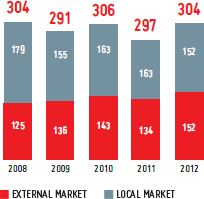

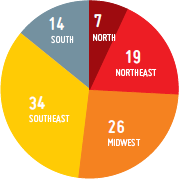

CHRYSOTILE MINERAL SALES |

|

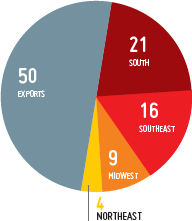

BREAKDOWN OF CHRYSOTILE |

|

A Global demand for chrysotile asbestos remained buoyant during the year, leading Eternit to maintain its strategy of operating at full capacity in its chrysotile mining operation. In its line of finished products, production accompanied demand, with a capacity utilization rate of approximately 80% for fiber-cement production and 60% for concrete tiles. The current production capacity levels of the companies in the Eternit Group are around 300,000 tons a year at the mining company, 1 million tons a year of fiber-cement production and 10 million square meters a year of concrete tiles.

Chrysotile asbestos mining

SAMA, the chrysotile mining company, has a world market share of 15%, with a current global demand of 2.1 million tons a year. Chrysotile fiber is the main raw material for Eternit’s fiber-cement products, and the company’s strategy is to prioritise supply to the domestic market, while exporting its surplus production to more than 20 countries – India, Indonesia, Mexico, Thailand, Malaysia, among others.

Limited by its production capacity, chrysotile mineral sales totalled 303,500 tons in 2012, practically unchanged on the volume in 2011. Of particular note were export sales, which compensated for retraction in the domestic market as a consequence of reduced demand for construction materials, thus maintaining a distribution of approximately 50% for each market.

Fiber-cement

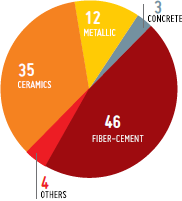

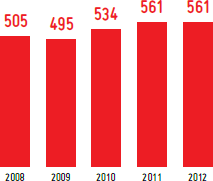

The roofing segment is one of the largest construction markets in the Country, with annual demand of around 560 million square meters. Fiber-cement roofing panels and tiles represent 46% of this market, in which the Company has a leadership position, with a 32% market share.

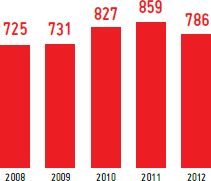

Fiber-cement products containing chrysotile asbestos, for example, play a strategic role in the construction market, seeing that they meet the technical and economic requirements of these public audiences, particularly families with low purchasing power, seeing that they combine a longer useful product life with a lower cost of installation. This means that this material is the first option of choice for these consumers. In 2012, fiber-cement sales amounted to 786,000 tons, down 8.5% compared to the sales volume in 2011, as a result of the slowdown in the sector and price repositioning on the part of the Company.

TOTAL COVERING MARKET – |

COVERING MARKET EVOLUTION (million m2) |

BREAKDOWN OF FIBER-CEMENT TILES SALES BY REGION (%) |

FIBER-CEMENT SALES (thousand tons) |

|||

|

|

|

|

|||

Concrete Tiles

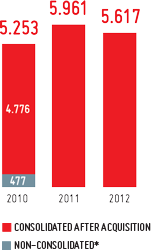

Concrete Tile Sales (‘000 m2) |

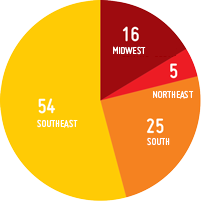

Breakdown of Concrete Tile Sales by Region (%) |

|

|

|

|

| * Tégula was acquired on February 11, 2010. The amount of 477 thousand m2 doesn’t refer to Eternit. |

||

Concrete tiles, focused at the high income population, represent 3% of the roofing market, in which the Company continues to have a leadership position, with a market share of approximately 30%.

Sales volume in 2012 amounted to 5,617,000 square meters, 5.8% less than in 2011, as as a result of the reduction in demand for construction materials. Tégula has a portfolio of more than 33 product lines, the majority of which are concrete tiles.

Bathroom Chinaware

Bathroom chinaware is becoming a more important component of the portfolio of the Group, which is preparing to operate a production plant in the state of Ceará. In only four years in the bathroom chinaware segment, Eternit has already acquired a significant position, even overtaking some traditional players.