Corporate governance

GRI 4.1

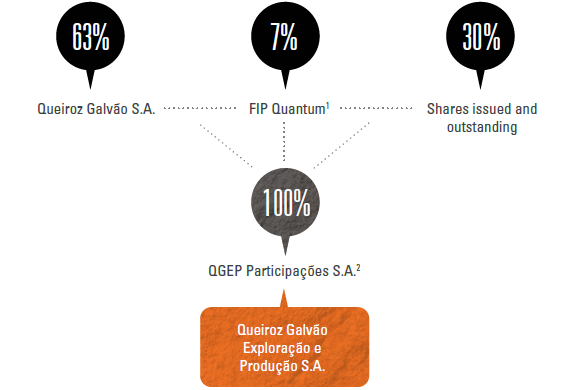

The Company is traded on the BM&FBovespa Novo Mercado and the principles of transparency, fairness and full disclosure are fundamental to its management practicesQueiroz Galvão Exploração e Produção S.A. is the only company in the Queiroz Galvão Group which is publicly traded. Its management follows the Group’s high standards of corporate governance and its solid ethical foundation. The corporate governance of Queiroz Galvão Exploração e Produção S.A. is overseen by QGEP Participações S.A., and complies with the transparency, disclosure, fairness and corporate responsibility guidelines of the Brazilian Institute of Corporate Governance (IBGC). The Company also complies with best market practices by being a member of the BM&FBovespa Novo Mercado, the section of the Brazilian stock exchange reserves for companies with the highest standard of corporate governance. The Company also applies the 10 principles of the Global Compact in its governance practices.

The Company’s corporate governance structure oversees investment decisions and monitors the Company's relationship with its stakeholders, ensuring continuous value creation and sustainable business development.

2. Direct holding company of QGEP, which incorporated Manati S.A. in 2012. The chairman of the Board of Directors of Queiroz Galvão Participações S.A. is also a member of the Board of Directors of Queiroz Galvão S.A.

BOARD OF DIRECTORS

GRI 4.3

The Board of Directors consists of seven members, two of whom are independent (representatives of minority shareholders). All Board members are elected at the Company’s Annual General Meeting. The Board’s responsibilities include setting the Company’s long-term strategies and policies, as well as overseeing the management of the Executive Board. Each member serves a two-year term, with the possibility of re-election. Consistent with the corporate governance requirements of the Novo Mercado, the chairman of the Board of Directors is not a member of the Executive Board. QGEP does not have committees linked to the Board, but is considering implementing this practice. GRI 4.2

Employees and shareholders rely on the Investor Relations department to forward suggestions and requests to the Board. Minority shareholders also have direct contact through the Contact IR channel, which is available on the Company’s Investor Relations website. During the year there were no specific requests made to the Board, while the majority of inquiries made to the IR function related to the distribution of dividends, the QGEP portfolio, growth prospects and stock performance. In 2013 the Company will be studying various options related to creating a direct communication channel for Minority Shareholders to reach board members. For more information about the Board, please see the Company’s Bylaws at www.qgep.com.br/ri.

GRI 4.4

In keeping with the Corporations Act, the members of the Board of Directors are not allowed to vote at any shareholders’ meeting, or undertake any transaction or business in which they have a conflict of interest with the Company. Additionally, any decisions taken by the Board of Directors on transactions with related parties, as defined by applicable legislation, must be approved by the Company’s independent board members. GRI 4.6

QGEP’s corporate governance is constantly evolving. One of the advances made in 2012 was the implementation of performance-linked remuneration policy for directors. The criteria that affect this remuneration will be linked to a set of financial and performance indicators, and subjected to continuous monitoring by the Board of Directors. GRI 4.5

Total remuneration for board members and directors in 2012 reached R$2.1 million, and was paid by QGEP Participações S.A. The Board of Directors received R$843,000, while R$1.2 million was allocated to the Executive Board. Total remuneration for directors last year was R$14.7 million, received through the Queiroz Galvão Exploração e Produção S.A. subsidiary, of which 20% was for fixed pay, 42% for variable pay, 26% for completion bonuses or change of position, and 12% was related to a stock-based compensation.

QGEP also has a stock option purchase plan. For the fiscal year ended December 31, 2012 it granted 1,568,958 options (or 0.59% of the Company’s share capital) to directors and advisors to purchase common shares. This policy maximizes the quality of management by helping QGEP to attract, motivate and retain qualified managers, and to align the interests of the Company with those of its shareholders.

- Remuneration Policy: based on the development and retention of employees. QGEP is studying the adoption of a profit and results sharing plan based on social, environmental, economic, financial and operational criteria.

- Disclosure of Material Act or Fact Policy: manages the disclosure of clear information to investors through QGEP communication channels and leading newspapers, and prohibits any practice of unfair disclosure of results and strategic actions.

- Trading Policy: establishes rules for the trading of securities issued by QGEP by employees to ensure the practice of good conduct and to prevent insider trading.

- Market Risk Management Policy: formalizes measures for the mitigation of market risks, such as interest rate risk.

One of the main goals to be achieved by 2014 is to create a series of internal events to ensure Board members are continuously engaged with the issue of sustainability. This initiative includes establishing a selection policy for the Board of Directors to clearly assess potential Board members’ qualification. GRI 4.7 | 4.10

At the 8 meetings it held in 2012, the Board approved the Company’s quarterly and annual financial statements, Code of Ethics (which was created in 2011), and the purchase of shares to bolster the stock option program. The Board also monitored the Company’s budget and executed changes in the QGEP Executive Board. The Board members had a 98% participation rate in Board meetings during the year.

| Members of the Board of Directors* | |

|---|---|

| Antonio Augusto de Queiroz Galvão | Chairman |

| Ricardo de Queiroz Galvão | Vice-Chair |

| Maurício José de Queiroz Galvão | Member |

| José Augusto Fernandes Filho | Member |

| Leduvy de Pina Gouvêa Filho | Member |

| José Luiz Alquéres | Independent member |

| Luiz Carlos de Lemos Costamilan | Independent member |

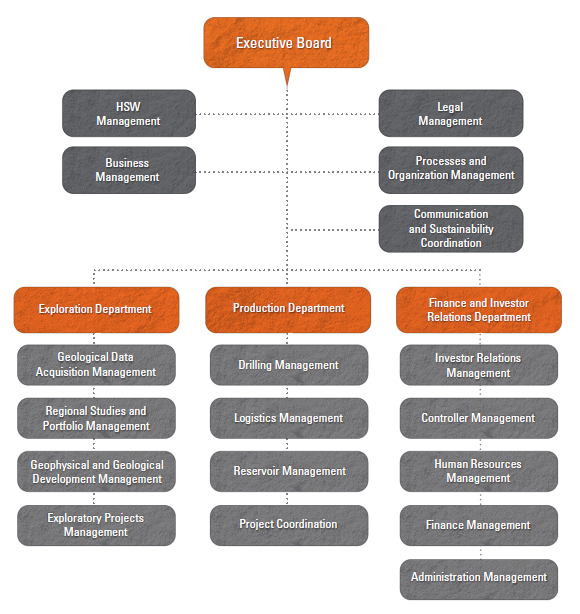

EXECUTIVE BOARD

The Executive Board is responsible for conducting the business of the Company and implementing the policies and guidelines established by the Board of Directors. Its four members are appointed by the Board of Directors for a two-year term, with the possibility of re-election. In 2012 the then director of Exploration, Lincoln Rumenos Guardado, assumed the position of CEO as part of a succession process which began in 2011. Sergio Michelucci, formerly manager of Exploration Projects, became the new director of Exploration. For more information about the Executive Board, please see the Company’s Bylaws at www.qgep.com.br/ri.

One of the advances made in 2012 was the implementation of a performance-linked remuneration policy for directors

| EXECUTIVE BOARD members | |

|---|---|

| Lincoln R. Guardado | Chief Executive Officer |

| Sergio Michelucci | Director of Exploration |

| Paula Costa Corte-Real | Financial and Investor Relations Director |

| Danilo Oliveira | Production Director |

Organizational structure

INVESTOR RELATIONS

QGEP's relationship with shareholders and investors is based on the highest levels of transparency and is managed by the Investor Relations (IR) team. Its activities are governed by various policies, including the Material Act or Fact Disclosure and Securities Trading Policies. The Company also seeks at all times to meet the interests of all shareholders in a fair and non-discriminatory manner.

In 2012 the IR team participated in 163 meetings with shareholders and investors plus 16 conferences in Brazil and abroad, bringing it into contact with over 800 investors. Additionally, the team held a public meeting in conjunction with – Apimec SP, at which QGEP officers disclosed results and expectations for the business.

A redesign of the company website is planned for 2013. IR and institutional content will be integrated, modernizing the site and making it accessible to all stakeholders. This initiative is the result of analyses carried out to evaluate the perception of investors and their satisfaction with the tools QGEP makes available to them.

QGEP's goal is to include clauses on human rights in 100% of its agreements and contracts by 2014

Recognition

A public meeting held by QGEP in December of 2011 was listed as one of Sao Paulo’s top 10 meetings of the year by The Association of Capital Markets Analysts and Investment Professionals – Apimec SP. An Apimec SP jury assessed 136 meetings held during the year, and made its selections based on feedback from the investment professionals who attended each meeting.

Transparency

In May 2012 QGEP sponsored and participated in the Rio Investors Day event, which brought together senior executives from leading public companies, domestic and international investors, as well as representatives of the federal, state and municipal governments. QGEP also sponsored the event in 2011.

HUMAN RIGHTS

In 2011 the QGEP Code of Ethics was developed in partnership with Company employees. The Code is not a strict set of rules and procedures, but rather it expresses the commitment of our staff members to the Company, based on six principles: professional development; participatory management; ethics and transparency; results and meeting challenges; the promotion of well-being; and a commitment to sustainability. The Code is available at www.qgep.com.br in the About Us section.

To disseminate the Code to employees, the Company conducted internal marketing initiatives and discussions on ethics during Workplace Accident Prevention Week (SIPAT). Approximately 70% of our employees took part in these initiatives and discussions.

Our respect for human rights is also demonstrated by our commitment to the United Nations Global Compact, and to the National Compact for the Eradication of Slave Labor, which was created by the Ethos Institute for Corporate Social Responsibility, the International Labor Organization (ILO) and Repórter Brasil, an NGO. GRI 4.12

Major investment contracts involving fixed assets worth more than R$200,000 (or equivalent) adhere to International Financial Reporting Standards (IFRS), and contain clauses regarding compliance with labor conditions, work related accidents, life and personal injury insurance, environmental protection and social responsibility. Of the four contracts signed in 2012, two included human rights elements. The Company's goal is to include human rights clauses in all agreements and contracts by 2014. GRI HR1

Share price at December 31, 2012: R$ 13.12

Market value: R$ 3.5 billion

In supplier relations, QGEP has always included human rights provisions in its contracts. During the year, 65.38% of signed contracts contained elements related to health, environment and safety, environmental permits, working conditions and payroll and tax obligations. Of 26 supplier contracts, 17 contained clauses on human rights. GRI HR2