Eternit’s economic performance is due to focusing the Group’s activities on obtaining results as well as initiatives and investments made with a focus on its relationship with its public audiences – society, suppliers, government, employers, among others –, seeing that all these directly contribute to the working of the business, through the product and services that they consume.

SECTOR ANALYSIS

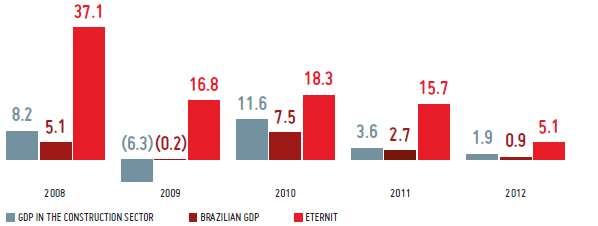

The year 2012 was marred by international economic instability, the result of the crisis in Europe, uncertainty with respect to economic recovery in the United States, and the slowdown of the Chinese economy. In Brazil, despite the low rate of global economic growth, the economy began a gradual process of growth recovery. After a series of stimulus packages introduced by government bodies, such as a reduction in the Selic rate (base rate), widespread easing of the tax burden, easing of the tax burden on company payrolls in certain sectors of industry, among others, the Brazilian economy began to show signs of recovery, ending the year with GDP growth of 0.9%, with GDP growth of 1.9% in the building sector – below the growth seen in 2011, of 2.7% and 3.6%, respectively.

BRAZILIAN GDP VS. GDP IN THE CONSTRUCTION SECTOR AND ETERNIT’S CONSOLIDATED GROSS

REVENUE (%)

Source: BACEN. Eternit’s gross consolidated revenue growth is based on a comparison for the period from January to December 2012, compared to the same period in 2011, adjusted for inflation in accordance with the IGP-M index.

According to the Brazilian Construction Materials Industry (ABRAMAT), sales of construction materials in 2012 were up by 1.4% compared to the previous year, falling short of the forecast of 2.0%. The consequence of this scenario was low growth in the sales of basic materials, such as cement, tiles and water pipe.

In order to stimulate sales of construction materials, with a view to helping activity recover in the sector, the National Association of Construction Material Merchants (ANAMACO) has encouraged public and private-sector banks to create credit lines for the purchase of construction materials by private individuals at reduced rates of interest.

Despite the weak demand for construction materials in 2012, Eternit managed to achieve a growth, deflated by the IGPM (general market price index) index, of 5.1% compared to 2011.

Continuing works under government programs such as Minha Casa Minha Vida (my house, my life), expansion to infrastructure works, which represent the purchase of materials for major works, such as highways, railways and ports, as well as a higher rate of investment in preparation for mega-sporting events – the 2014 World Cup and the 2016 Olympic Games – and the complementary works required by them, all indicate good prospects for the coming years, and particularly favorable to the construction sector, of which Eternit is a part, in addition to the creation of jobs, the distribution of income as a result of these works, and the stimulus measures being offered by public and private-sector commercial banks for the purchase of construction materials, which should have a positive impact on growth in demand for products in our portfolio.