Share Performance

Share Performance

Eternit’s shares have been listed on the stock exchange since 1948, and since 2006 have been listed on the Novo Mercado, BM&FBovespa’s highest level of corporate governance, under the ticker code ETER3. With the aim of heaping the population informed, and particularly the capital markets, with a view to reduce the degree of one-sidedness of the information circulating about the court judgement with respect to Eternit Italiana, in February 2012 in the city of Turin, the Company published a Material Fact Notice in newspapers in all Brazil’s state capitals and the main magazines,, explaining the differences in operational practices with respect to the use of asbestos, and particularly making clear that the decision would not affect activities in Brazil, due to the absence of a relationship between the Italian company and the Brazilian company. (see Eternit's Position).

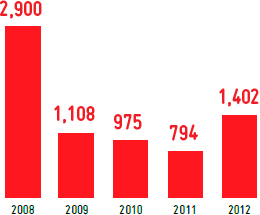

Motivated, principally, by the perception of risk and opportunity, the average daily volume in the Company’s shares amounted to R$1.4 million, up 76.6% compared to the figure of R$793,800 in 2011.

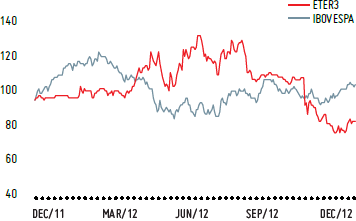

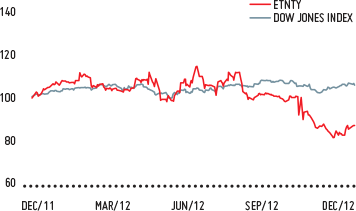

Eternit’s share price quote of R$8.10 (ETER3) at the end of 2012 showed depreciation of 9.0% compared to the end of 2011. Over the same period, the IBOVESPA closed at 60,952 points, down 7.4% compared to the end of December 2011. As at December 31, 2012, Eternit’s market capitalisation amounted to R$725 million.

Taking the depreciation in the share price, together with the amounts distributed to shareholders, the amount of variation was practically unchanged (negative variation of 1.1%) from December 2011 to December 2012.

PERFORMANCE OF ETER3 SHARE VS. IBOVESPA INDEX |

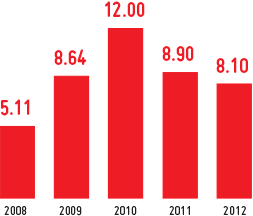

ETER3 SHARE PRICE (R$)* |

|

|

|

|

| * Closing value of the last business day of the year. |

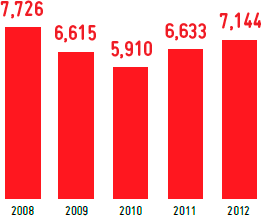

NUMBER OF SHAREHOLDERS |

LIQUIDITY – DAILY AVERAGE OF BUSINESS VOLUME (R$ THOUSAND) |

|

|

|

|

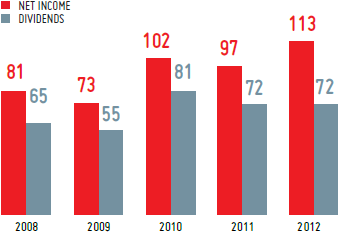

NET INCOME VS. PAYMENTS OF DIVIDENS (R$ MILLION) |

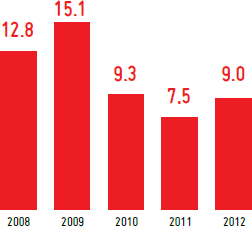

DIVIDEND YIELD EVOLUTION – % |

|

|

|

|

ADRs on the Over-The-Counter MarketThe Company has had an American Depositary Receipts (ADR) level 1 program since May 2010, allowing the Company’s shares to be traded on a secondary or over-the-counter market in the United States, under the ticker code ETNTY. In 2012, the first trades took place in Eternit’s ADRs. Every quarter the Company publishes its results information in the main communication vehicles in the United States, with the objective of providing it with international visibility, as well as giving investors another investment option. |

PERFORMANCE OF ETNTY (OTC) VS. DOW JONES INDEX (BASIS 100) – QUOTE US$/SHARE |

|

|

Dividends

Eternit continues to have one of the the highest rate of return for its shareholders among Brazil’s listed companies, being one of the few companies to reconcile growth with dividends, which are distributed on a quarterly basis. In 2012, the total distributed to shareholders in the form of dividends and interest-on-equity amounted to R$71.6 million, representing a dividend yield of 9.0% (7.5% in 2011). The reduction in the payout percentage was as a result of the Company’s Structured Program for Expansion and Diversification, with the tranche of profits retained being reinvested in diversification of the businesses, which will generate results in the future, and consequently convert into dividends.

The Company’s dividend policy is set out in Article 30 of the Company Bylaws. Annually, net earnings for the financial year are allocated as follows:

I) 5% (five per cent) of the net income for the fiscal year shall be allocated, prior to any other allocation, to the constitution of the Legal Reserve, which shall not exceed 20% (twenty percent) of the capital stock of the Company.

II) an amount may, as per proposal of the Board of Directors, be allocated to Reserves for Contingencies pursuant to Article 195 of Law No. 6.404/76.

III) 5% shall be allocated to the formation of a Statutory Reserve for the Maintenance of Working Capital, as set out in Article 32 of the current Company Bylaws.

IV) an amount of the net income for the fiscal year, as per proposal of the Board of Directors, may be retained based on the preliminary approved capital expenditures budget pursuant to Article 196 of Law No. 6.404/76 contingent on compliance with the legal requirements and limits.

V) these allocations having been made, the outstanding balance shall be allocated to the payment of the mandatory minimum dividend pursuant to the provision in Article 32 of these Bylaws.

VI) After these allocations, should there still be a remaining balance, this shall be fully allocated to the payment of dividends to the shareholders.

Sole paragraph: the payment of dividends approved in the General Meeting, and the distribution of shares arising from an increase in capital, shall be effected within 60 (sixty) days as from the publication of the respective minutes.