Capital Market

The relationship with the capital market is mediated by the Investor Relations area, which periodically discloses the business model, strategy and main results for Multiplus. To do this, channels such as phone conferences, public meetings with analysts, the IR website (with reports, notices, relevant facts and minutes), roadshows and conferences in Brazil and abroad, the annual report and direct contact with the team by phone and e-mail are used. In 2012, 973 contacts were made with investors and 8 roadshows and 11 conferences were promoted.

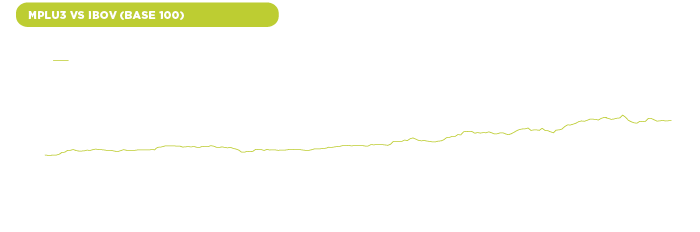

Share performance

Multiplus is controlled by TAM S.A., which at the end of 2012 held 72.87% of its capital; the remaining shares are in free float. The company's shares are traded on the BM&FBovespa Novo Mercado (MLPU3) and are also included in the Brazil Index (IBrX-100).

Multiplus shares ended the period at BRL47.72, up 5.4% for the year, while the Ibovespa was 7.4% higher for the year, having gained 265.3% since the initial public offering. Average daily share volume was approximately BRL16.7 million, compared to BRL9.5 million in 2011.

Shareholder remuneration

Positive cash generation resulting from the nature of the Multiplus business – only accounting for revenue from the sale of points at the time they are redeemed – made a historic payout of around 99% possible, maximizing return for shareholders.