One of the factors that position us as one of the most solid global financial institutions is the diversification of our earnings, which are generated by four main sources of products and revenues, with loans accounting for 31%, insurance, 32%, services, 29%, and securities/others, 8%.

Credit has been under greater pressure due to the economic situation, which has led to increased delinquency and low volume growth. However, in the medium term diversification in the individual account portfolio, with an increased share of products with lower delinquency rates, such as housing loans and payroll credit, associated with the prospect of improvements in the economy in 2017, will ensure improved performance in this activity.

The share of service revenues in earnings has been increasing, worthy of note being cards (29%) and checking accounts (28%) – percentage of total service revenues (book value) –, which have been growing due to segmentation initiatives in the retail base. We have a multiple product line in insurance with private pensions accounting for a significant part of the policies. This diversification ensures stability in producing solid, consistent results.

The breakdown in value generation is reinforced by our capillarity, represented by the fact that we have the largest distribution network of financial and insurance products in Brazil and a competitive presence which enables it to serve more than 73 million clients spanning four generations and having different income profiles. At their disposal, they have more than 60,000 physical service points and a broad range of mobility solutions and access to products, services and transactions in both the physical and digital environments.

Another strategic differential is the broad segmentation offered to the more than 26 million business and individual account holder, in accordance with their income, revenues and needs. To elaborate, develop and offer the best solutions for each of these segments, we map consumption and relationship habits (physical and digital) and provide credit, finance and insurance options based on real needs and life phases.

Adopting a global vision, we are engaged in a series of initiatives to gradually integrate the physical and digital environments, driving growing convergence for clients. Worthy of note is the growth in the volume of transactions undertaken via digital channels from 3.6 billion in 2008 to 12.5 billion in 2016.

We are also committed to constantly creating and offering inclusive products and services, enabling the disabled to manage their finances. We are boosting the use of CRM and optimizing the branch structure to drive the increased efficiency of our service channels.

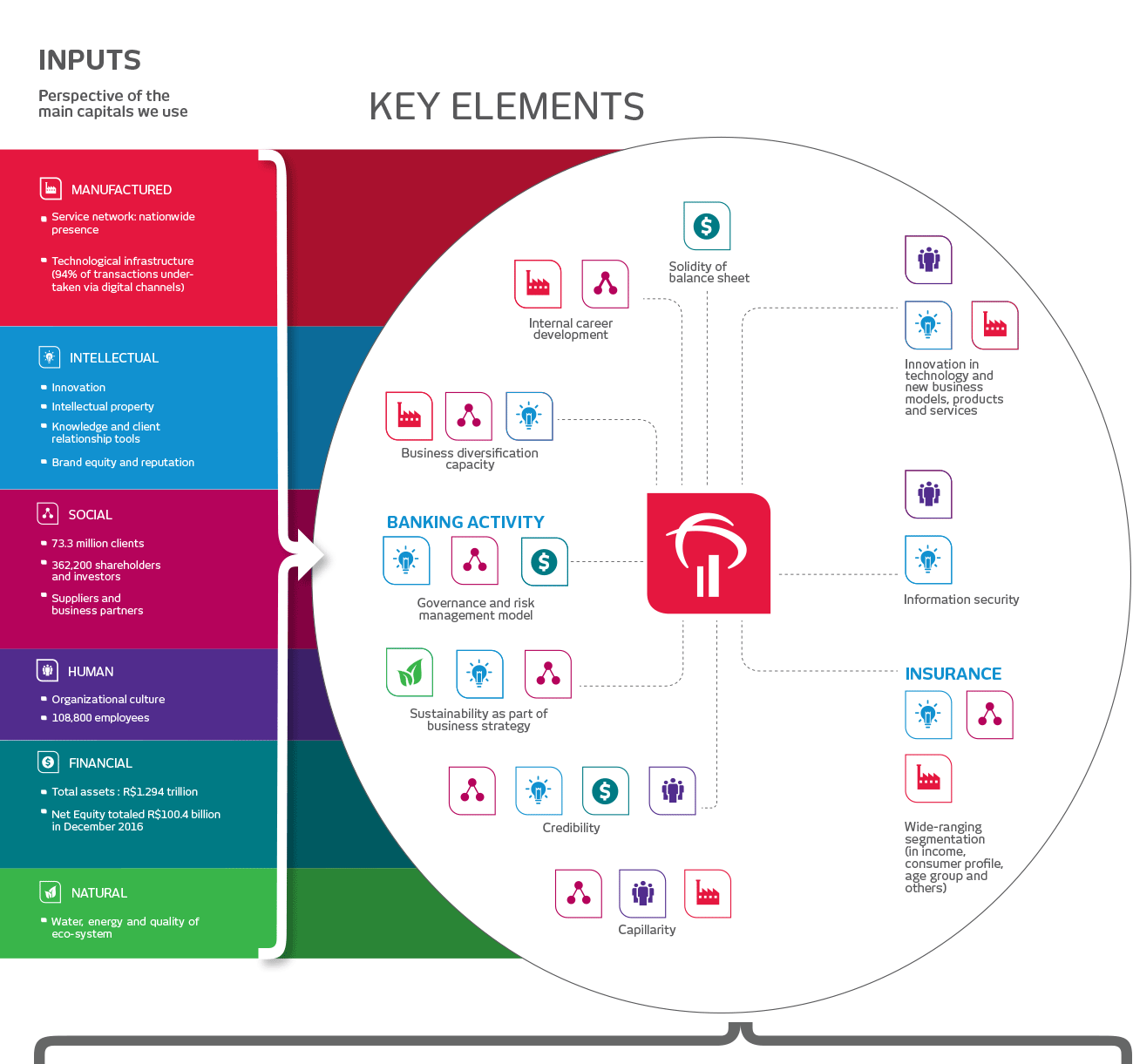

In this context, quality, innovation and efficiency, risk and opportunity management, ethical conduct, the generation of shared long-term value, leveraging results and employee training are key elements designed to guarantee ongoing business continuity. Value generation takes into account the risks and opportunities associated with social and environmental responsibility, which include eco-efficiency initiatives and social investment in promoting educational, cultural, artistic, sporting and environmental preservation measures.

HOW BRADESCO GENERATES VALUE

Products and Services

| IN BANKING ACTIVITY | IN INSURANCE | ||

|---|---|---|---|

| Services for individuals: loans (real estate; payroll; personal; vehicles), credit cards; microcredit, exchange operations and investments |

Corporate services: working capital; BNDES onlending; advances; exchange; exports; credit cards; overseas operations; real estate finance; guarantees and loans |

Financial services: cards; checking accounts; payment and receipt of bills; credit operations; asset management; consortium; capital market; derivatives |

Insurance, Supplementary Pension Plans e and Capitalization Bonds |

| Value Generated | More n Chapter |

|---|---|

| Client satisfaction and offer of suitable products and services | - Risk management strategy - Client relations - Innovation and technology |

| Fomenting economic growth based on finance (for other companies, partnerships and taxes) | - Economic-financial performance - Risk management strategy |

| Social inclusion, accessibility and quality of life (nationwide presence, bancarization and customized means of access; development of culture focused on provision of economic security and financial provision for people) | - Risk management strategy - Client relations - Community relations |

| Inclusion and education in finance and security (for employees, clients and society in general) | - Client relations - Community relations |

| Social inclusion through basic education, sport, foment for culture and the environment | - Community relations |

| Stakeholder engagement and development | - Personnel management - Community relations - Risk management strategy |

| Attraction and retention of talent | - Personnel management |

| The scale of the business increases its influence and its potential to create a positive impact | - Economic-financial performance - Risk management strategy |

| Balanced revenues; solidity and solvency (diversified revenues) ensure resilience | - Economic-financial performance |

| Distribution of wealth | - Economic-financial performance |

| Quality of credit (expansion of credit versus reduction in delinquency) | - Risk management strategy |

| Ongoing improvement in operational efficiency rating | - Risk management strategy - Economic-financial performance |

We have been efficient in driving people’s access to the financial system, with at least one branch, service point or banking correspondent in each Brazilian municipality, adapting the physical structure in accordance with each region’s economic potential, driving local development and adding value for our businesses, which is only possible by means of investments in technology.

We constantly and systematically adopt a series of measures that enable recognition both of excellence in terms of financial results and perception of service quality by clients.

Five years before the publication of Brazil’s Consumer Defense Code, we created Alô Bradesco, a channel for receiving contacts and listening to clients and non clients. In the social networks, we react non-stop with clients and non clients, providing rapid responses through our own specialized team. This totals more than 35,000 interactions per month.

G4-DMA Product and service labeling

Aligned with the goal of banking inclusion, our financial education project is aimed at driving the financial well-being of employees, clients and non-clients, as well as helping to prevent indebtedness through the rational use of money, responsible use of credit, incentives for savings and investments appropriate for specific profiles and needs. During the course of 2016, 320 regional meetings were held in underdeveloped locations where banking services are provided through service points or banking correspondents. Some 13,000 people participated.

Through the Portal Sociedade de Negócios we make exclusive contents for companies available, providing information and updates on the market and novelties for entrepreneurs, as well as helping ensure the success of new businesses.

It has always been a principle for us to guarantee service quality and drive client satisfaction, ensuring that they may perceive the real meaning of each one of our actions and pursuing greater quality in the contacts made by our managers. The segmentation process favors this strategy of grouping clients with the same profile, enabling differentiated service and gains in productivity. Created in 2003, Bradesco Prime, for example, which is dedicated to high-income clients, is noted for the high levels of satisfaction with service quality.

Bradesco Prime also provides an Asset Management Platform for clients who live far from large urban centers and a service structure for expatriates and clients who are out of the country. To serve these clients, we remodeled our internet banking, offering a series of international services, including the issue of payment orders for sending and receiving remittances and solutions to facilitate withdrawals and financial transactions overseas.

Aligned with new consumer trends, we restructured the concept of the digital platform with the launch of Digital Platforms, introducing the convenience of the digital world without sacrificing personalized service, with expanded working hours. Currently clients in the Exclusive, Prime and Private segments are entitled to use this platform.

In the post-sale process, we assess client satisfaction with commercial and relationship measures frequently and systematically, ranging from the opening of accounts, to service standards to migration from one segment to another. The consolidated data enable us to draft a general satisfaction index for each one of our sites. These results directly impact our Programa de Objetivos (Goal Program)..

In 2016, we launched the Financial Review, a commercial methodology which permits the offer of financial consultancy by means of a detailed, attentive interview with the client. The tool enables managers to assess clients’ needs and expectations and to identify opportunities for the offer of tailor-made solutions. Based on the Financial Review, the client is better able to understand his/her own needs and to take advantage of the benefits of the financial planning we provide, including the possibility of participating in relationship events in areas of their preference, such as sports, music and cinema.

Additionally, more than 99% of our managers are CPA10 and CPA20 certified. In 2016, more than 30,000 employees were trained.

Heightened Perception

On an annual basis, we conduct research in all segments, seeking to understand the perception of our clients and our competitors’ clients with respect to the diverse relationship areas in the banking market and to monitor potential gaps in performance indicators. Worthy of note among these surveys are:

MAPPING OF FINANCIAL MARKET (MMF) – This is aimed at assessing our own and our competitors’ performance. It is conducted among individuals and companies that have relations with banks. With nationwide coverage, there were 10,718 interviews. The main indicators investigated are: Use of banks, Client’s 1st bank, Awareness, Attractiveness, Recommendation, Satisfaction, Reasons for using the bank, Possession of products and Channels used in each bank. This mapping takes place in two stages: in May/June and in October/November.

MAPPING OF FINANCIAL MARKET (MMF) – This is aimed at assessing our own and our competitors’ performance. It is conducted among individuals and companies that have relations with banks. With nationwide coverage, there were 10,718 interviews. The main indicators investigated are: Use of banks, Client’s 1st bank, Awareness, Attractiveness, Recommendation, Satisfaction, Reasons for using the bank, Possession of products and Channels used in each bank. This mapping takes place in two stages: in May/June and in October/November.  IMAGE SURVEY – This assesses the current state of our image in relation to our competitors, verifying how we are positioned in the perception of the diverse segments with whom we relate. The survey is conducted nationwide among a universe of 5,782 interviewees, broken down into: Low income, Classic, Exclusive, Prime and Company Retail (Varejo PJ), Companies and Corporate. The main indicators measured are: Awareness, Bank in which respondent has an account, Main bank and Image attributes associated with

the banks.

IMAGE SURVEY – This assesses the current state of our image in relation to our competitors, verifying how we are positioned in the perception of the diverse segments with whom we relate. The survey is conducted nationwide among a universe of 5,782 interviewees, broken down into: Low income, Classic, Exclusive, Prime and Company Retail (Varejo PJ), Companies and Corporate. The main indicators measured are: Awareness, Bank in which respondent has an account, Main bank and Image attributes associated with

the banks.