GRI G4-DMA Occupational health and safety | G4-DMA Diversity and equal opportunity

Eternit maintains transparent relationships with all of its stakeholders, seeking to maintain a permanent dialogue and enhance its communication tools. The recognition received over the years reinforces the Company’s commitment to transparency in the rendering of accounts, effectively demonstrating the best practice of Corporate Governance adopted with regard to its investors and society.

In its constant pursuit of transparency and equitable treatment in its relations with all stakeholders, the Corporate Governance model adopted by Eternit is based on best market practices. The main objective of this model is to enable the Company to act in a responsible and sustainable manner in all communities where it operates, thereby generating value for shareholders, capital markets and other stakeholders, in full compliance with Brazilian Corporation Law and the Listing Regulations of the Novo Mercado segment of the São Paulo Stock Exchange (BM&FBovespa).

The Company, which is a publicly traded corporation since 1948, also adopts an external audit, which is conducted by an independent firm that is substituted within a maximum of five years, as determined by the Securities and Exchange Commission of Brazil (CVM).

Through Assembleia na Web, a tool adopted since 2010, shareholders can participate in shareholders’ meetings from anywhere in Brazil or abroad. The platform includes remote registration and digital certification for casting votes via electronic proxy.

To ensure the integrity of the decisions and comply with Brazilian Corporations Law, directors may not vote on or act on matters in which they have a potential conflict of interest with the Company. The Board’s Internal Charter determines that, when a conflict of interest is identified in relation to any matter, the person involved must remove themselves, including in the physical sense, from the discussion and resolutions for such a matter, this temporary removal being registered in the minutes. GRI G4-41

Corporate governance differentials

| Under 30 years | From 31 to 50 years | Over 51 years | ||||

|---|---|---|---|---|---|---|

| Men | Women | Men | Women | Men | Women | |

| Board of Directors | 1 | - | 2 | - | 3 | - |

| Board of Auditors* | - | - | 5 | - | 1 | - |

| Executive Board | - | - | 2 | - | 4 | - |

| Committees | 1 | - | 5 | - | 8 | 1 |

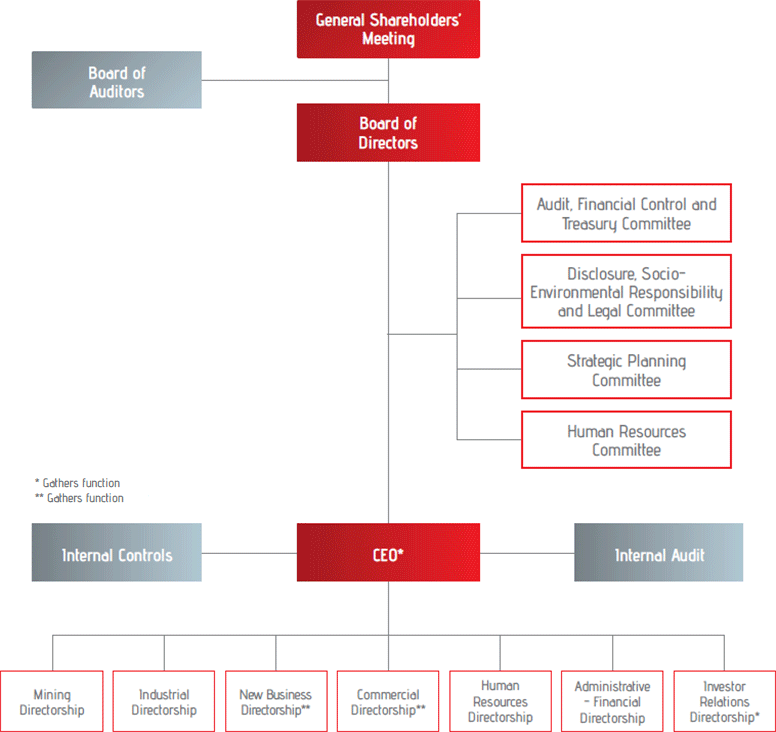

The Board of Directors is an independent, collective body formed by up to seven members and regulated by an internal charter that governs its activities and the rights and duties of its members and its relationship with the Executive Board and other bodies .

It is responsible for establishing the general orientation of the business and for deciding on strategic matters, in accordance with the principles of corporate responsibility and ethics established in the Eternit Code of Ethics, while endeavoring to uphold the corporate guidelines and protect the interests and stakeholders of the Company. Its mission also includes expressing an opinion on the financial statements and the reports prepared by the Executive Board, determining the allocation of profits and approving the annual budget. It is also responsible for the election, supervision and removal from office of the officers and for choosing the independent auditors. GRI G4-42, G4-45, G4-46, G4-56

With practices that go beyond the requirements of Novo Mercado rules, which include a Board of Directors formed by at least 20% independent directors, in December 2014, 100% of directors were independent, with the board formed by one chairman and five directors, who were elected at the Annual Shareholders’ Meeting for one-year terms and are eligible for reelection.

The body evaluates annually its performance while also considering the individual performances of the directors and the activities of the Advisory Board (when installed) and of the Chief Executive Officer of the Company. Its members are chosen for their technical skills. The concept of independent member adopted by Eternit is as defined in the Novo Mercado Regulations of the BM&FBovespa. Through the channel Talk to the Board, stakeholders are able to contact the body directly while keeping their identity anonymous. GRI G4-40, G4-43, G4-44, G4-49, G4-57, G4-58

In 2014, the Board of Directors discussed topics such as: the distribution and payment of dividends and interest on equity; approval of the financial statements; considering and voting on the interim, individual and consolidated financial statements; and electing the Executive Board. GRI G4-50

The compensation paid to members of the Board of Directors in the year amounted to R$2,020,000, of which R$852,000 referred to variable income. The compensation was approved in the Annual Shareholders’ Meeting held on April 23, 2014 and granted based on the Company’s financial, social and environmental performance. GRI G4-51, G4-52, G4-53

| Executive | Position | Specialty and Committees |

|---|---|---|

| Luis Terepins | Chairman - independent* | Specialties: Financial and industrial. Participates on the Human Resources; Audit, Financial Control and Treasury; and Strategic Planning committees. |

| Lírio Albino Parisotto | Director - independent* | Specialties: Financial and industrial. Participates on the Strategic Planning Committee. |

| Marcelo Munhoz Auricchio | Director - independent* | Specialty: Industrial. Participates on the Human Resources; Audit, Financial Control and Treasury; and Strategic Planning committees. |

| Benedito Carlos Dias da Silva | Director - independent* | Specialty: Industrial. Participates on the Human Resources; Disclosure, Socio-Environmental Responsibility and Legal; Audit, Financial Control and Treasury; and Strategic Planning committees. |

| Leonardo Deeke Boguszewski | Director - independent* | Specialty: Financial. Participates on the Human Resources; Disclosure, Socio-Environmental Responsibility and Legal; Audit, Financial Control and Treasury; and Strategic Planning committees. |

| Marcelo Gasparino da Silva | Director - independent* | Specialty: Legal. Participates on the Human Resources; Disclosure, Socio-Environmental Responsibility and Legal; and Strategic Planning committees. |

For more information on the Board of Directors, go to www.eternit.com.br/ir in the section Investor Information/Forms.

The Board of Auditors is an advisory body to the Board of Directors whose key responsibility is supervising the financial situation of the Company. The Board of Auditors was installed in 2013 at the request of a shareholder. It is not a standing body and entitles its members to a term ending at the next Annual Shareholders’ Meeting, eligible for reelection, in accordance with the internal charter approved in June 2013.

Due to its installation, the Advisory Board, a body that supports the Board of Directors, remained vacant during 2014.

The annual compensation paid to the members of the Board of Auditors amounted to R$294,000 in 2014. GRI G4-51, G4-52

| Executive | Position | Specialty and Committees |

|---|---|---|

| André Eduardo Dantas | Coordinator | Specialty: Legal. Participates on the Audit, Financial Control and Treasury committee. |

| Edson Carvalho de Oliveira Filho | Member | Specialty: Financial. |

| Paulo Henrique Zukanovich Funchal | Member | Specialty: Financial. |

| Charles René Lebarbenchon | Alternate | Specialty: Legal. |

| Guilherme Affonso Ferreira | Alternate | Specialty: Financial. |

| Daniel Cupponi | Alternate | Specialty: Financial. |

The Executive Board is formed by six officers, who include the chief executive officer of the Company, who also accumulates the function of investor relations officer. The body meets on a monthly basis, in accordance with Article 23 of the Company’s Bylaws, and its functions include executing the strategic decisions proposed by the Board of Directors, monitoring the actions and results of Eternit and promoting greater synergy among the areas and/or companies of the Group, all in accordance with the Bylaws and its own Internal Charter. The officers serve for terms of one year and are eligible for reelection.

The annual compensation paid to the Executive Board is composed of a fixed portion that amounted to R$6,259,000 in 2014, and of a variable portion (profit sharing bonus) that amounted to R$3,375,000 in the year. GRI G4-51, G4-52

| Executive | Position | Specialty and Committees |

|---|---|---|

| Nelson Pazikas | Chief Executive Officer and Investor Relations Officer. He is also chairman of the Board of Directors and the Managing Director of Companhia Sulamericana de Cerâmica (CSC). | Participates on the Audit, Financial Control and Treasury; Disclosure, Socio-Environmental Responsibility and Legal; Strategic Planning and Human Resources committees. |

| Flávio Grisi | Chief Human Resources Officer He is also a member of the Board of Directors of CSC. | Participates on the Strategic Planning; and Human Resources committees. |

| Marcelo Ferreira Vinhola | Chief Sales Officer. Also a member of the Board of Directors of CSC. | Participates on the Audit, Financial Control and Treasury; and Strategic Planning committees. |

| Rubens Rela Filho | Chief Mining Officer and General Director of SAMA S.A. Minerações Associadas. |

Participates on the Disclosure, Socio-Environmental Responsibility and Legal; and Strategic Planning committees. |

| Rodrigo Lopes da Luz | Chief Financial and Administrative Officer. He is also the Chief Financial Officer of CSC. | Participates on the Audit, Financial Control and Treasury; Disclosure, Socio-Environmental Responsibility and Legal; and Strategic Planning committees. |

| Welney de Souza Paiva | Chief Industrial Officer | Participates on the Disclosure, Socio-Environmental Responsibility and Legal; and Strategic Planning committees. |

For more information on the composition of the Executive Board, go to www.eternit.com.br/ir in the section Corporate Governance/Management.

The Company has four advisory committees to the Board of Directors: Audit, Financial Control and Treasury; Disclosure, Socio-Environmental Responsibility and Legal; Strategic Planning; and Human Resources.

Each committee must be formed by the chief executive officer, one or more directors or members of the Advisory Board, one or more officers and, if necessary, any member of the management of the Company or of its subsidiaries, or the respective consultants and/or external auditors when the committee is addressing matters related to their field of expertise.

The chair of the Board of Directors may participate, at his or her own discretion, in the meetings of the committees. Meetings of the committees may also be attended as guests, therefore with no voting rights, by managers and employees of Eternit and its subsidiaries, experts or others whose contribution is deemed useful to the committee’s activities.

The Internal Control and Internal Audit areas are independent and report directly to the chief executive officer. The Internal Controls area is responsible for protecting assets by implementing a set of procedures and adopting administrative standards, and for establishing the procedures for all companies of the Group to ensure internal alignment with regard to the particularities of each business.

The Internal Audit area conducts assessments provided for in the annual calendar and ensures that the activities of the companies forming the Eternit Group comply with internal standards, policies and values, and responds to requests made by the Executive Board and Board of Directors. In 2014, 100% of the Company’s units, including CSC, were audited once or more times and in more than one topic of the 17 possibilities duly mapped (procurement, HR, inventory, costs, investments, etc.), with the result submitted to the managers of the units and to the officers of the Eternit Group. The goal of the work was to assess the procedures adopted by the companies to ensure the correct application of internal procedures, compliance with Brazilian law, industry standards and other legal provisions, and the consistency of the information generated for the Company. The audit includes all points of non-compliance identified, regardless of whether they generated financial losses, and the conclusions of the work as a whole.GRI G4-SO3

The external audit services related to the annual financial statements and conducted in accordance with the requirements of the Securities and Exchange Commission of Brazil (CVM) have been provided by Ernst & Young since March 2012.

Eternit has been listed on the stock exchange since 1948 and in 2006 migrated to the Novo Mercado, the listing segment with the highest corporate governance standards, through which it voluntarily undertook to comply with differentiated management, transparency and market relations practices.

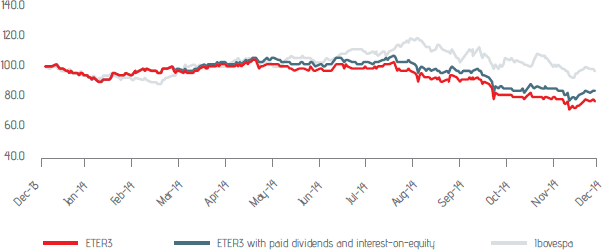

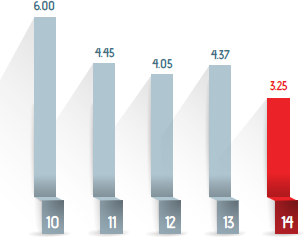

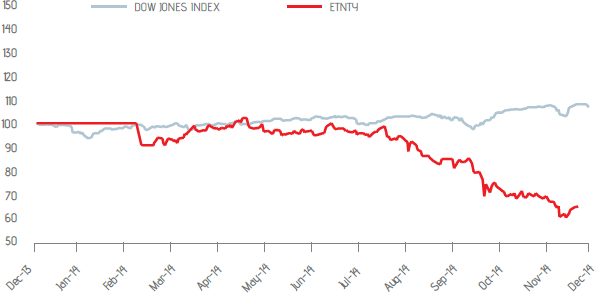

In December 2014, the Company’s stock, which trades under the ticker ETER3, was quoted at R$3.25, which represents a decline of 25.6% from the same period in 2013. In the same period, the benchmark Bovespa Index (Ibovespa) closed at 51,507 points, declining 2.9% in the period. On December 31, 2014, Eternit’s market capitalization stood at R$581.8 million. Considering the stock price appreciation plus the distribution of profits, the return on the stock was negative 17.8% in the period between December 2013 and December 2014.

The Company maintains a Level I American Depositary Receipt (ADR) program since May 2010, which allows its shares to trade on the secondary or over-the-counter market in the United States under the stock ticker ETNTY. Each ADR represents one common share of Eternit, i.e., a 1:1 ratio.

ADRs are negotiable U.S. certificates that represent the ownership of shares in a non-U.S. company. Quoted and traded in U.S. dollar, ADRs were created to facilitate transactions in foreign securities by U.S. investors.

Eternit discloses its earnings on a quarterly basis in the main communication vehicles of the United States and the United Kingdom to gain greater visibility and attract investors.

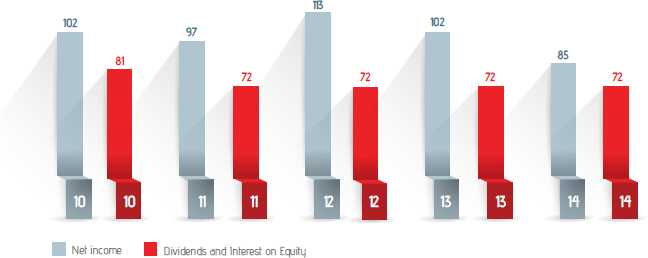

Eternit continues to be one of the publicly held corporations in Brazil delivering the highest returns to shareholders. In 2014, its dividend yield1 was 9.2%, with earnings distributed to shareholders amounting to R$71.6 million.

Eternit’s dividends and interest on equity have historically been paid on a quarterly basis. In view of this practice, individual investors account for a large share of Eternit’s shareholder base.

The Company’s dividend policy is set forth in Article 30 of the Bylaws, which defines the allocation of net income for the year.

More information is available on the IR website under Information for Investors - Dividend Policy (www.eternit.com.br/ir).

1 Dividend yield means the return of the dividend: shareholder payments (dividends + interest on equity)

per share distributed in the fiscal year (payment base date) divided by the stock price quoted on the last trading day

of the previous fiscal year.

On September 24, 2014, the Extraordinary Shareholders’ Meeting approved the proposal by the Board of Directors for a split of its common shares without par value, issued by the company, so that each one (1) existing share would be represented by two (2) shares of the same type and with no change in the capital stock, which consequently consists of one hundred seventy-nine million (179,000,000) registered, book-entry common shares without par value.

The rights of the common shares resulting from the split, including the holders of Level 1 ADRs, will remain unchanged in relation to the previous shareholder position. The parity existing between the shares issued and the ADRs of 1:1 was maintained.

The shareholders of record at the close of September 25, 2014 were considered the base for the stock split. On September 26, the shares began trading without stock split rights. The shares were credited automatically by the transfer agent Banco Itaú Unibanco S.A. to the accounts of shareholders on October 1, 2014.

The goal of the proposed stock split was to increase investors’ access to the shares issued by the Company, diversify the shareholder base and increase trading liquidity in the shares.

Eternit’s Investor Relations (IR) department was created in 2004, in view of the maturation of Brazil’s capital markets and the consequent increase in the number of individual investors. The IR department seeks to ensure transparency in the rendering of accounts and establish a channel for communication with shareholders, analysts and other capital market agents.

As part of this effort, the Company holds quarterly conference calls with webcasts and public meetings, publishes releases and fact sheets, organizes domestic roadshows and holds one-on-one meetings. Supported by the software Investor Relationship Manager (IRM), the department maintains a target of responding to any inquiry within 48 business hours.

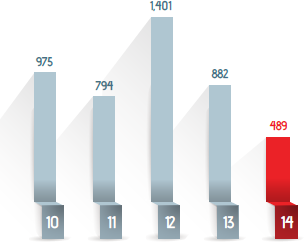

In 2014, the department conducted over 500 contacts and meetings with investors, shareholders and analysts, including individual investors, and organized four public meetings at the local chapters of the Capital Market Professionals and Investors Association (Apimec) in the cities of Porto Alegre (Rio Grande do Sul), São Paulo (São Paulo), Rio de Janeiro (Rio de Janeiro) and Belo Horizonte (Minas Gerais), seeking to improve communication with its more than 9,000 shareholders located nationwide and abroad. The team also maintains a presence online through Twitter, YouTube, SlideShare and RSS, and shares information through Eternit’s blog (www.blogdaeternit.com.br).

This continuous improvement in the relationship with shareholders, capital markets and all other stakeholders was recognized through the various awards won by the team and confirms the quality of Eternit’s corporate governance. In 2014, the IR team received the Capital Markets Award from Apimec Minas Gerais, which considered the Company’s meeting the best of 2013 at the Minas Gerais chapter.

On December 31, 2014, Eternit’s fully subscribed and paid-in capital stock amounted to R$334,251,000 and was represented, as from 2014, by one hundred seventy nine million common shares without par value and with the right to vote in shareholders’ meetings.

With highly disperse stock ownership and no shareholders’ agreement or controlling group, the Company’s shareholder base on December 31, 2014 was formed as follows: 65.1% individual investors, 10.4% foreign investors and 24.5% companies, clubs, investment funds and foundations.

In 2014, only three shareholders held interests of over 5%, which combined held 36.4% of all shares, while the Company’s officers held 1.2% of the shares. .

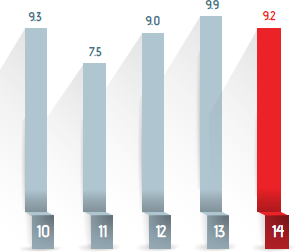

In the same period, the number of shareholders reached 9,357, increasing by approximately 14.0% from 2013, despite the depreciation in the Company’s shares mentioned above.

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Qty. | % | Qty. | % | Qty. | % | Qty. | % | Qty. | % | |

| Individuals | 5,543 | 58.1 | 6,302 | 61.3 | 6,745 | 60.8 | 7,866 | 61.0 | 9,012 | 65.1 |

| Companies | 90 | 2.3 | 126 | 4.6 | 91 | 2.0 | 97 | 1.8 | 94 | 1.8 |

| Clubs, funds and foundations | 205 | 32.0 | 132 | 27.0 | 177 | 26.3 | 131 | 24.4 | 114 | 22.7 |

| Foreign residents | 72 | 7.6 | 73 | 7.1 | 131 | 10.9 | 146 | 12.8 | 137 | 10.4 |

| Total | 5,910 | 100.0 | 6,633 | 100.0 | 7,144 | 100.0 | 8,240 | 100.0 | 9,357 | 100.0 |

Click here to see the updated ownership structure.

Eternit is recognized in the market and confers competitive advantages to the Group by the responsible and efficient way it which it manage its resources in order to minimize and prevent problems in its operations. The Company adopts the practice of constantly monitoring its processes (e.g., water and power consumption, waste generation and environmental by taking samples of its filters and chimneys for particulate emissions) based on consumption and availability indexes, and constantly analyzes the risks to which it is exposed and that could adversely affect its business, financial situation and the results of its operations. These resources are managed based on specific programs and projects, and on the definition of targets and objectives in line with the Group’s strategic planning. It also maps any physical risks arising from climate change, which are monitored based on emission levels identified in the GHG emissions inventory.

This effort is also supported by a multidisciplinary group formed by professionals specializing in a number of fields, by the Internal Controls and Internal Audit areas and by the Audit, Financial Control and Treasury Committee and the Board of Auditors, which accompany the operational, labor, environmental, community and investor relations areas to recognize the risks and address them based on the characteristics of each area.

In 2014, Eternit launched the consolidation of its integrated safety system, which is monitored by the Internal Audit, to ensure that the mapping identifies, through questionnaires, the areas most vulnerable to risks. The purpose of this measure is to concentrate efforts in the most needed sectors and maintain complete control of the risks to guarantee business efficiency.

The Eternit Group invests in human capital to ensure the well-being of its internal stakeholders. On this front, it monitors the health of its employees and organizes campaigns to encourage them to maintain healthy habits and quality of life. Read more about the topic in the chapter Valuing employees.

The Company plans to expand its business through the Structured Expansion and Diversification Program (read more in the chapter Business Strategy) to become a supplier of construction products and solutions through the vectors of Organic Growth, Diversified Organic Growth and Inorganic Growth.

Aware of the potential variations in the Brazilian economy that may affect its activities and business, the Company and its subsidiaries are exposed to factors that could have affect the competitiveness and implementation of its growth strategy, such as reductions in job creation, income distribution, credit availability and consumption, exchange rates, restriction on the use and/or mining of chrysotile asbestos (see below), among others.

Among the principles of the Eternit Group, safeguarding the health and safety of its employees and respect for the environment occupy prominent positions. To prevent accidents and mitigate any impacts, the Companies comply with international principles and standards with regard to the following factors:

Through training and campaigns, the Group upholds and reinforces its commitment to health, safety, respect for the environment and the quality of life of its employees and their families. In addition, all units have Safety Committees and Fire Brigades formed by employees from all hierarchical levels. Note that all units of the Group have an Internal Accident Prevention Commission (CIPA), Emergency Brigade and Safety Committee + Golden Hand (Tégula). Workplace accidents at the Group are reported in accordance with all technical standards and legal provisions in force. GRI G4-LA5

In the case of employees who handle chrysotile asbestos, in addition to providing specific training and ensuring the use of PPEs (Personal Protection Equipment), the Group adopts collective safety measures, such as adopting wet processes to prevent the generation and inhalation of particulate matter, enclosing manufacturing and processing activities, local exhaust ventilation and other collective protection systems. The National Accord for the Controlled Use of Asbestos, which was signed by companies, employer associations and trade associations and unions and was lodged at the Ministry of Labor and Jobs, guarantees stability and autonomy to any employee who shuts down production activities, including the plant’s Inspection Commission, if they believe there is any risk posed to human health and safety.

These safety measures have yielded solid results for the Company. The lost-time injury frequency rate of the Eternit Group in 2014 was 8.34, compared to 10.48 in the previous year. Meanwhile, the severity rate was 105.99, compared to 279.66 in 2013. SAMA has not reported any lost-time injuries for over three years. In 2014, there was no registration of workplace fatalities at the companies of the Group. The Eternit Group did not incur significant fines in terms of monetary value or the total number of non-monetary sanctions applied due to failure to comply with laws and regulations. GRI G4-LA6, G4-LA7, G4-LA8

Eternit has a history of being a strong cash generator and holding low debt, while not conducting transactions involving derivative instruments of any kind that could represent speculative positions, demonstrating the responsibility it adopts with regard to its financial obligations. The Company strives to honor its financial commitments and is proactive in avoiding any risk of this nature.

Client credit risk is managed by the Group on a daily basis and controlled by a rigorous credit approval process, and as such is considered a low risk to the Company. This process was reinforced in 2010 with the adoption of automated credit analysis using the Credit Management tool developed by Serasa Experian, which enables sales and marketing campaigns to attract new clients and ensures the profitability of the portfolio of financial products by standardizing and expediting the decision-making process.

Whenever necessary, SAMA enters into advances against draft presentation (ACEs) and forward foreign exchange contracts (ACCs) for its working capital needs.

The Eternit Group seeks to mitigate its environmental impacts through waste management, energy efficiency, water reuse, reforestation of mining slopes and other actions. The risk identification process is conducted through audits based on the requirements and guidelines of the ISO 14001 standard, which serve as the basis for the development of mitigation plans.

Every six months, all fiber-cement units and the mining company are subjected to tests of airborne respirable fibers conducted by an organization accredited by the National Institute of Metrology, Standardization and Industrial Quality (INMETRO), as well as tests of other suspended particulates, gas emissions and external verification of the waste disposal results of the mining company.

The Company clarifies that the extraction, processing, use, sale and transport of chrysotile asbestos and products containing the mineral are regulated by Federal Law 9055/95, Decree 2,350/97 and the Rules of the Ministry of Labor and Employment.

State Law 10,813/2001 of São Paulo and State Law 2210/2001 of Mato Grosso do Sul, which prohibited the importation, extraction, processing, sale and installation of products or materials containing any sort of asbestos, in any form, were both, through Direct Actions of Unconstitutionality (ADI) 2656 and 2396, adjudicated and declared unconstitutional by the Federal Supreme Court (STF), based on the fact that they violated the jurisdiction of the federal government.

Current State Laws 12,684/2007 of São Paulo, 3,579/2004 of Rio de Janeiro, 11,643/2001 of Rio Grande do Sul and 12,589/2004 of Pernambuco that restrict the use of asbestos in their jurisdiction are currently the subject matter of the ADIs filed by the National Confederation of Industrial Workers (CNTI) at the Federal Supreme Court (STF).

On April 2, 2008, the National Association of Labor Court Judges (Anamatra) and the National Association of Labor Prosecutors (ANPT) filed ADI 4,066 questioning the constitutionality of Article 2 of Federal Law 9,055 of 1995.

On December 30, 2013, State Law 21,114/13 was sanctioned, whose article 1 prohibits the import, transport, storage, production, sale and use of products containing asbestos in the state of Minas Gerais, establishing a period of 8 to 10 years to comply with said article 1. Therefore, compliance with this provision will be required between 2021 and 2023.

In 2013 and 2014, the Labor Prosecution Offices of the states of São Paulo and Rio de Janeiro filed two public interest civil lawsuits against the Company on different issues related to working conditions and occupational illness. The claims in each lawsuit include payment of R$1 billion for collective pain and suffering, to be paid to entities or projects recommended by the Labor Prosecution Office or the Workers’ Support Fund (FAT).

In parallel, the Brazilian Association of People Exposed to Asbestos (ABREA) also filed two lawsuits that were forwarded to the Labor Courts of São Paulo and Rio de Janeiro given that they deal with the same facts claimed in the lawsuits mentioned above. The defense for both lawsuits has already been submitted and we are awaiting the court decision.

The Company reaffirms its belief in Brazil’s legal system and expects the technical and scientific evidence to be considered in the trying of these actions.