Presentation

Our Integrated Report is the product of a collective effort in which diverse areas undertook an exercise in transparency related to the topics of interest to our most diverse stakeholder groups (clients, investors, suppliers, community and others). We believe that the report has continued to evolve, with a higher number of indicators and the enhancement of our Relevance Matrix. G4-18 Further information in the GRI Attachment

For the 2016 reporting cycle, we reviewed our Relevance Matrix via a process that took into account quantitative and qualitative assessments and analysis of these results, in three stages proposed by the GRI– Global Reporting Initiative G4 guidelines:

1st stage: review of the list of relevant topics

Understanding the sustainability context and reflecting business strategy is a fundamental point for a well grounded process for determining the most relevant topics for management and for the reporting process. Therefore, we reviewed the list of subjects defined the last time we updated our Matrix, considering relevant topics considered to be benchmarks for Brazilian and overseas banks; research into news items about us and the financial sector; the Global Risks Report 2016 – World Economic Forum; market guidance mechanisms such as the FEBRABAN self-regulatory system Sistema de Autorregulação Bancária – SARB 14; the Dow Jones Sustainability Index (DJSI) and the ISE/ BOVESPA Corporate Sustainability Index; and internal information. We also included the perceptions of strategic stakeholder groups aired in a meeting held to assess the 2015 Integrated Report, which was attended by 24 representatives. G4-26 Further information in the GRI Attachment

2nd stage: consultation and analysis process

After internal analysis, we aligned the relevant topics and their respective sub-topics for submission to the strategic stakeholder groups. The main modification was the exclusion of the topic “Economic-financial business result” and its sub-topic “Share appreciation”. Two sub-topics were also redistributed: “Brand management (intangible asset)” and “Pursuit of operational efficiency”.

These topics were inserted in an electronic system for consultation by the following groups: employees, clients, investors, suppliers, government and community/society/third sector.

We used a methodology that cross references the axes of influence and impact to define what is relevant for the Organization.

Influences were considered to be:

- Stakeholder perceptions about the organization's impact.

- Stakeholder expectations in relation to action and response.

Impacts were considered to be:

- The probability and seriousness of the impact.

- Criticality for long-term performance.

- The opportunity for the organization to grow or gain advantage.

The result of the consultation was assessed using the following weighting system:

Influence:

- Online consultation with priority stakeholders (clients, investors, suppliers, government and community/society/third sector): 60%.

- Media research: 20%.

- Sector studies: 20%.

Impact:

- Consultation with executives: 40%.

- Online consultation with employees: 30%.

- Competitors: 25%.

- Megatrends: 5%.

3rd stage: validation of the relevant topics

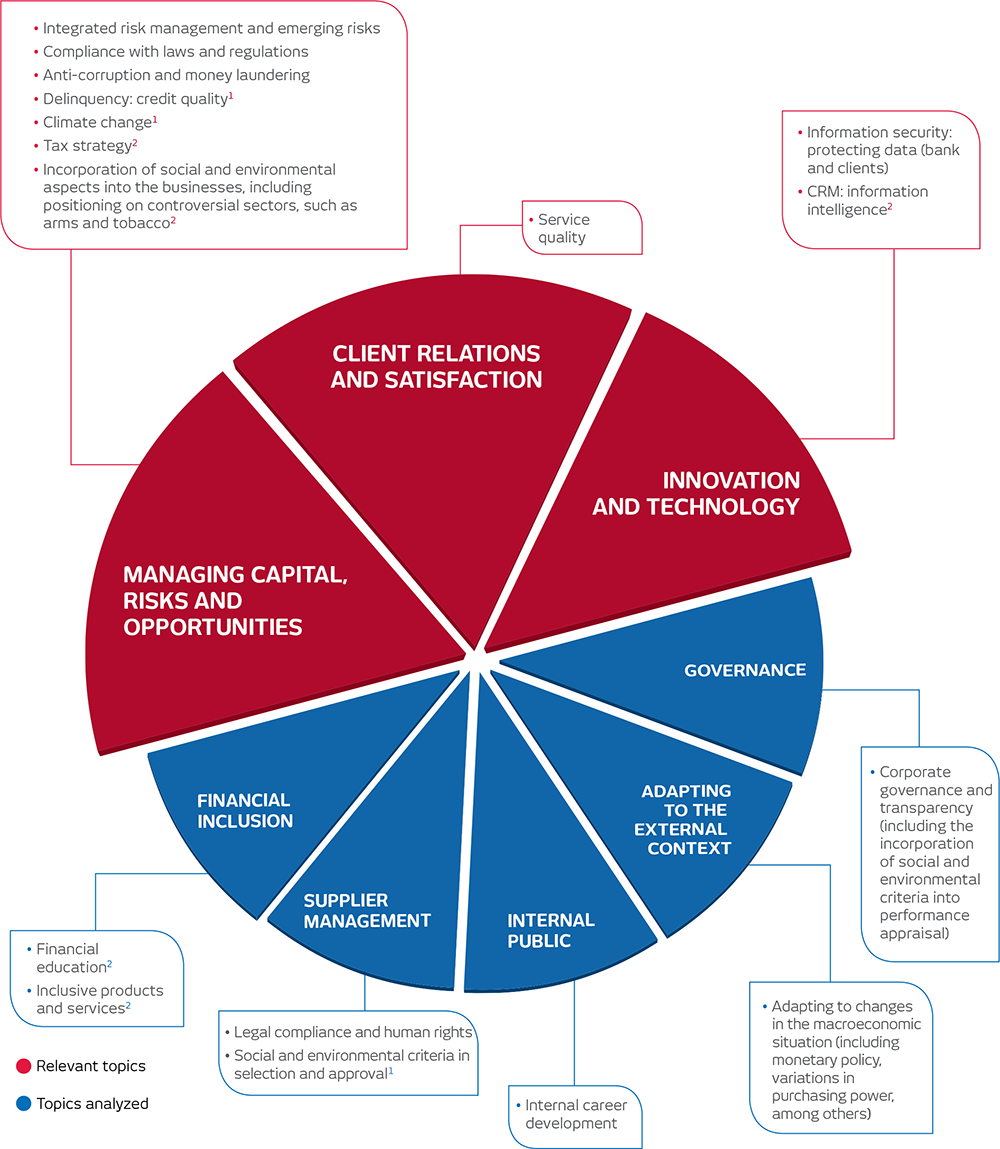

The topics and respective sub-topics selected were assessed, reviewed and validated by the Executive Board. There follows the prioritized list that orientates our report:

1. Managing capital, risks and opportunities

2. Client relations and satisfaction

3. Innovation and technology

4. Governance

5. Adapting to the external context

6. Internal public

7. Supplier management

8. Financial inclusion

Within these topics, the first three were considered priorities, representing the same subjects raised in the previous Matrix, however, in a different order.

Managing Capital, Risks and Opportunities: its relevance is due to the fact that the topic is related to questions such as risk management, compliance, delinquency, climate change, tax strategy and the incorporation of social and financial aspects into the businesses. Risk control, for example, seeks to anticipate market events and situations so that our instruments may be controlled, allowing us to mitigate and anticipate possible adverse effects. This is an essential factor in enabling us to ensure stakeholder security and comfort.

Client Relations: for us guaranteeing high quality service and client satisfaction is a principle. An example is the tools we have to optimize this goal. In this respect, we have a Customer Relationship Management (CRM) structure that interacts with the other organizational areas, receiving diverse types of specific information about clients. This information is assessed to enable painstaking analysis of client profiles so that we can develop commercial measures, products and services to meet the specific needs of each client. Within this same context, we have two independent Ombudsman services, one dedicated to client contacts in accordance with the rulings of the Brazilian Central Bank (Bacen) and the Comissão de Valores Mobiliários (CVM) and the other to address contacts from Bradesco Seguros Group clients, which is compliant with the standards of the insurance authority Superintendência de Seguros Privados (SUSEP) and its private health insurance equivalent Agência Nacional de Saúde Suplementar (ANS). The objective here is to represent the client impartially, transforming a complaint into an experience that strengthens the client's relationship with us and drives improvements that generate mutual benefits.

Innovation and Technology: increasingly efficient and with friendlier and simpler interfaces, the digital channels are essential in client relations, enabling us to fully meet client needs and offer them mobility and independence as a means of increasing the business they do with us. In the current scenario of convergence, the challenge is to make the banking experience even faster, safer and more convenient so that the diverse types of client may choose how to access us, as well as to attract new people to our solutions. In this context, Innovation and Technology are directly linked with ensuring the best possible performance in client service and relations, one of the Organization's priority topics.

The capitals used by the Organization are indicated throughout the Report by the following symbols:

- FINANCIAL

- SOCIAL

- HUMAN

- INTELLECTUAL

- MANUFACTURED

- NATURAL

The stakeholder groups in one way or another related to or impacted by the Organization’s activities are also identified throughout the report by the symbols below:

- CL CLIENTS

- PI INTERNAL PUBLIC

- AI SHAREHOLDERS AND INVESTORS

- F SUPPLIERS

- G GOVERNMENT (REGULATORY AUTHORITIES)

- CO COMMUNITY/SOCIETY/THIRD SECTOR

TOPICS PRIORITIZED

G4-27 Further information in the GRI Attachment

| Temas relevantes | Temas analizados | ||||||

|---|---|---|---|---|---|---|---|

| Gestão de capital de riscos e oportunidades | Relacionamento e Satisfação dos clientes | Inovação e tecnologia | Inclusão financeira | Gestão de fornecedores | público interno | adaptação ao contexto externo | governança |

|

Qualidade no atendimento |

|

|

|

Desenvolvimento da carreira profissional interna | Adaptação a mudanças no cenário macroeconômico (incluindo políticas monetárias, variações no poder aquisitivo, entre outras) | Governança corporativa e transparência (inclusive incorporação de critérios socioambientais na avaliação de desempenho) |

1. Temas trazidos em análise com

o Bradesco.

2. Temas do DJSI.

Obs.: os subtemas estão nos boxes associados a cada tema.