Strategy

QGEP is based on the expansion of its portfolio and the maturing of its assets. To accomplish this we will intensify our search for new opportunities and exploration projects in Brazil, particularly in emerging and producing basins. The Company also seeks to strengthen strategic partnerships that contribute to risk mitigation and add to our knowledge of production processes of the exploration and production chain.

QGEP’s goal is to be one of the top three oil and gas producers in Brazil by 2020, and to always adhere to transparent and responsible management practices. Major operational goals during this period include the development of the Atlanta Field, and further ahead, the Carcará discovery.

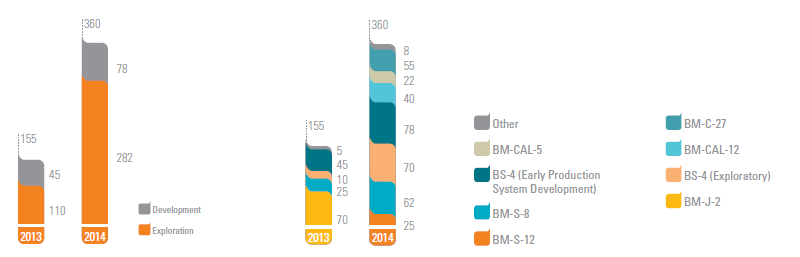

The Company's investment capacity is a key element in the implementation of this strategy. Estimated capital expenditures (Capex) on equipment and facilities for 2013 and 2014 are R$155 million and R$360 million, respectively. In subsequent periods QGEP plans to increase investment in order to continue the development of the Atlanta Field and to drill exploratory wells in the Campos, Santos and Camamu-Almada basins.

QGEP – NET CAPEX (US$ million) |

QGEP – NET CAPEX (US$ million) |

|

|

STRATEGIC RISK MANAGEMENT

QGEP’s risk management is based on the Market Risk Management Policy approved by the Board of Directors in 2011. This document establishes the measures the Company must take to mitigate exposure to market risks that are not inherent to oil and gas exploration and production, including foreign exchange risk. It also sets the conditions and limits for the use of derivatives, which can only be used forhedging. Risk assessment is carried out by a working group comprised of employees from various Company areas, which seeks the advice of market experts and reports to the Executive Board and Board of Directors.

With respect to the blocks it operates, the Company uses best industry practice methodologies such as Preliminary Risk Analysis (PRA) and Hazard and Operability Study (HAZOP). In addition, periodic inspections of third-party contractors are conducted, including assessments of Management Practice No. 12 of ANP Resolution No. 43/07 (Operational Security Management System – SGSO), a technical regulation which establishes requirements for identifying and analyzing risks that could result in any such incidents.

A new incident management structure based on the Incident Command System (ICS) is planned for 2013. Additionally the company is analyzing the possibility of setting up a specific committee for monitoring and managing other risks in coming years.

For more information, please see the Reference Form at www.qgep.com.br/ri in the section for Notices and Minutes/Documents submitted to the Brazilian Securities and Exchange Commission (CVM)..

INTANGIBLE ASSETS

Intangible assets managed by QGEP are viewed as strategic assets which are fundamental to the success of our projects and business. Accordingly, the Company continually invests in initiatives that add value to these assets.

BRAND

The unique history and growth of the Queiroz Galvão Group over the past 60 years enhances QGEP’s reputation. The Group’s successful practices in sectors such as construction, concessions, energy, real estate, agribusiness and steel have been transferred to oil and gas exploration and production. This is just one of the factors that allows the QGEP brand to represent strength, responsibility and reliability. Additionally, QGEP’s activity in the capital markets and good governance practices enhance the Company’s reputation for transparent disclosure and responsible stakeholder relations.

- Future drilling programs may not be carried out, or may not produce commercially viable quantities or qualities of oil or gas.

- Oil and gas exploration and production involves risks such as spills, explosions in pipelines and exploration wells, and geological and environmental disasters.

- QGEP is not an operator in most of its blocks, which limits its capacity to control exploration activities, development deadlines and associated costs, or the rate of production from a successful project.

- The loss or dismissal of senior management or exploration and production personnel may impair future success.

- Projects are subject to delays and budget overruns, which can adversely affect current and future operations.

- Global prices and the demand for crude oil and natural gas may fluctuate due to factors beyond the Company's control.

- The oil and natural gas industry is subject to strict federal government regulation and intervention.

- Changes in the exchange rate between the US dollar and the Brazilian real can affect items denominated in dollars or whose price in reais is indexed to, or strongly influenced by, their price in foreign currency

260 million barrels of oil in recoverable volume constitute the Atlanta Field

QGEP’s participation in trade fairs and events also strengthen the Company’s brand. In 2012 QGEP, in partnership with other Queiroz Galvão Group companies in Construction and Oil and Gas. QGEP also took part in Rio Investors Day, and the Rio Oil & Gas Expo and Conference, Latin America’s leading industry conference. The Company also contributed to Good Social Responsibility Practices, a document published by the Brazilian Institute of Oil, Gas and Biofuels (IBP) and launched at Rio Oil & Gas Expo. To increase efficiency and effectiveness, the Company plans to redesign its offices and websites in 2013.

HUMAN CAPITAL

For QGEP the development of its staff involves both recognizing their previous experience, and developing innovative new talents. To ensure the development of this model and to maintain a work environment conducive to getting the best from every employee, QGEP invests in the development and training of all of its staff. In addition to establishing an open-door policy, in 2012 QGEP launched an intranet with an ombudsperson channel available at Contact Us. These initiatives reinforce the company's commitment to transparency and the values expressed in its vision and mission.

PROMOTING innovation

Constant investment in new methodologies, tools and processes for exploration and the operating of wells is essential to effectively manage the uncertainty inherent in our business. We promote the development of innovative technologies by participating in sector committees and seminars, and by maintaining a constant dialogue with the market and the scientific community. The Company is constantly meeting and overcoming new technical challenges. At the Atlanta Field, for example, the challenge for QGEP is to bring together a range of technologies to explore the first ultra-deep water field for 14º API gravity heavy oil in friable sandstone. The different equipment necessary to extract this oil has already been used separately. QGEP has assembled a highly skilled technical team to manage their joint use.

The extraction and production of heavy oil is more complex and costly than for light oil, making it a challenge for many companies. To correctly assess a project’s economic viability requires tools and technology which have been successfully tested on these heavy oil reserves.

The Atlanta Field is operated by QGEP and has a production potential of about 260 million barrels of recoverable oil. By overcoming the exploration challenges in this type of pioneering project, QGEP and its partners will demonstrate the effectiveness of the integrated use of technology for drilling and completing wells. The process will also provide valuable information about the behavior and productivity of this reservoir and production plant, to the benefit of the entire oil and gas sector.

In addition to discovering new reserves, QGEP seeks to develop previously discovered reserves with unusual characteristics in oil quality or geological structure, which were not developed due to technical limitations. Through this project we estimate that over a thousand indirect jobs will be created, plus a further hundred direct outsourced jobs.