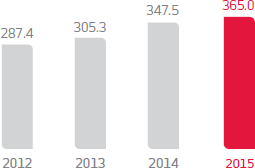

Bradesco’s revenues from Asset Management grew 6.9% in 2015, accounting for 10.5% of all service revenues.

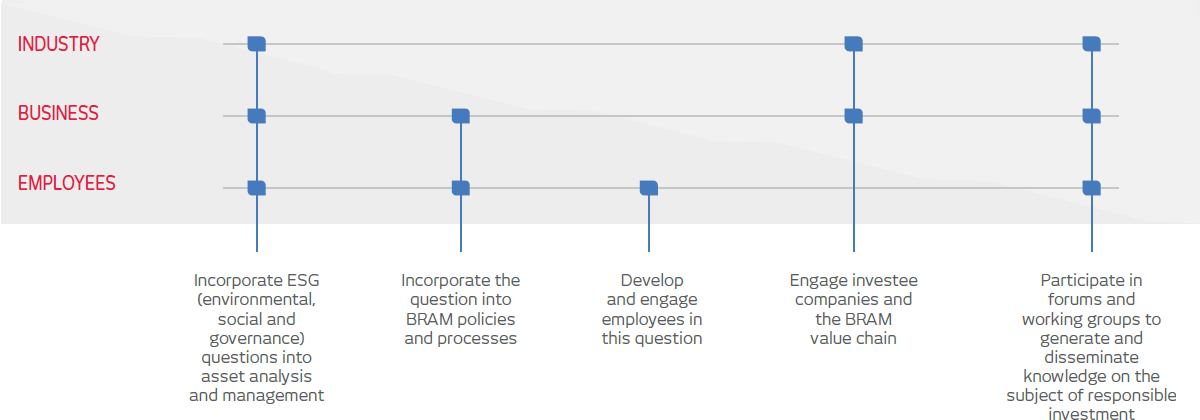

In analyzing investments, Bradesco Asset Management (BRAM), specialized in managing investments funds and portfolios for all market segments, employs processes and methodologies that take environmental, social and governance questions into account at all levels of its decision making.

The unit is a signatory to the United Nations Principles for Responsible Investment (PRI) and since 2013 has had a specific project for analyzing and integrating these questions into management activities. The approach to responsible investment is based on three fronts that impact employee behavior, the business and the investment industry. These are set forth in the BRAM Responsible Investment Standard and Manual.

DMA Active Ownership

Based on these principles, BRAM applies methodologies that take into account the most relevant questions for the different sectors in which the institution invests.

| Definition of ESG* criteria to be analyzed | Survey of company information | Contact for engagement and more in-depth analysis | Elaboration of ESG rating for analysis and management |

| *Environmental, Social and Corporate Governance. | |||

In 2015, the unit conducted analyses and engagement meetings for 100% of the companies covered by BRAM variable income analysts. A pilot project was also initiated to analyze these questions for corporate fixed income assets. This will be concluded in 2016.

Additionally, BRAM offers its clients variable income investment products with a more specific focus on ESG questions via the positive triage of the assets. All the actively managed variable income assets are subject to ESG analyses. The criteria used in the triage include a sector methodology comprising a total of 29 sub-sector methodologies, which are divided into general questions for all the sectors and specific ones for each sector of activity of the companies in the BRAM variable income portfolio. The triages only contain recommendations and are not legal requirements. In 2015, the area had R$395.82 billion under management, R$9.97 billion of which had undergone positive triage for these criteria (2.52%).

| Total assets (R$ billion) | Assets subject to environmental and/or social triage (R$ billion) | ||||||

|---|---|---|---|---|---|---|---|

| Positive | Negative | Positive and negative combination | |||||

| Total | % | Total | % | Total | % | ||

| 2014 | R$ 347.50 | R$ 6.40 | 1.84 | Not done | Not done | R$ 6.40 | 1.84 |

| 2015 | R$ 395.82 | R$ 9.97 | 2.52 | Not done | Not done | R$ 11.70 | 3.21 |

Since 2015, BRAM has expanded the positive assessment methodology to all its stock portfolio and not just for ESG-oriented niche products.

Among the funds associated with social and environmental responsibility, the area manages funds from the Fundação Amazonas Sustentável (FAS) and assets on the Corporate Sustainability Index (ISE), which comprises companies committed to economic-financial, social and environmental questions and to good corporate governance practices (ESG), as well some on the BM&FBOVESPA Differentiated Corporate Governance Index (IGC).

Fundação Amazonas Sustentável (FAS)

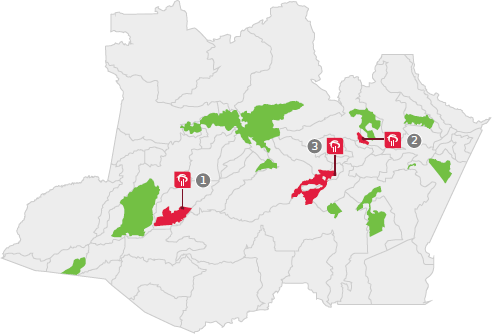

The partnership between FAS and Bradesco facilitated the installation of a Bradesco Expresso unit in the Piagaçu-Purus Sustainable Development Reservation (RDS) in the municipality of Beruri in Amazonas. The initiative benefits more than 4,900 riverside community residents in an area of over 1 million hectares. In addition to this unit, another two are already in operation in the Rio Negro and Uacari sustainable development reservations, respectively in the communities of Tumbira and Bauana, with a direct impact on 3,500 people living in 49 riverside communities, covering an area of over 730,000 hectares.

In addition to facilitating access to the benefits of the Bolsa Floresta (Forest Allowance) program, Bradesco Expresso helps drive community development by ensuring that funds generated in the region circulate internally. One of the main economic activities is breeding and commercializing fish, in particular the pirarucu, one of the production chains supported by the FAS.

As co-founder, Bradesco made initial contributions to the foundation’s permanent fund, and assisted with operational and administrative costs, enabling the execution of all the programs in place in the 16 sustainable conservations units in the state of Amazonas, where the FAS operates. However, each year FAS has become more self-sustaining, seeking new partners for its activities.

In 2015, by means of the Municipal Children’s and Adolescents’ Rights Fund, the unit also supported FAS projects in four municipalities in the Amazon (Carauari, Maraã, Novo Aripuanã and Uarini), directly impacting more than 1,500 children and adolescents.

Management Ranking (R$ Billion)

Legend: 1 Uacari Sustainable Development Reservation (Bauana) | 2 Rio Negro Sustainable Development Reservation (Tumibira) | 3 Piagaçu-Purus Sustainable Development Reservations (Cuiuanã)

During the same period, another 40,098 people benefited from diverse measures promoted by the foundation, including:

- Empowerment of the associations representing beneficiaries of the Bolsa Floresta (Forest Allowance) program, provoking a powerful impact on financial inclusion.

- Financial support to enable meetings of leaders, worthy of note being the participation of leaders in public hearings for the Amazon Environmental Service Law, which led to the introduction of the Forest Allowance public policy in 2015.

- Incentives for entrepreneurship, with exchanges driving the development of sustainable businesses which, in turn, provoke positive impacts on the management of initiatives in riverside communities and increase income generation.

- Sponsorship of the 1st Virada Sustentável in Manaus, led by the FAS and executed by a group of organizations committed to sustainable development. The event mobilized more than 8,000 people in different public areas in the city with more than 150 activities.

Fundação SOS Mata Atlântica

The Fundação SOS Mata Atlântica is one of the non-governmental organizations, foundations and institutions with which Bradesco Seguros maintains partnerships aimed at promoting the conservation of biological and environmental diversity and fostering civic awareness.

The foundation’s projects which benefit include forest monitoring studies and the Atlas of Atlantic Rainforest Forest Remnants, which showed a 24% reduction in the level of deforestation in the biome from 2013 to 2014. Through the Clickarvore program, also run by SOS Mata Atlântica, Bradesco contributed to the planting of more than 28 million seedlings, helping restore more than 16,000 hectares in 508 municipalities in nine Brazilian states.

In the Florestas do Futuro project, which covers 46 municipalities in five states, an area of 2,600 hectares was reclaimed with the planting of around 5 million seedlings. In all, the forestry reclamation projects undertaken by the foundation involved planting 33.5 million seedlings, restoring an area totaling 19,000 hectares. In 2015, Bradesco Cards contributed R$4.5 million, while Bradesco Capitalization donated R$3.5 million to the foundation.