GRI G4-DMA Economic performance

Eternit always strives to deliver its best, whether results or products. It communicates clearly with its shareholders, employees and society because it believes everyone is part of this cycle of results and contributes to the country’s growth.

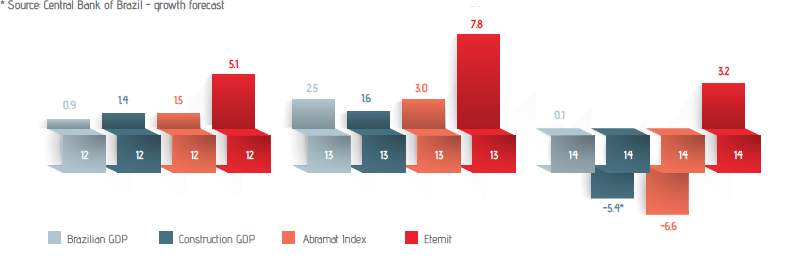

In 2014, Brazil’s economy was marked by weak growth and deceleration in investments, credit markets and consumption, among other factors. Based on this scenario, projections for Brazil’s GDP growth in 2014 in comparison with 2013 were periodically revised. The final figure for GDP growth in 2014 was 0.1%, while construction GDP should contract by -5.4%, according to the Market Readout published in early January 2015 and the Inflation Report published in March by the Central Bank of Brazil, respectively.

According to the Brazilian Association of Construction Material Manufacturers (Abramat), construction material sales in the domestic market contracted by 6.6% in 2014 compared to 2013, falling far short of the forecast of positive growth of 4.5% made at the start of the year. The market was severely affected by the negative sentiment regarding the economy, the fewer business days due to the World Cup and holidays, and the growth in imports.

Another important factor was the retail industry, which accounts for around 50% of Brazil’s construction material sales, according to Abramat. The industry was adversely affected by variables such as employment and income levels and credit availability. In 2014, the retail industry faced difficulties in obtaining loans from banks, as well as higher interest rates caused by uncertainty regarding the future of the economy, which creates insecurity among consumers.

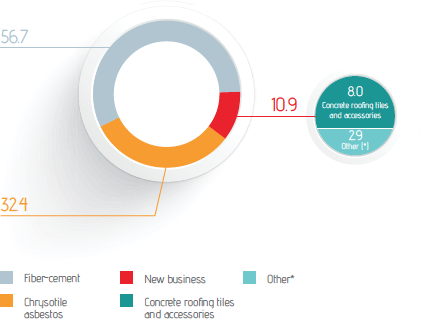

In comparison, Eternit1 posted growth in consolidated gross revenue in 2014 of 3.2%, which was much higher than the industry average. The Company’s chrysotile mining and finished product units operated at full capacity and the fiber-cement and concrete roofing tiles line kept pace with market demand throughout 2014.

1 The growth in Eternit’s consolidated gross revenue compares the period from January to December of the year with the same period of the immediately preceding year, deflated by the IGP-M index.

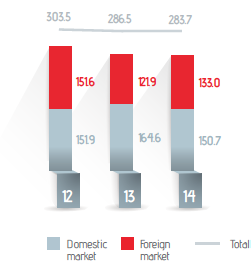

In 2014, chrysotile asbestos sales amounted to 283,700 tons, virtually stable (down 1.0%) in comparison with 2013. The highlight in the period was the foreign market, which posted sales growth of 9.1%, due to the gradual recovery in Asian markets, which partially offset the 8.5% contraction in the domestic market caused by lower consumption of the mineral, particularly in the country’s South.

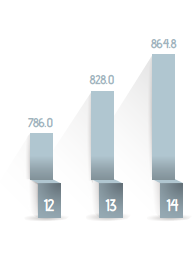

In 2014, fiber-cement sales, including construction solutions, came to 864,800 tons, up 4.4% from 2013, mainly due to the repositioning of inventories by construction material retailers due to pent-up demand after the high number of holidays in the first half of the year, combined with seasonality, since the period typically generates stronger demand for the Company.

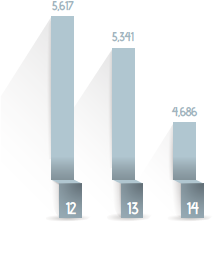

In 2014, concrete roofing tile sales amounted to 4,686,000 square meters (equivalent to 41,477,000 pieces), down 12.3% from 2013, due to weaker demand in the high-end roofing segment, especially in the B2C (business-to-consumer) segment.

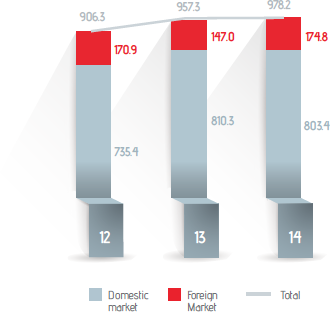

In 2014, consolidated net revenue amounted to R$978.2 million, increasing 2.2% from 2013. This performance was the result of higher chrysotile exports and the 9.1% appreciation in the U.S. dollar against the Brazilian real (based on the average PTAX rate in the period). Domestic sales came to R$803.4 million, virtually stable (down 0.9%) from 2013, due to the weaker sales of chrysotile asbestos and concrete roofing tiles, which were partially offset by increased fiber-cement sales.

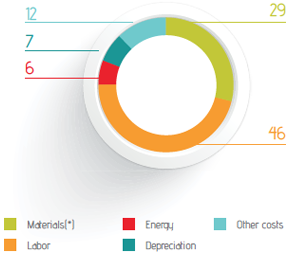

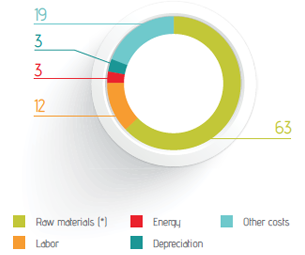

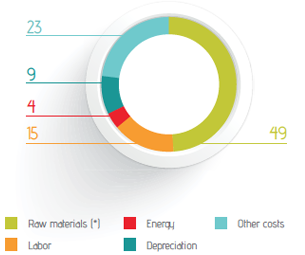

In 2014, consolidated cost of goods sold amounted to R$593.9 million, increasing 3.1% from 2013, due to higher mining and production costs. Since the increase in the consolidated cost of goods sold outpaced the increase in net consolidated revenue in 2014, gross margin declined 1 percentage point from 2013 to close the period at 39%.

The main variations in mining and production costs are shown below:

Chrysotile mining | 10% increase due to higher expenses with labor and outsourced services related to the higher volume of rock handling (strip ratio).

Fiber-cement | 9% increase due to the higher price of raw materials (especially chrysotile asbestos and pulp) and higher electricity rates.

Concrete roofing tiles | 5% increase due to higher raw material prices (mainly gray and white cement), higher electricity rates and higher consumption of fuel and packaging.

In 2014, operating expenses came to R$242.8 million, up 4.7% on 2013, due to increased administrative expenses caused in turn by higher expenses with the setting up the unit for the research, development and production of construction material inputs in Manaus, Amazonas and with defending chrysotile asbestos activities. In the line Other operating income (expense), the variation was due to social security credits and PIS/COFINS tax credits from prior periods.

Equity pickup refers to the proportional gain or loss from the bathroom chinaware plant in the state of Ceará under the joint venture Companhia Sulamericana de Cerâmica (CSC). In 2014, this figure was negative R$13.7 million, compared with negative R$6.2 million in 2013, since it is a greenfield project.

In 2014, the net financial result was positive R$2.3 million, compared to the negative R$1.0 million in 2013, mainly due to the positive effects of exchange variation on the Eternit Group’s financial operations.

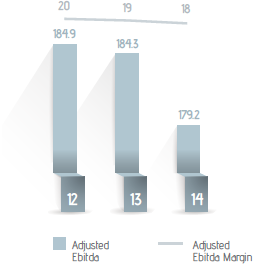

In 2014, adjusted Ebitda amounted to R$179.2 million, down 2.8% on 2013, with Ebitda margin of 18%, down 1 percentage point, mainly due to higher cost of goods sold and operating expenses, as mentioned above.

Ebitda is calculated in accordance with Instruction No. 527 issued by the Securities and Exchange Commission of Brazil (CVM) on October 4, 2012. With the startup of operations at CSC, its results are included in consolidated Ebitda in accordance with the equity method.

Adjusted Ebitda is an indicator used by the Company’s Management to analyze the Group’s operational and economic performance, and is calculated as net income for the fiscal year; income tax and social contribution tax; net financial result; depreciation and amortization; and equity pickup. Since Companhia Sulamericana de Cerâmica is a joint venture, its figures are not consolidated.

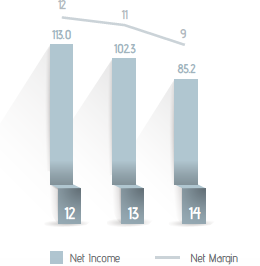

Eternit posted net income of R$85.2 million in 2014, down 16.7% from 2013. Net margin contracted 2 percentage points and ended the period at 9%, due to higher cost of goods sold and operating expenses, combined with the negative equity pick-up.

Eternit’s net debt ended 2014 at R$79.5 million. The gross debt of Eternit and its subsidiaries amounted to R$127.9 million, basically explained by: (i) the advances against draft presentation (ACE) contracted for working capital; and (ii) financing for the acquisition of machinery and equipment.

Cash, cash equivalents and short-term financial investments amounted to R$48.4 million, with financial investments remunerated at an average rate corresponding to 102% of the variation in the overnight rate (CDI).

Eternit does not contract transactions involving derivative instruments of any type that could be interpreted as speculative positions.

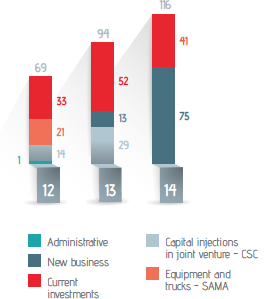

In 2014, investments amounted to R$116.2 million, 24.2% more than in 2013, and were allocated as follows: (i) R$75.2 million to the construction of a unit for the research, development and production of construction material inputs; and (ii) R$41.0 million for maintaining and modernizing the Group’s industrial facilities.

For 2015, investment is expected to amount to approximately R$39.8 million, with R$29.6 million allocated to maintaining and modernizing the industrial facilities, R$4.6 million to building the research, development and production unit for construction material inputs in Manaus, and R$5.6 million to strategic investments.

In 2015, Brazil’s GDP is projected to contract by -0.66% (Market Readout of March 6, 2015), which incorporates the prospects for moderate economic recovery, with the intensification of this process depending on, among other factors, an increase in consumer and business confidence and moderate growth in credit markets. In this scenario, projected construction GDP growth is -2.5% (through the third quarter of 2015), according to the Central Bank of Brazil.

Brazil’s housing deficit, estimated at 5.8 million homes (2012 preliminary results, João Pinheiro Foundation), is formed by households that are excessively burdened by rent costs and cohabitation of families, which account for over 70% of this deficit, followed by precarious housing conditions and excessive density in rented homes. Although the federal government’s housing program known as My Home, My Life reduced the housing deficit, according to a study published in 2014 by the Getulio Vargas Foundation (FGV), by 2024, with population growth, Brazil will have approximately 16.4 million new families, of which 10 million will have household income of less than three minimum monthly wages. The study also highlights that zeroing the housing deficit will require investments of approximately R$760 billion in low-income housing over the course of ten years.

Job creation, better income distribution, increased financing, higher infrastructure investments and the increased number of housing units to be built under the My Home, My Life program will help reduce the housing problem, while also having a positive impact on the Company’s business, given the stronger demand for the products in our portfolio designed primarily for self-build construction projects.

The Brazilian Construction Materials Industry Association (Abramat) projects industry growth of 1.0% this year compared to 2014, which will depend on a continuation of the government incentives for the construction industry, on stability in employment and income levels, on higher investments under the My Home, My Life program, infrastructure projects and increased activity by construction companies, among other factors.

For 2015, the Brazilian Construction Materials Merchants Association (Anamaco) expects a more positive scenario than in the previous year, due to more business days, adjustments to the economy without causing reductions in employment and income levels, and the outlook for higher consumer financing for construction materials by private banks and higher mortgage lending.

Management believes it is important to take into consideration the current scenario of the Brazilian economy and the following challenges facing the country and the Company’s industry: the competitiveness of Brazilian manufacturers given the infrastructure bottlenecks, tax aspects and weaker local currency, job creation and income distribution, sustainable economic policies, and higher consumer and business confidence.

In 2014, Companhia Sulamericana de Cerâmica (CSC) started conducting equipment trials and achieved the minimum pace expected for initial production. In 2015, Management expects to ramp up production in line with the progress of the greenfield project.

The year 2015 will mark a period for consolidating all the investments made in recent years, drawing on the strength of our brand and the broad coverage of our network of over 16,000 points of sale. Eternit is well positioned to meet the demand for construction materials and, if current market conditions persist, it will maximize its capture of opportunities in the industry to expand its fiber-cement production, in line with its organic growth strategy.

Regardless of the aforementioned challenges, Eternit believes in a recovery in the country’s economic growth, especially in its industry.

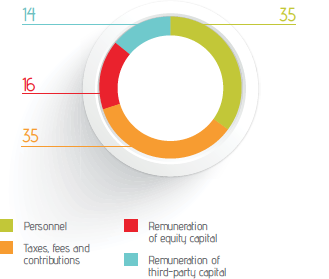

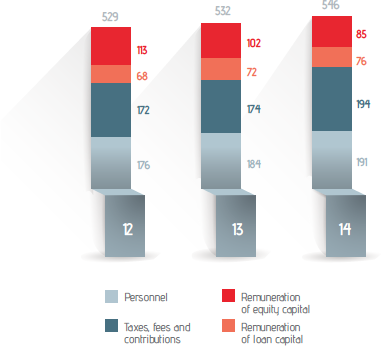

Value added in the year came to R$546.5 million, up 2.8% from 2013. Of this amount, 35.0% was distributed to employees and 35.5% to the federal, state and municipal governments in the form of taxes and contributions. Shareholders received 15.6% of the value added generated, while 13.9% went to the payment of interest on third-party capital.

The companies of the Eternit Group receive tax incentives from the federal government under the Rouanet Law and through programs, such as Produzir in the state of Goiás, Desenvolve in the state of Bahia, Fundo do Idoso and others. GRI G4-EC4

| Significant financial assistance received from the government (R$ ‘000) | 2014 | 2013 | 2012 |

|---|---|---|---|

| Eternit + Precon | 21,517 | 17,138 | 12,979 |

| SAMA | 5,466 | 6,243 | 2,565 |

| Tégula | 499 | 647 | 1,124 |

| Total | 27,482 | 24,028 | 16,668 |