This Attachment complements our 2016 Integrated Report. Use the GRI G4 Content Summary as a guide to know where to find the indicators reported. We decided to include some of them in this attachment to provide our strategic stakeholders with more detailed information.

SPECIFIC STANDARD DISCLOSURES

GRI G4-DMA INDIRECT ECONOMIC IMPACTS

We are committed to contributing towards ensuring public access to the financial system and to credit, promoting the concept of civic awareness and driving local development. With at least one branch, service post or banking correspondent in each Brazilian municipality, we offer products and services, as well as guidance on finance-related concepts, such as sustainable budgeting and handling money responsibly. We also have a partnership with the vessels Voyager III and Voyager V, each of which covers a 1,600 km route between the regions of Manaus and Tabatinga in the state of Amazonas. The trip takes 15 days (there and back), serving 11 municipalities and 50 communities and a population of 250,000, most of whom are indigenous peoples who previously had no access to financial services. Moreover, we maintain three other service points in communities served by the Fundação Amazonas Sustentável (FAS) programs.

Users also have access to digital channels which are improving continuously, with friendlier and simpler interfaces, and which have become essential tools. Furthermore, our clients who access their accounts via mobile telephone do not have to use their data package due to an agreement the bank has with the main telephony carriers in Brazil.

By means of Bradesco Auto/RE, we pursue our mission of protecting the assets of our policy holders with rapid, innovative and high quality products and services. As such, we produce a positive effect on diverse actors within the property insurance operation value chain, including professionals and small entrepreneurs in the risk inspection, claims regulation, emergency service and insurance brokerage sectors etc.

With Bradesco Saúde, we generate positive impacts on the productivity of client organizations by guaranteeing access to private healthcare on a national level and by offering health promotion and risk and disease prevention programs. Additionally, we indirectly generate employment in the supplier chain through the payment of claims in the supplementary healthcare value chain.

External factors

The financial system has an important role in the economy, and is a big GDP driving agent. The bank credit, by allowing the anticipation of consumption and of the investment, generates positive impacts on the added demand. It is important to mention that the financial institutions are big taxpayers of the Federal Revenue Service in the generation of taxes and contributions, thus collaborating with the current expenses of the government.

We understand that the operation of Banco Bradesco adds relevant external factors in the economy both directly and indirectly, but in this first measurement we shall assess only some direct impacts. We consider the financial margin as a direct impact on the economy. Besides, the salaries paid, the taxes collected, the expenses with suppliers and investments performed potentially increment the Consumption, the Investment and the Expenditures of the Government.

We also include in the measurement the granted volume of credit directly related to the Consumption and Investment (loan for acquisition of goods, vehicles and real estate and transfers of BNDES, among others), and we have adopted this volume as a reference for the impacts of the bank products in the Consumption and Investment. Evidently that other credit facilities could also be used to consume or invest and there are also the multiplying effects of the bank credit and of the resources paid in salaries and taxes, but these effects have not been considered in the analysis. That is why it can be said that this is an estimation of the minimum impact of the operation of Bradesco and of the credits granted for Consumption and Investment.

It is important to say that Banco Bradesco is the largest private employer of the financial sector in Brazil with 108,793 employees in 2016 and the second largest employer of the sector, thus representing approximately 15% of all the employees of the financial segment. That is to say, besides the potential impact on the GDP, the operation of Banco Bradesco also exerts an important impact on the workforce and in the generation of jobs.

| Socioeconomic Impacts of the Operation in 2016 - Banco Bradesco S.A. (in R$ million) |

| |

Operation – Banco Bradesco S.A. |

Products directly related to consumption and investment |

Total |

| Direct impact (financial margin) |

62,454 |

|

|

| Impact on the consumption of the families, investments and expenses of the government (payment of salaries, suppliers, investments and taxes) |

58,662 |

35,076 |

|

| Total |

121,116 |

35,076 |

156,192 |

| Socioeconomic impact as GDP % |

|

|

2.5% |

Source: Banco Bradesco S.A.

GRI G4-EC9 | Proportion of spending on local suppliers in key operating units

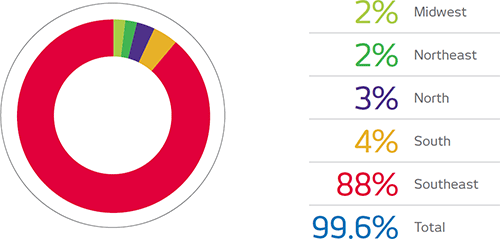

a. Spending on local suppliers in 2016 (%). The amounts shown in the chart below do not present a significant variation in comparison with the previous year:

b. For us, the term "local" refers to Brazilian territory where most of our significant operational units as well as the majority (99.6%) of our suppliers are located.

c. We consider important operational units to be: the Administrative Centers and Branch Networks segregated by all the country's federative units.

| VALUE GENERATION FOR SUPPLIERS |

| |

2013 |

2014 |

2015 |

2016 |

| Number of contracts |

2,340 |

2,319 |

2,585 |

3,754 |

| Amount* (in R$ billions) |

12.3 |

12.5 |

13.4 |

16.01 |

* The amounts refer to the sourceable volume within the Organization's total spend.

| NUMBER OF SUPPLIERS APPROVED |

| 2013 |

2014 |

2015 |

2016 |

| 4,958 |

5,513 |

5,450 |

5,690 |

GRI G4-DMA MATERIALS

We manage the materials we consume with a view to controlling and preventing waste, identifying demands and seasonal consumption factors. We also have an online materials management platform, Online Supplies, which controls the flow of materials requested by all company areas.

GRI G4-EN1 | Materials used by volume

- Plastic consumption (cards)

- Issuer Banco Bradesco Cartões S.A.

- PVC – volume: 27,913,380 units

- Recycled PET – volume: 47,500 units

gri G4-DMA ENERGY

We are committed to reducing electricity and water consumption in our departments, our associated companies and the branch network by means of the Eco-efficiency Steering Plan (2016-2018 cycle) and the Electricity and Water Management tool, adopted in December 2012. In this way, we monitor our impact, reduce costs and influence stakeholders, driving a joint reduction in emissions and the consumption of natural resources while contributing to the achievement of targets to combat global warming.

By monitoring and analyzing monthly water consumption, we establish targets by location. The information on consumption by generators is provided by the companies contracted to maintain the equipment. Other consumption management measures include the substitution of fluorescent light bulbs with LEDs and managing lighting and electricity measurement by sector in some administrative buildings.

In the event of water or electricity-related problems, the areas responsible provide a solution with support from the Energy and Water Management area.

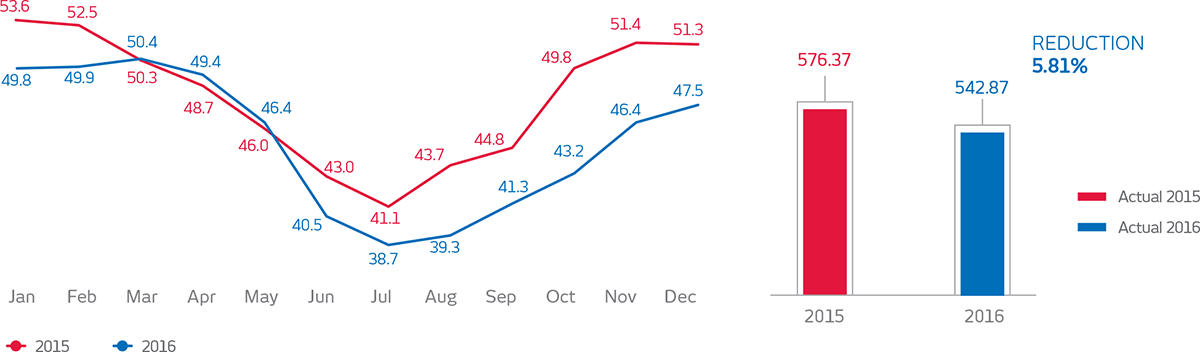

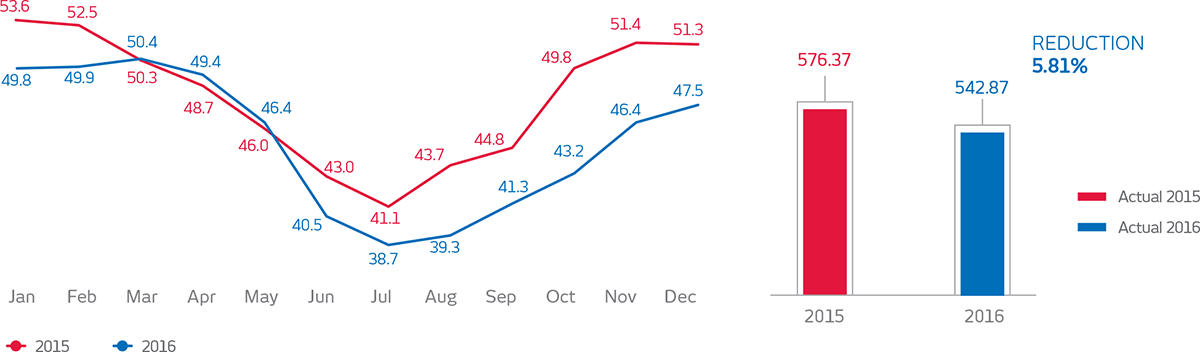

GRI G4-EN3 | Energy consumption inside the organization

bradesco energy consumption – 2016

MM kWh

GRI G4-DMA WATER

Our water management is aimed at promoting the responsible use of this resource to minimize social and environmental impacts, and by reducing consumption, to decrease expenses. This involves initiatives focused on eco-efficiency, such as periodic maintenance and the Eco-efficiency Steering Plan (2016-2018 cycle), which establishes consumption reduction targets.

In 2016, the water consumption reduction target was 4.2%. In actual fact, the economy totaled 7.2%, with cost savings of R$1.5 million.

Since December 2012, we have used a computerized tool (Electricity and Water Management System) which enables the monitoring and analysis of water consumption on a monthly basis, with the establishment of monthly targets per location.

We conduct efficient consumption awareness campaigns, such as Rationalize, which involves communication and education measures for the entire Organization, including the training of multipliers. Another measure is the Organization of talks focused on awareness in partnership with the utility companies in order to minimize consumption.

GRI G4-EN8 | Total water withdrawn by source

Water withdrawn by source:

Consumption of drinking water (utility): 1,401,238.26 m3.

Consumption of ground water (wells): 192,569.00 m3.

Consumption of reused water (wastewater treatment plants): 74,752.00 m3.

Consumption of rainwater: 1,046 m3.

Consumption is controlled and monitored by means of ISO 14064. The gross water consumption data are collected by means of the utility bills at all our installations nationwide and are managed using the Electricity and Water Management tool implanted in December 2012. Control of these bills and data analysis is conducted by a specialized company, enabling the monitoring of the Organization's performance on a monthly basis.

GRI G4-DMA EMISSIONS

In 2006, we became the first bank in Brazil to conduct a greenhouse gas (GHG) inventory. Since then we have published the scope 1, 2 and 3 emissions of all the companies over which we have operational control on an annual basis. All the indicators are compiled and analyzed on a quarterly basis, with the reports drafted in accordance with Brazil's ABNT NBR ISO 14064-1 standard and the Brazilian GHG Protocol program. This enables us to promote and stipulate reduction targets, as well as to offset scope 1 and 2 emissions.

For us, eco-efficiency is an integral part of our strategic management, linking environmental and financial performance through the optimization of processes, recycling, technological innovation and economy in the use of natural and material resources. We believe in the importance of monitoring our impact and in influencing our stakeholders in a joint effort to reduce emissions and to contribute towards the achievement of targets for combating global warming. This is the Eco-efficiency Management Program's reason for being.

GRI G4-EN15 | Direct greenhouse gas (GHG) emissions (Scope 1)

2016 emissions have yet to be calculated. They will be released in the greenhouse gas (GHG) emissions inventory, which will be ready in May.

GRI G4-EN16 | Indirect greenhouse gas (GHG) emissions from the acquisition of energy (Scope 2)

2016 emissions have yet to be calculated. They will be released in the greenhouse gas (GHG) emissions inventory, which will be ready in May.

GRI G4-EN17 | Other indirect greenhouse gas (GHG) emissions (Scope 3)

2016 emissions have yet to be calculated. They will be released in the greenhouse gas (GHG) emissions inventory, which will be ready in May.

GRI G4-EN18 | Greenhouse gas (GHG) emissions intensity

2016 emissions have yet to be calculated. They will be released in the greenhouse gas (GHG) emissions inventory, which will be ready in May.

GRI G4-EN19 | Reduction in greenhouse gas (GHG) emissions

2016 emissions have yet to be calculated. They will be released in the greenhouse gas (GHG) emissions inventory, which will be ready in May.

GRI G4-EN20 | Emissions of ozone-depleting substances (ODS)

2016 emissions have yet to be calculated. They will be released in the greenhouse gas (GHG) emissions inventory, which will be ready in May.

GRI G4-EN21 | NOx, SOx and other significant atmospheric emissions

2016 emissions have yet to be calculated. They will be released in the greenhouse gas (GHG) emissions inventory, which will be ready in May.

GRI G4-DMA EFFLUENTS AND WASTE

Effluent, material consumption and waste management is aimed at minimizing social and environmental impacts and reducing expenses. The Eco-efficiency Steering Plan (2016-2018 cycle), which includes a Corporate Solid Waste Management Plan, promotes initiatives aimed at increasing production at the sewage treatment plant in the Cidade de Deus Center and reducing the volume of waste (including technological waste) disposed of in landfills. In 2016, the sewage treatment plant processed 74,700 m3, representing around 25% of total water consumption on the site.

Around 70% of the solid waste, mainly organic material, paper and plastic, that we generate is disposed of in landfills. This waste is quantified in two different ways: by weighing it in the administrative buildings that have scales; or estimating it based on sampling in the branches and administrative buildings that do not have scales. In the current calculation only the waste disposed of in landfills is considered, since the rest is either recycled, donated or returned to the supplier (reverse logistics) as per contract. Because technological waste (from maintenance work and the substitution of electric and electronic equipment) is hazardous, it is collected via internal logistics or directly by suppliers and sent for recycling. From the implantation of this process in 2008 to 2016, around 3 metric tons of this material had been recycled.

GRI G4-EN23 | Total weight of waste, discriminated by type and disposal method

Waste is collected and disposed of by contracted companies who send it to landfills or for recycling.

Total solid waste (landfill): 19,318,782 kg

Total solid waste (recycling): 1,194,242 kg

Composting: 91,480 kg

Light bulbs and reactors (hazardous): 14,796 units

Technological waste: 415,855 kg

There was an increase in the disposal of recyclable materials (around 10%) due to the increase in selective collection at Cidade de Deus and in the Edifício Paulista.

GRI G4-EN29 | Monetary value of significant fines and total number of non-monetary sanctions applied for non-compliance with environmental laws and regulations

In 2016 we received no complaints or significant fines related to environmental impacts.

GRI G4-DMA TRANSPORTATION

The use of the most diverse types of transportation, such as our own fleet (air and land), armored cars for transporting money and valuables, mail bags, as well as spending on taxis is managed with care. There are reduction targets for all types of transportation as part of the Eco-efficiency Steering Plan (2016-2018 cycle).

The major impacts related to transportation services are greenhouse gas emissions and the cost, both of which are monitored by the competent areas.

We believe it is important to monitor our impact and to influence stakeholders to jointly reduce emissions, contributing to targets in the combat against global warming.

GRI G4-EN30 | Significant environmental impacts caused by the transportation of products and other goods and materials used in the organization's operations, as well as employee transportation

2016 emissions have yet to be calculated. They will be released in the greenhouse gas (GHG) emissions inventory, which will be ready in May.

The inventory is conducted by a consultancy and verified by a third party before being published.

When it is finalized, the data is updated on the "Bradesco Sustainability" webpage (address below):

www.bradescosustentabilidade.com.br (only in Portuguese)

The scope 1 and 2 emissions inventoried in the first cycle of the Eco-efficiency Program (2011-2015) were fully offset (225,761 tCO2e), with 77% occurring via the planting of native seedlings for the reclamation of degraded areas in partnership with the Fundação SOS Mata Atlântica; and 23% by means of the purchase of carbon credits from small hydroelectric plant projects and the capture of methane gas on pig farms, in partnership with Get2C.

We have adopted a series of measures aimed at reducing environmental impacts, in particular with respect to GHG emissions:

- Preventive maintenance in our own vehicle and rented vehicle fleet in accordance with the manufacturers' manuals.

- Preventive maintenance for the aircraft (helicopters and jet) in the Organization's own fleet, in accordance with the manufacturers' guidelines.

- Rental of flexible fuel vehicles, prioritizing the use of ethanol.

- Use of ethanol in the flexible fuel vehicles in the company-owned and rental fleet, regardless of whether it is more economical or not.

- For employee travel, incentives for sharing regular taxis and/or using vehicle rental companies.

- Ongoing actions to reduce expenses with security vans used to transport money and valuables, resulting in reduced GHG emissions, considering that with logistics improvements the number of trips and the mileage covered are reduced.

- Ongoing optimization in cargo transportation and the elimination of the use of air freight.

- Optimization of mail bag transportation, ensuring the simultaneous delivery/collection in the branches and in land and air routes.

The GHG inventory is conducted on an annual basis in accordance with the ABNT NBR ISO 14064-1 standard, the 2006 IPCC Guidelines for National GHG Inventories and the specifications of the Brazilian GHG Protocol program.

GRI G4-EN31 | Total investment and spending on environmental protection, discriminated by type

Conscious Consumption Campaign (Rationalize): R$135,000.00

Spending on Environmental Management System (consultancy and audits): R$125,650.00

Waste disposal (landfill): R$2,611,992.00

Production of water for reuse: R$1,041,646.08

GRI G4-DMA ENVIRONMENTAL ASSESSMENT OF SUPPLIERS

The assessment and monitoring of suppliers is important for us since the majority of social and environmental risks associated with financial institutions are indirect, arising from business relationships. We therefore seek to encourage our suppliers to adopt positive social and environmental management practices.

Within this context, possible social and environmental problems caused by suppliers could represent risks and financial, reputational and legal damage for us. As such, analysis, assessment and monitoring of the chain are fundamental for preventing, addressing and mitigating these potential risks, ensuring our credibility and adherence to our values by commercial partners.

Managing commercial partners includes monthly monitoring. The results of social and environmental risk analysis are communicated to the areas involved by means of a social and environmental report highlighting any risks identified. The Integrated Risk Control Department presents documentation and an action plan when a supplier with a contract is identified as constituting a risk with a view to resolving/understanding the risk (contaminated/embargoed areas, among others). If the action plan does not lead to the solution of the problem, the supplier may be disqualified.

By means of the supplier approval system, 100% of the companies contracted are assessed using social and environmental criteria (such as greenhouse gas (GHG) emissions, water and energy indicators, paper consumption, waste generation, labor practices and child and slave labor), as well as commercial and financial ones. The registration approval process requires that suppliers adhere to and sign the Code of Ethical Conduct, the Procurement Professional's Code of Ethical Conduct and Corporate Anti-corruption Policy.

Additionally, we carry out a specific assessment of suppliers contracted to provide graphic material and furnishings, given that these processes require that partners have FSC certification.

Suppliers classified in critical segments in relation to economic, social and environmental factors, are assessed by means of documentation and a tool denominated Certifica.

To enhance relations with suppliers, we maintain a framework of standards comprising: Code of Ethical Conduct and the Sector Code of Ethical Conduct, in addition to Corporate Anti-corruption policies. In 2016, we adopted a supplier registration module with a management tool that enables the supplier's registration details to be viewed by all employees.

GRI G4-EN32 | Percentage of new suppliers screened using environmental criteria

100% of suppliers are screened using environmental criteria.

GRI G4-EN33 | Significant actual and potential negative environmental impacts in supplier chain and measures taken

Suppliers are assessed for a number of social and environmental aspects, including compliance with environmental legislation and the identification of possible environmental infractions such as embargoed and/or contaminated areas as informed by the competent agencies. All registered and active suppliers (with current contracts), including ones considered strategic and critical, undergo risk analysis when embargoed or contaminated areas are identified. Suppliers considered critical with contracts in force whose rating under the Certifica System is below 50 points are also subject to social and environmental risk assessment. Additionally, we carry out a specific assessment of suppliers contracted to provide graphic material and furnishings, given that these processes require that partners have FSC (Forest Stewardship Council) certification.

a. A total of 60 suppliers were submitted to environmental impact assessments, including 16 strategic ones; 12 with embargoed and/or contaminated areas; and 32 with social and environmental ratings below 50% in the Certifica system.

b. Of the 12 suppliers with embargoed and/or contaminated areas, six did not present documentation proving the implantation of impact mitigation measures thus elevating the degree of risk.

GRI G4-LA1 | Total number and rates of new employee admissions and employee turnover by age group, gender and region

|

2014 |

2015 |

2016 * |

| Employees admitted |

Admission rate

(%) |

Employees terminated |

Turnover rate

(%) |

Employees admitted |

Admission rate

(%) |

Employees terminated |

Turnover rate

(%) |

Employees admitted |

Admission rate

(%) |

Employees terminated |

Turnover rate

(%) |

| Region |

|

|

|

|

|

|

|

|

|

|

|

|

| North |

348 |

ND |

432 |

12 |

216 |

6 |

306 |

9 |

128 |

3 |

255 |

7 |

| Northeast |

732 |

ND |

917 |

7 |

472 |

4 |

713 |

6 |

461 |

4 |

971 |

7 |

| Midwest |

419 |

ND |

534 |

11 |

262 |

6 |

384 |

9 |

114 |

2 |

404 |

7 |

| Southeast |

4,659 |

ND |

6,636 |

10 |

4,063 |

6 |

6,088 |

9 |

1,771 |

3 |

5,479 |

8 |

| South |

618 |

ND |

864 |

9 |

383 |

4 |

755 |

9 |

279 |

2 |

871 |

5 |

| Overseas |

22 |

ND |

17 |

6 |

19 |

8 |

16 |

6 |

56 |

21 |

16 |

6 |

| Gender |

|

|

|

|

|

|

|

|

|

|

|

|

| Male |

ND |

ND |

4,848 |

10 |

2,782 |

6 |

3,984 |

9 |

1,449 |

3 |

4,193 |

8 |

| Female |

ND |

ND |

4,552 |

9 |

2,633 |

6 |

4,278 |

9 |

1,360 |

2 |

3,803 |

7 |

| Age |

|

|

|

|

|

|

|

|

|

|

|

|

| Under 30 years |

ND |

ND |

5,636 |

11 |

5,152 |

12 |

4,579 |

10 |

2,694 |

6 |

3,574 |

8 |

| Between 30 and 50 years |

ND |

ND |

3,092 |

7 |

262 |

1 |

3,075 |

8 |

111 |

0 |

2,970 |

5 |

| Over 50 years |

ND |

ND |

672 |

10 |

1 |

0 |

608 |

8 |

4 |

0 |

1,452 |

14 |

* In 2016, the method used to calculate employee turnover at Bradesco was changed, counting the number of employees on December 31th.

GRI G4-LA2 | Comparison of benefits for full-time and part-time and temporary workers, discriminated by important operational units

We offer all employees salaries compatible with the market and the functions they exercise, irrespective of gender, as well as a range of benefits that goes beyond legal requirements. This includes life and personal accident insurance, funeral allowance, discounts on medicines in accredited drugstores, emergency loans, online shopping, meal and food allowances, nursery/nurse allowance for children, free health and dental insurance, supplementary private pension, pension fund, daily snacks, corporate education programs and vaccination against influenza and the H1N1 virus, as well as areas for leisure activities in some locations, such as the Sports courts in the Cidade de Deus Center in Osasco (São Paulo).

GRI G4-LA3 | Return to work and retention rates after maternity/paternity leave, discriminated by gender

| MATERNITY LEAVE – NUMBER OF EMPLOYEES |

| Period |

Entitlement |

Used |

Returned |

Remaining

after

12 months |

Return rate (%) |

Rate of employees remaining after

12 months (%) |

| 2014 |

2,964 |

2,964 |

2,963 |

2,802 |

99.9 |

94.6 |

| 2015 |

3,502 |

3,502 |

3,464 |

3,309 |

98.9 |

95.5 |

| 2016 |

3,414 |

3,414 |

3,400 |

3,299 |

99.6 |

96.6 |

| PATERNITY LEAVE – NUMBER OF EMPLOYEES |

| Period |

Entitlement |

Used |

Returned |

Remaining

after

12 months |

Return rate (%) |

Rate of employees remaining after

12 months (%) |

| 2014 |

1,934 |

1,437 |

1,437 |

1,391 |

100.0 |

96.8 |

| 2015 |

1,912 |

1,616 |

1,616 |

1,562 |

100.0 |

96.6 |

| 2016 |

1,984 |

1,484 |

1,484 |

1,433 |

100.0 |

96.6 |

GRI G4-LA9 | Average number of hours training per employee per year, discriminated by gender and functional category

| Functional category |

2014 |

2015 |

2016 |

| |

Mean nº of hours training for employees in the organization |

Mean nº of hours training for employees in the organization |

Mean nº of hours training for employees in the organization |

Mean nº of hours training for employees in the organization by functional category |

| |

Men |

Women |

Men |

Women |

Men |

Women |

| Directors + Board of Directors |

51 |

144 |

60 |

103 |

78 |

53 |

77 |

| Superintendents |

144 |

224 |

79 |

144 |

83 |

201 |

99 |

| Managers |

86 |

81 |

40 |

30 |

27 |

22 |

25 |

| Supervisory/Administrative |

63 |

69 |

26* |

23* |

25 |

26 |

26 |

| Operational |

58 |

56 |

17 |

18 |

11 |

8 |

9 |

| Apprentices |

37 |

33 |

0 |

0 |

0 |

0 |

0 |

| Interns |

71 |

79 |

6 |

5 |

3 |

2 |

2 |

| Total |

61 |

58 |

25 |

22 |

21 |

19 |

20 |

* Supervisory and administrative.

GRI G4-LA10 | Programs for skills management and lifelong learnings that support the continued employability of employees and assist them in managing career endings

We offer two programs for employees about to retire or who have been terminated: a recycling course for those who intend to carry on working; and a severance package – both provided for in collective agreements. In the case of professional requalification, the initiative is for employees dismissed without due cause; the amount paid is up to R$1,457.68. These funds may be used for language and computing courses and for civil service preparatory programs, among others.

GRI G4-LA11 | Percentage of employees receiving regular performance and career development reviews, by gender and functional category

| PROFESSIONAL CATEGORY |

% of employees |

| Men |

Women |

| Directors + Board of Directors |

96 |

100 |

| Superintendents |

100 |

100 |

| Managers |

86 |

85 |

| Supervisory/Administrative |

77 |

78 |

| Operational |

63 |

64 |

| Apprentices |

7 |

4 |

| Interns |

25 |

25 |

| Total |

73 |

72 |

gri G4-DMA DIVERSITY AND EQUALITY OF OPPORTUNITY

Diversity and gender equality are incorporated into our personnel management. We value internal salary parity, which is integral to our career development policy. On a permanent basis we survey job profiles and compare salaries with the market. Thus we offer salaries compatible with the function exercised irrespective of gender or any other social condition. We believe that a successful company is one that generates robust results for all its stakeholders and rewards its employees fairly. Additionally, we maintain an adequate balance between remuneration and benefits, which go beyond those provided for by law.

GRI G4-LA12 | Composition of groups responsible for governance and discrimination of employees by functional category, gender, age group, minority groups and other diversity indicators

| GOVERNANCE BODIES |

| AGE GROUP |

% |

RACE/COLOR |

% |

GENDER |

% |

| Between 30 and 50 years |

9.1 |

Oriental |

2.3 |

Female |

9.1 |

| Over 50 years |

90.9 |

White |

97.7 |

Male |

90.9 |

| AGE GROUP (%) |

UP TO 30 YEARS (%) |

31 TO 40 YEARS |

41 TO 50 YEARS |

OVER 50 YEARS |

OVERALL TOTAL |

| Directors |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

| Superintendents |

0.0 |

0.0 |

0.1 |

0.1 |

0.2 |

| Managers |

2.8 |

5.0 |

4.7 |

2.2 |

14.7 |

| Supervisory/Administrative |

18.4 |

17.5 |

9.7 |

5.0 |

50.7 |

| Operational |

20.9 |

4.9 |

3.6 |

2.4 |

31.7 |

| Apprentices |

1.2 |

0.0 |

0.0 |

0.0 |

1.2 |

| Interns |

1.5 |

0.0 |

0.0 |

0.0 |

1.6 |

| Overall total (%) |

44.7 |

27.4 |

18.1 |

9.7 |

100.0 |

| RACE/COLOR (%) |

WHITE |

MIXED |

BLACK |

ORIENTAL |

INDIGENOUS |

OVERALL TOTAL |

| Directors |

0.1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

| Superintendents |

0.1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.2 |

| Managers |

11.2 |

2.9 |

0.3 |

0.3 |

0.0 |

14.7 |

| Supervisory/Administrative |

39.6 |

8.8 |

1.3 |

0.9 |

0.1 |

50.7 |

| Operational |

22.4 |

7.6 |

1.3 |

0.3 |

0.1 |

31.7 |

| Apprentices |

0.6 |

0.4 |

0.1 |

0.0 |

0.0 |

1.2 |

| Interns |

1.1 |

0.3 |

0.1 |

0.0 |

0.0 |

1.6 |

| Overall total (%) |

75.1 |

20.0 |

3.1 |

1.6 |

0.2 |

100.0 |

| GENDER (%) |

FEMALE |

MALE |

OVERALL TOTAL |

| Directors |

0.0 |

0.1 |

0.1 |

| Superintendents |

0.0 |

0.1 |

0.2 |

| Managers |

5.1 |

9.6 |

14.7 |

| Supervisory/Administrative |

27.5 |

23.2 |

50.7 |

| Operational |

17.3 |

14.4 |

31.7 |

| Apprentices |

0.8 |

0.4 |

1.2 |

| Interns |

0.8 |

0.8 |

1.6 |

| Overall total (%) |

51.4 |

48.6 |

100.0 |

| DISABLED PERSONS (%) |

Total |

| Managers |

2.9 |

| Supervisory/Administrative |

28.8 |

| Operational |

68.3 |

| Overall total (%) |

100.0 |

gri G4-DMA EQUAL REMUNERATION FOR WOMEN AND MEN

Gender equality is always taken into account in our personnel management. We value internal salary parity, which is incorporated into career development policy. On a permanent basis we survey job profiles and compare salaries with the market. Thus we offer salaries compatible with the function exercised irrespective of gender because we believe that a successful company is one that generates robust results for all its stakeholders and rewards its employees fairly. Additionally, we maintain an adequate balance between remuneration and benefits, which go beyond those provided for by law.

GRI G4-LA13 | Ratio of basic salary and remuneration of women to men by employee category and by significant locations of operation

| EMPLOYEE CATEGORIES |

2014 |

2015 |

2016 |

| PROPORTION OF BASE SALARY (%) |

PROPORTION OF BASE SALARY (%) |

PROPORTION OF BASE SALARY (%) |

| WOMEN/MEN |

WOMEN/MEN |

WOMEN/MEN |

| Statutory Directors + Board |

85 |

100 |

104 |

| Superintendents |

93 |

100 |

97 |

| Managers |

83 |

82 |

85 |

| Supervisory/Administrative |

91 |

88 |

85 |

| Operational |

98 |

99 |

94 |

GRI G4-DMA SUPPLIER ASSESSMENT FOR LABOR PRACTICES

Our relations with suppliers are based on criticality and performance in accordance with our values, goals and attributes. Compliance with labor legislation is indispensable and is verified on a monthly basis. Any non-compliance is notified immediately with an instruction to regularize the situation. Non-compliant partners may be disqualified.

The majority of social and environmental risks are indirect and arise from business relationships. Within this context, potential social and environmental problems caused by service providers may represent financial, reputational and legal risks for us.

To mitigate such risks in the supplier chain, we identify, classify, assess and monitor a series of questions based on the Bradesco Social and Environmental Responsibility in the Supply Chain Program. This involves audits on suppliers in critical categories in partnership with an independent auditor. This process is complemented by inspection visits and action plans to drive improvement, when this is considered necessary. The determination of partners to be inspected is undertaken by sampling after analysis of: social aspects (activities requiring the use of personal protective and safety equipment; ergonomic conditions; work shifts; freedom of association and entitlement to collective bargaining; disciplinary practices; slave, forced or child labor; discrimination and sexual and/or psychological harassment; products consumed by our employees; and environmental and economic questions; environmental aspects (categories with high greenhouse gas (GHG) emissions; the timber chain; waste collection and disposal; and products containing toxic materials, such as paint/lead, etc.); and economic questions (brand management; image and reputational risk; and high degree of dependence).

We also maintain diverse supplier monitoring and relationship channels, such as the Ombudsman, Alô Bradesco and the corporate email address 4080.fornecedor@bradesco.com.br.

GRI G4-LA14 | Percentage of new suppliers screened using labor practice criteria

We seek to enhance and forge closer relations with suppliers on a continual basis. For this reason, we maintain a framework of standards comprising: Code of Ethical Conduct and the Sector Code of Ethical Conduct, Corporate Policies and Anti-Corruption Policies.

In 2016, the supplier registration module was concluded with management tools that enable the supplier's registration details to be viewed by all employees.

The approval process addresses social and environmental responsibility factors for all suppliers, encompassing labor practices, slave and child labor, environmental risks as well as the mitigation of risks related to suppliers considered to be critical in social and environmental terms.

GRI G4-LA15 | Significant actual and potential negative impacts for labor practices in the supplier chain and measures taken

a. 203 suppliers were submitted to assessments of impacts related to labor practices.

b. The same number of suppliers generate significant actual and potential negative impacts for labor practices.

c. In accordance with the new Corporate Social Responsibility Management system contacts via the Communication Channels in 2016 reported a total of 26 suppliers presenting significant potential risks. The Human Rights and Labor-related issues were: Discrimination and Inadequate Conduct; Remuneration, Benefits Payments; the Suppliers' Internal Policies, Processes and Procedures.

d. The percentage of suppliers generating significant actual and potential negative impacts for labor practices with whom improvements were agreed on based on the assessments was 13%.

e. The percentage of suppliers generating significant actual and potential negative impacts for labor practices whose contracts were rescinded based on assessments was 34%.

gri G4-DMA GRIEVANCE AND COMPLAINT MECHANISMS RELATED TO LABOR PRACTICES

Our new Corporate Social Responsibility Management System, certified by an international body, addresses relationship quality and conditions in the work environment, reinforcing our commitment to improve and strengthen relations with employees, promoting open dialogue and driving improved working conditions. It also establishes requirements aligned with our Human Resources Management policy, aimed at continuous improvement in relations and the conditions of the work environment based on respect. To manage labor practice impacts and ensure compliance with RespSocial certification, we employ monthly, quarterly, six-monthly and annual indicators.

Our Human Resources Management policy establishes directives on relations between the internal and external publics and indicates the criteria to be adopted in decision making. The Social Responsibility and Climate area of the Human Resources Department and the contact channels receive and address reports. These go to the Human Resources Committee and are channeled to those responsible for solving them. The process is overseen at executive level.

Contacts related to harassment and discrimination are received, filed and addressed with a full guarantee of confidentiality. On a weekly basis, these cases are reviewed by the Human Resources Committee, and every quarter they are reviewed by the Ethical Conduct Executive Committee. The indicators of the Corporate Social Responsibility Management System, which include cases of discrimination, are verified by means of compliance assessments and external audits every six months, and preventive and corrective measures are adopted to contain any deviations.

The communication channels and the process flow are also available for dealing with reports from suppliers. These are monitored by the Time Panel and the same preventive and corrective measures are adopted to contain any internal deviations.

We also have our Supplier Engagement Program, through which employees of partnering companies learn how to use the RespSocial communication channels. The program addresses questions related to health and safety, labor legislation, human rights and children's rights.

GRI G4-LA16 | Number of grievances about labor practices filed, addressed, and resolved through formal grievance mechanisms

| GRIEVANCES/YEAR |

2014* |

2015* |

2016* |

| Number of grievances about human rights filed, processed and resolved through formal mechanism during the reporting period |

Total |

1,093 |

783 |

617 |

Processed

|

1,093 |

783 |

617 |

| Resolved |

928 |

643 |

570 |

Number of grievances about human rights filed in previous years,

but resolved in the reporting period |

321 |

120 |

147 |

* For the Organization, the labor and human rights cases are addressed jointly, being impossible to manage them separately.

The Bradesco Seguros Group Ombudsman service did not receive any human rights related complaints.

GRI G4-HR1 | Total number and percentage of investment agreements and contracts that include human rights clauses or that were submitted to human rights assessment

The percentage of significant financing contracts submitted to social and environmental risk analysis is not available; however, we are working on making this information available in the medium term.

GRI G4-HR2 | Total number of hours of employee training in human rights policies or procedures related to aspects of human rights relevant for the organization's operations and percentage of employees trained

The number of hours training in human rights totaled 190,794, involving 47% of the employees and third-party employees.

GRI G4-DMA FREEDOM OF ASSOCIATION AND COLLECTIVE BARGAINING

We recognize the unions as the legitimate representatives of our category. As such, all employees enjoy freedom of association, are represented by unions and are covered by collective bargaining agreements. Moreover, we minimize conflicts and negotiate solutions via communication and relationship channels. We also support union membership campaigns conducted on the organization's premises, providing infrastructure and orienting managers to ensure neutrality where employee decisions are involved.

GRI G4-HR5 | Operations and suppliers identified as presenting significant risk of child labor and measures taken to contribute to the effective eradication of child labor

In 2016, no young workers exposed to risk, child labor or forced and slave labor were identified. We monitor 100% of our supplier base on a monthly basis. If any such case is identified, the supplier is immediately disqualified. In 2016, with the Bradesco Social and Environmental Responsibility in the Supply Chain Program, risks are also verified by means of independent audit.

GRI G4-HR6 | Operations and suppliers identified as presenting significant risk of forced or slave labor and measures taken to contribute to the elimination of all forms of forced or slave labor

In 2016, no suppliers with young workers exposed to risk, child labor or forced and slave labor were identified. We monitor 100% of our supplier base on a monthly basis. If any such case is identified, the supplier is immediately disqualified. In 2016, with the Bradesco Social and Environmental Responsibility in the Supply Chain Program, risks are also verified by means of independent audit.

GRI G4-DMA ASSESSMENT

The defense and protection of human rights is a principle which is declared publicly in our Human Resources Management Policy and in our Code of Ethics. Our management structure is certified under the RespSocial standard, which replaced the SA 8000 standard in June 2016, with the provision of communication channels to receive and deal with any deviations to this principle. The Social Responsibility and Climate area of the Human Resources Department receives and addresses any reports. These go to the Human Resources Committee and are channeled to the executive spheres, such as the Ethical Conduct Committee.

Our Human Resources Management policy establishes directives on relations between the internal and external publics and indicates the criteria to be adopted in decision making. There is also the Corporate Social Responsibility Management System, certified by an international body, which assesses conditions in the work place and provides for periodic evaluations of all requirements through the verification of internal and external compliance and external audits. Thus, each semester the management system is subjected to critical analysis, taking into account adherence to the policy, reports of deviations and the non-conformances identified in audits, as well as indicating opportunities for improvement. The maintenance process and the expansion plan for the system also provide for widespread communication to raise employee and supplier awareness.

Our target for 2017 is to evaluate the results of the new Corporate Social Responsibility certification as it relates to 30,500 employees and around 5,800 third-party employees, increasing the scope of compliance assessment in operations involving suppliers.

GRI G4-HR9 | Total number and percentage of operations subject to human rights reviews or impact assessments

In 2016, we approved 888 new suppliers, all of whom were subject to human rights screening.

GRI G4-DMA SUPPLIER ASSESSMENT FOR HUMAN RIGHTS

Our relations with suppliers are based on criticality and performance in accordance with our values, goals and attributes, including commitment to human rights. Compliance with labor legislation is indispensable and is verified on a monthly basis. Any non-compliance is notified immediately with an instruction to regularize the situation. Non-compliant partners may be disqualified.

Most social and environmental risks are indirect and arise from business relationships. Within this context, potential social and environmental problems caused by service providers may represent financial, reputational and legal risks for us. To mitigate these risks and interruptions to the services provided by suppliers, we identify, classify, assess and monitor our suppliers in relation to commercial questions such as the non-use of child, forced or slave labor; social and environmental management; occupational health and safety and environmental legislation; FSC certification; and financial situation, among other aspects. To do this we use a third-party independent auditor whose work involves visits to suppliers in critical categories.

We also maintain a robust governance structure, comprising committees, policies, standards and procedures which ensure that risks are duly identified, measured, mitigated, monitored and reported. As internal commitments, in addition to the Corporate Sustainability Policy and the Social and Environmental Responsibility Standard, overseen by the Planning, Budget and Control Department, we have the Social and Environmental Risk Standard, the responsibility of the Integrated Risk Control Department, which is aimed at defining and declaring the scope of assessment with respect to our exposure to social and environmental risks, enabling the identification of suppliers employing forced or slave labor. Other documents are: the Code of Conduct and the Procurement Professional Sector Code of Ethics; Procurement Policy; Code of Ethical Conduct and Corporate Anti-corruption Policy.

Contracts contain clauses that are also aimed at ensuring partners guarantee human, labor and social rights. These include mandatory certificates of good standing for social security and CRF contributions and other standards related to Brazil's CLT labor laws, as well as non-discrimination and the non-employment of illegal, slave or child labor.

Furthermore there are diverse supplier monitoring and relationship channels, such as the Ombudsman, Alô Bradesco and the corporate email address 4080.fornecedor@bradesco.com.br.

Targets achieved in 2016:

- Finalization of the implementation stage of the supplier approval module using the new Item and Supplier Management tool;

- Adoption of the Bradesco Social and Environmental Responsibility in the Supply Chain Program;

- Supplier social and environmental rating approved and adopted, addressing the question of human rights;

- Organization of the 14th Bradesco Suppliers' Encounter centered on Governance and Sustainability initiatives. The event included the presentation of the CDP Supply Chain on Climate Change – A Global Vision and Regulatory Compliance. Furthermore, three commercial partners presented their experiences and practices related to governance and sustainability, addressing topics such as employee quality of life and well-being, social actions, community engagement and respect for diversity.

Targets for 2017:

- Increase the number of supplier audits under the Bradesco Social and Environmental Responsibility in the Supply Chain Program.

- Organization of the 15th Bradesco Suppliers' Encounter.

GRI G4-HR10 | Percentage of new suppliers selected based on human rights screening

In 2016, we approved 888 new suppliers all of whom were subject to human rights screening.

GRI G4-HR11 | Significant actual and potential negative human rights impacts in the supply chain and measures taken

|

ASSESSMENT OF IMPACTS ON HUMAN RIGHTS |

| SUPPLIERS SUBMITTED TO ASSESSMENT |

CAUSING NEGATIVE IMPACTS |

HAVING IMPROVEMENT PLANS |

| 2016 |

1,635 |

203 |

26 (13%) |

| 2015 |

921 |

183 |

24 (13%) |

| 2014 |

490 |

180 (37%) |

20 (11%) |

| 2013 |

522 |

248 |

(48%) |

GRI G4-DMA HUMAN RIGHTS GRIEVANCE AND COMPLAINT MECHANISMS

Our new Corporate Social Responsibility Management System, certified by an international body, addresses relationship quality and conditions in the work environment, reinforcing our commitment to improve and strengthen relations with employees, promoting open dialogue and driving improved working conditions.

We maintain indicators to monitor questions related to human rights and a Human Resources Management policy that establishes directives on relations between the internal and external publics and indicates the criteria to be adopted in decision making. The Social Responsibility and Climate area of the Human Resources Department and the contact channels receive and address reports. These go to the Human Resources Committee and are channeled to those responsible for solving them. The process is overseen at executive level by the Ethical Conduct Committee. Although the official time limit for a return on these reports is 60 days, after improvements in the process in 2015, the response time was reduced to 56 days. In the ongoing pursuit of improvement, we ended 2016 with an average response time of 32 days, a 47% reduction in comparison with the established deadline.

To support the report handling process, we use the Time Panel tool which enables us to identify any bottlenecks or deviations in the flow. External audits conducted by an independent international organization verify and certify our Management System on an annual basis.

We also have our Supplier Engagement Program, through which employees of partnering companies learn how to use the RespSocial communication channels. The program addresses questions related to health and safety, labor legislation, human rights and children's rights. There are also specific training programs related to these questions available for employees.

GRI G4-HR12 | Number of complaints and grievances about human rights impacts filed, addressed and resolved by formal grievance mechanism

| COMPLAINTS/YEAR |

2014* |

2015* |

2016* |

| Number of complaints and grievances about human rights impacts filed by formal grievance mechanism |

Total |

1,093 |

783 |

617 |

| Addressed |

1,093 |

783 |

617 |

| Resolved |

928 |

643 |

570 |

| Number of complaints and grievances about human rights impacts

filed in previous years, but resolved in the reporting period |

321 |

120 |

147 |

* For the Organization, the labor and human rights cases are addressed jointly, being impossible to manage them separately.

The Bradesco Seguros Group Ombudsman service did not receive any human rights related complaints.

GRI G4-SO4 | Communication and training in anti-corruption practices and procedures in the organization

| NUMBER OF EMPLOYEES WHO RECEIVED ANTI-CORRUPTION TRAINING IN 2016 |

| Corporate |

Board of Directors |

8 |

100% |

| Statutory Board |

138 |

100% |

| REGION |

|

South |

(%) |

Southeast |

(%) |

Northeast |

(%) |

North |

(%) |

Midwest |

(%) |

Overseas |

(%) |

| Functional category |

Superintendents |

1 |

33 |

29 |

19 |

0 |

0 |

0 |

0 |

0 |

0 |

5 |

71 |

| Managers |

279 |

11 |

1,266 |

15 |

404 |

13 |

101 |

12 |

195 |

17 |

15 |

34 |

| Supervisory/ Administrative |

3,020 |

33 |

4,454 |

12 |

644 |

11 |

201 |

13 |

395 |

14 |

61 |

32 |

| Operational |

1,974 |

40 |

4,730 |

21 |

882 |

21 |

343 |

26 |

385 |

24 |

15 |

63 |

| Apprentices |

22 |

31 |

373 |

39 |

30 |

17 |

13 |

28 |

17 |

53 |

0 |

0 |

| Interns |

179 |

56 |

542 |

38 |

8 |

24 |

1 |

8 |

5 |

25 |

0 |

0 |

GRI G4-DMA PUBLIC POLICIES

On September 17, 2015 the Federal Supreme Court passed ruling no. 4650 declaring legal provisions authorizing companies or other legally constituted organizations to make contributions to candidates, parties and electoral campaigns unconstitutional. From this date donations by legally constituted organizations were prohibited.

GRI G4-SO6 | Total value of contributions to political parties and politicians, discriminated by country and recipient/beneficiary

There were no donations in 2016.

GRI G4-SO8 | Monetary value of significant fines and total number of non-monetary sanctions resulting from non-compliance with laws and regulations

We received fines related to infractions of the CLT labor laws amounting to R$712,571.49; there were cases of psychological harassment in which settlements totaled R$1,434,398.50.

gri G4-DMA SUPPLIER ASSESSMENT FOR IMPACTS ON SOCIETY

See the G4-DMA Assessment of suppliers for human rights, Assessment of suppliers for labor practices, Assessment of suppliers for environmental impacts.

GRI G4-SO9 | Percentage of new suppliers screened using criteria for impacts on society

In the approval process, 100% of suppliers are subject to social and environmental assessments using a tool that applies the following criteria: labor practices, human rights, slave and child labor, social and environmental risks, in addition to contract clauses whereby suppliers commit to respect labor, social and environmental rights.

GRI G4-SO10 | Significant actual and potential negative impacts on society in the supply chain and actions taken

a. 100% – We seek to improve and drive closer relations with suppliers continuously. In 2016, the supplier registration module was concluded with management tools that enable the supplier's registration details to be viewed by the entire Organization.

The approval process addresses social and environmental responsibility questions such as labor practices, slave and child labor, environmental risks as well as the mitigation of risks related to suppliers considered to be critical in social and environmental terms.

b. 637 suppliers with contracts in critical segments that could generate significant actual and potential negative impacts on society were identified.

c. We analyze the purchase categories in accordance with the aspects of each dimension, as described below. After this analysis, each one's aspects are totaled. Categories with a total of six or more aspects were considered to be critical.

Economic: brand management: image and reputational risk; high degree of dependence (both the category/supplier and the Bank; category with the highest purchase volume (80% of total purchases).

Environmental: categories with high GHG emissions; timber chain; waste collection and disposal; products with toxic materials (including manufacture – e.g.: paint/lead, etc).

Social: activities requiring the use of PPE, safety or ergonomics equipment; work shift (in accordance with the law); slave, forced or child labor; psychological and sexual harassment; products consumed by the Organization's employees.

d. No suppliers who generated significant actual or potential negative impacts were identified. It was not necessary to develop any action plans.

e. No contracts were terminated due to impacts on society.

GRI G4-DMA CLIENT HEALTH AND SAFETY

This aspect is being assessed internally. We are working on making this information available.

GRI G4-PR1 | Percentage of significant product and service categories for which health and safety impacts are assessed with a view to improvement

This aspect is being assessed internally. We are working on making this information available.

GRI G4-PR2 | Total number of incidents of non-compliance with regulations and voluntary codes concerning the health and safety impacts of products during their life cycle, by type of outcomes

This aspect is being assessed internally. We are working on making this information available.

GRI G4-PR3 | Type of product and service information required by the organization's procedures for product and service information and labeling, and percentage of significant product and service categories subject to such information requirements

We provide general content on conscious consumption via diverse channels: the portal of the Together for Health Program was created by Bradesco Saúde to help its policy holders to attenuate the main risk factors for diseases, either through preventive measures or active health promotion.

Cuide BEM is a channel in which policy holders may find information on how to use their health insurance correctly, on their rights and responsibilities, on how to make best use of consultations with doctors and how to clarify any doubts.

We provide general content on education in the use of the insurance, as well as printed materials for clients: the Policy Holder Manual provides information on the health insurance rules and the policy holders' rights and obligations in relation to Bradesco Saúde. It was created to keep policy holders well informed about all the details of their plan and to teach them how to use it correctly. Policy holders may access the manual via the Bradesco Saúde website, logging in using their identification card.

We provide simulators and other free tools to help clients make decisions: a preview of the reimbursement is a service offered by Bradesco Saúde to give clients prior notification of the reimbursement they are entitled to for a determined service covered by their health insurance. The consultation is made by telephone through the Client Relationship Center.

There are explicit notifications about the suitability of each product for the client on the individual promotional materials for each product, as well as recommendations of alternative products: via the Bradesco Portal it is possible to see the benefits available for each client profile, the suitability of the insurance and alternative products.

GRI G4-DMA MARKETING COMMUNICATION

This aspect is being assessed internally. We are working on making this information available.

GRI G4-PR6 | Sale of banned or disputed products

This aspect is being assessed internally. We are working on making this information available.

GRI G4-PR7 | Total number of incidents of non-compliance with regulations and voluntary codes concerning marketing communications, including advertising, promotion, and sponsorship, by type of outcomes

This aspect is being assessed internally. We are working on making this information available.

GRI G4-DMA Customer privacy

As a financial and insurance institution, we must protect the confidentiality of our clients' information, in accordance with internal and external regulations. As such, we continually reaffirm our commitment to ongoing improvement in protecting the privacy of our clients' data.

We employ one of the most advanced security technologies: biometrics, available in 100% of the ATMs in the Bradesco-owned network and the Banco24Horas network. This identifies the client and authorizes the transaction made on the ATM by means of an invisible sensor/light which captures the vascular pattern of the palm of the hand. We also monitor the digital channels continuously, using modern tools which are updated constantly. Every access/transaction can be compared with prior ones (good and bad) by advanced data analysis to detect possible deviations. The processes are accompanied by management reports issued on a daily basis.

In information security, we classify and define directives, standards and policies for treating information (confidentiality, integrity and availability), as well as regulatory principles to ensure data privacy for clients. The Executive Board and the other hierarchical levels are involved in discussions related to information security via the Information Security Commission and the Corporate Security Executive Committee.

The Information Security area of the Corporate Security Department is responsible for elaborating, maintaining, reviewing and disseminating corporate information security policy and standards. Among other activities, it is strategically involved in internal (processes and technologies) and external (access/use by clients) security, which involves: training and ensuring employee awareness; assessment of information security risks; issuing reports on products and services; and preventing fraud in the electronic channels. It interacts with the management and technical areas to propose solutions aimed at increasing security in the service channels.

We also engage actively in preventing, detecting and correcting information security fraud to protect internal information assets and those of our clients.

With specific reference to privacy, in 2016 the document Privacy Directives was updated to incorporate legal modifications and best market practices.

The Information Security area is responsible for underscoring the importance of this document and disseminating it in the Corporate Information Security Awareness and Education Program.

GRI G4-PR8 | Total number of substantiated complaints regarding breaches of customer privacy and losses of customer data

In 2016, our legal area dealt with 57 cases which resulted in settlements totaling R$152,089.16.

In the Ombudsman area, 107,269 external complaints were received and validated by the Organization resulting in settlements totaling

R$157,433.36. The Ombudsman received 145,300 complaints from clients of the National Financial System and none from regulatory agencies. No leaks, thefts or loss of client data occurred. The Bradesco Seguros Group Ombudsman received no complaints about the violation of customer privacy or loss of data.

GRI G4-DMA COMPLIANCE

We have an Executive Committee and a Product and Service Commission which, in conjunction with the management areas, assess the opportunities and the financial and operational viability of proposals to create or alter products and services and to monitor their performance. This process, which is documented via a Business and Compliance Plan, involves analyzing regulations (laws and standards governing the commercialization of products and services), characteristics, functionalities, processes, risks, controls and sustainability-related aspects.

GRI G4-PR9 | Monetary value of significant fines for non-compliance with laws and regulations concerning the provision and use of products and services

We paid a total of R$46,104,415.88 in fines to PROCON, SUSEP and ANS. These amounts reflect the alterations in the regulations governed by ANS – responsible for issuing Resolution no. 388.

SECTOR SUPPLEMENT – FINANCIAL SERVICES

GRI G4-DMA PRODUCT PORTFOLIO

The Social and Environmental Risk Analysis and Control area of the Integrated Risk Control Department is responsible for providing social and environmental risk assessment reports to ensure well-targeted decision making. The Integrated Risk Control Department is also responsible for assessment and monitoring to ensure compliance with policies and standards via its Internal Controls area, as well as the Internal Audit and the Model Validation areas, with a view to identifying operational improvements.

We also employ our Social and Environmental Risk Standard, which establishes the scope of its exposure to social and environmental risks in lending operations and where suppliers are concerned. In 2016, this scope was extended to include the assessment of real estate and investment (private equity) guarantees for projects and companies that have higher exposure, for clients with pre-existing risks related to embargoed and contaminated areas, as well as those presenting signs of producing or commercializing any product or activity that may be considered illegal under Brazilian law and international conventions and agreements (e.g.: child labor, sexual exploitation and wildlife trafficking). Satellite images and documents are scrutinized before accepting the guarantees in order to avoid any risk of accepting real estate with liabilities and/or environmental restrictions.

As signatories to the Equator Principles, we require the application of the directives of this standard in addition to the criteria and obligations established by Brazilian law, as well as the International Finance Corporation (IFC) Performance Standards and the World Bank's Health, Safety and Environment Guidelines.

There is also a Social and Environmental Risk Control and Analysis Manual for activities that involve greater exposure to social and environmental risk in business, such as the production and commercialization or arms and munitions, radioactive materials and others. Consequently, operations with companies in these sectors are analyzed and social and environmental risk reports are prepared to contribute to decision making in the loan concession process.

The prioritization of topics is characterized by the type of risk identified during the risk assessment. As an example, during the project analysis phase, clients are provided with an explanation about the social and environmental risk policies and practices adopted and applied in our operation. Whenever necessary, the client's documentation and information are assessed. Similarly, interactions are promoted aimed at improving and adapting the project in accordance with our guidelines, legislation and the IFC performance standards, when applicable. These procedures may lead to the preparation of actions plans elaborated by us in conjunction with the client; these plans will be included in any contract that may come to be signed.

Suppliers considered to be strategic and critical, such as those having embargoed and/or contaminated areas or indications of slave labor, are subjected to a more rigorous social and environmental assessment.

GRI G4-FS6 | Percentage of the portfolio for business lines by specific region, size (e.g. micro/sme/large) and by sector

Segmentation of Net Equity under management

Net equity under management (R$ million): 569,486 in December 2016

| SEGMENTATION |

RESULT (R$ MILLION) |

% CONTRIBUTION TO BRAM EARNINGS |

| Short-term |

|

0.00 |

| Referenced DI |

|

0.00 |

| Fixed income |

342,358 |

60.12 |

| Multimarket |

42,433 |

7.45 |

| Exchange |

454 |

0.08 |

| Foreign debt |

|

0.00 |

| Shares |

7,109 |

1.25 |

| Private pension |

168,938 |

29.66 |

| Closed exclusive |

|

0.00 |

| FIDC |

8,105 |

1.42 |

| Real estate |

90 |

0.02 |

| Stakes |

|

0.00 |

| SIZE OF CLIENT/COMPANY PROFILE

(FOR EXAMPLE: INDIVIDUAL, COMPANY, HIGH INCOME, SMALL COMPANY, LARGE COMPANY, ETC.) |

RESULT (R$ MILLION) |

% CONTRIBUTION TO BRAM EARNINGS |

| EFPC – public/state companies |

9,922 |

1.74 |

| EFPC – private companies |

37,457 |

6.58 |

| Insurer |

16,199 |

2.84 |

| EAPC |

191,731 |

33.67 |

| Capitalization |

4,403 |

0.77 |

| Corporate |

149,160 |

26.19 |

| Middle market |

17,883 |

3.14 |

| Private |

29,065 |

5.10 |

| High income retail |

41,804 |

7.34 |

| Retail |

41,260 |

7.25 |

| Public authorities |

12,164 |

2.14 |

| RPPS |

6,278 |

1.10 |

| Investment funds |

11,372 |

2.00 |

| Foreign |

775,878 |

0.14 |

| Others |

12,813 |

0.00 |

GRI G4-FS7 | Monetary value of products and services designed to deliver a specific social benefit for each business line, broken down by purpose

1) Bradesco SOS Mata Atlântica Card and 2) Fundação Amazonas Sustentável

In addition to the environmental benefits of these products (mentioned in G4-FS8), these institutions supported by the abovementioned Bradesco cards promote diverse social actions, such as:

- SOS Mata Atlântica – promoting education and knowledge about the Atlantic Rainforest, mobilizing, training and encouraging the exercise of social and environmental citizenship. Among others, the organization develops projects, campaigns and action strategies in the areas of public policy, environmental education, forestry reclamation, volunteer work, sustainable development and ecosystem protection and stewardship.

- Fundação Amazonas Sustentável – this institution promotes sustainable development, environmental conservation and improved quality of life for riverside communities in the state of Amazonas.

3) Cards with philanthropic organizations (AACD and APAE)

Part of the annual card fee goes to the philanthropic body.

4) BNDES Card

Product description – onlending of BNDES funds for the acquisition of machinery, equipment and production goods available for sale on the BNDES Card portal.

The objective is to facilitate the use of credit and help companies to invest and modernize.

Target public – micro, small and medium companies.

5) Membership Rewards program (Amex – Donation)

The Membership Rewards points donation campaign for partnering charitable institutions enables members to contribute to social and cultural projects. Partnering institutions: Tuca, IBCC, Ibase, GRAACC, AACD, Fundação Abrinq, Doutores da Alegria, Casa Hope, ADJ, Instituto Olga Kos, Fundação Gol de Letra and Beit Lubavitch.

Volume of points redeemed from January to December 2016: estimated financial volume R$64,371.00.

6) Bradesco Cards Loyalty Program

The redemption of points in the Bradesco Cards Loyalty Program for partnering charitable institutions enables the member to contribute to social projects.

Partnering institutions: AACD, GRAACC and Casa Hope.

Volume of points redeemed from January to May 2016: estimated financial volume R$10,488.00 (from June 2016 the program was migrated to Livelo).

7) Bonus Club Program

The redemption of bands in the Bonus Club Program for partnering charitable institutions enables the member to contribute to social projects.

Partnering institutions: AACD, GRAACC and Casa Hope.

Volume of bands redeemed from January to December 2016: R$24,880.00.

8) Saber para Crescer Blog

An educational channel with a relationship platform close to the target public through which tips and ideas may be shared in simple, straightforward language. The contents cover the categories Extra Income, World and Culture, Conscious Pocket, Thinking about the Future, Intelligent Routine and You as Entrepreneur. Approximately 12 subjects are addressed per month among the categories and on the Facebook page, which has more than 480,000 fans.

GRI G4-FS7 | Monetary value of products and services designed to deliver a specific social benefit for each business line, broken down by purpose | G4-FS8 | Monetary value of products and services designed to deliver a specific environmental benefit for each business line broken down by purpose

SUSTAINABLE PRODUCTS

| PRODUCT/PROJECT NAME |

AREA OF ACTIVITY |

DESCRIPTION/ MAIN CHARACTERISTICS |

FROM |

TARGET

PUBLIC |

December 2014 |

December 2015 |

December 2016 |

| Balance in R$ |

Qty |

Balance in R$ |

Qty |

Balance in R$ |

Qty |

| ENVIRONMENTAL |

|

|

|

|

|

|

|

|

|

| Environmental leasing |

Environmental/Economic |

Commercial leasing with differentiated terms for the acquisition of goods that help preserve the environment and drive sustainable development. |

Jun./07 |

Individual and Corporate Clients |

266,385 |

6 |

17,976 |

2 |

357 |

1 |

CDC

– gas kit |

Environmental/ Social/

Economic |

Financing to convert vehicles to use of natural gas (equipment certified

by INMETRO). |

2005 |

Individual and Corporate Clients |

75,483 |

20 |

509,316 |

127 |

317,088 |

95 |

Environmental working

capital |

Environmental/ Social/

Economic |

Loan for corporate clients with ISO 14000 certification whose activities are related to social development and environmental preservation or to the recovery of metals or plastics. |

2005 |

Corporate Clients with ISO 14000 certification whose activities are related to social development and environmental preservation or to the recovery of metals or plastics. |

187,587 |

8 |

604,355 |

38 |

409,252 |

19 |

Forestry working

capital |

Environmental/ Social/

Economic |

Loans for corporate clients who have forestry stewardship/custody chain certification or a contract demonstrating they are obtaining certification. |

2006 |

Corporate Clients who have Forestry Stewardship/Custody Chain certification or a Contract demonstrating they are obtaining certification. |

595,077 |

30 |

187,633 |

18 |

29,494 |

4 |

CDC –

solar heater |

Environmental/ Social/

Economic |

Financing for the acquisition of solar heating equipment (equipment certified

by INMETRO). |

2005 |

Individual and Corporate Clients |

51,676 |

15 |

26,223 |

7 |

16,191 |

7 |

CDC –

forestry certificate |

Environmental/ Social/

Economic |

Line of credit for clients intending to get Forestry Certification. |

Dec./06 |

Corporate Clients |

0 |

0 |

0 |

0 |

0 |

0 |

| CDC – fotovoltaico |

Environmental/ Social/

Economic |

|

Jul./16 |

Individual and Corporate Clients |

– |

– |

– |

– |

0 |

0 |

| |

|

|

|

|

1,176,208 |

79 |

1,345,503 |

192 |

772,382 |

126 |

| PRODUCT/ ROJECT

NAME |

AREA OF ACTIVITY |

DESCRIPTION/ MAIN

CHARACTERISTICS |

FROM |

TARGET

PUBLIC |

December 2014 |

December 2015 |

December 2016 |

| Balance in R$ |

Qty |

Balance in R$ |

Qty |

Balance in R$ |

Qty |

| ENVIRONMENTAL – with onlending of BNDES + FGTS funds |

Moderagro Solo/

Produsa |

Environmental/Social/

Economic |

Finance for projects involving soil correction, reclamation of degraded pastureland, ordering of lands and environmental regularization of farmland, in particular the reconstitution of legal reserve and permanent preservation areas. |

2004 |

Agricultural producers (Individuals and Companies) and

their cooperatives |

183,320,136 |

1,624 |

95,596,420 |

878 |

42,237,721 |

450 |

| ABC program |

Environmental/Social/

Economic |

Financing to promote the reduction of greenhouse

gas emissions from agricultural activities and to reduce deforestation. |

2011 |

Individual and Corporate Clients |

202,475,185 |

605 |

159,617,247 |

600 |

1,025,686,293 |

5,896 |

| Moderagro |

Environmental/ Social/

Economic |

Financing for agricultural/livestock projects aimed at boosting productivity, product quality standards and compliance with sanitary/environmental regulations (BNDES onlending). |

2004 |

Agricultural producers (Individuals and Companies) and

their cooperatives |

297,911,765 |

2,229 |

298,241,470 |

1,897 |

159,137,199 |

1,267 |

Sanitation for All (FGTS)

* Former Pró-Saneamento |

Environmental/ Social/

Economic |