty Renovations Engineering is an insurance for small renovations that protects against damage that occurs during construction work. Exclusive coverage is offered such as civil liability (damage to third parties resulting from construction work) and surrounding properties (damage to preexisting areas owned by the insured or under the insured’s responsibility, but which are not part of the renovation). Starting from the basic plan, the insured has coverage available for fire, robberies, theft and explosions.

Agricultural equipment

To support farming operations, Liberty provides insurance for tractors, harvesters, cutting decks, sprayers, irrigation and storage equipment and agricultural tools of every sort. The Company’s requirement is that the items should be new, or not more than five years old, only for agricultural use and valued at not more than R$1.5 million. As well as providing more security in agribusiness, the Company can offer a product to suit customers using Federal Government funds to finance their assets, and who must have adequate insurance during the period of the loan.

The basic coverage indemnifies loss or damage caused to the assets insured as the result of an accident caused by an external agent, including robbery or theft, and additional coverage for electrical or water damage, loss or payment of rental and third party liability.

Liberty Affinity

- Affinity Employees (Personal Accident; Apartment; Conscientious Auto; Profile Auto; Home Office; Home; Life)

- Affinity Financial Institutions

- Cooperatives and Associations

Affinity Employees

It encompasses a structured program of insurance, with advantages for the employees, in addition to benefits and easy contracting. The objective is to offer companies the maximum in terms of peace of mind, from planning to the adoption of the benefits program and the adhesion of the participants. To this end, Liberty Seguros has a team that specializes in assisting the Human Resources department.

LIU

Liberty offers a line of special risk insurance for large companies by means of Liberty International Underwriters (LIU), which is the Liberty Mutual Group’s special risks division. Among the products are:

- Managerial Liability (D&O)

- Professional Liability (E&O)

- Civil Liability

- Environmental Risks

- Product Recall

- Kidnapping

- Sabotage and Terrorism

- Property

- Energy

- Engineering Risks

- Marine